US Election Outcome to Shape Future of Meme Coins, Experts Weigh In

While most forecasts agree that a Donald Trump victory would favor the crypto market more than a Kamala Harris win, the impact on the meme coin sector remains a topic of debate.

A professor from Columbia Business School suggests that meme coins could face a downturn if Trump wins the election.

How Will The Election Results Affect Meme Coins?

Professor Omid Malekan believes that investors’ interest in meme coins stems from frustration with the unfair tokenomics of projects backed by venture capitalists. If Trump wins, the Republican Party might relax certain policies, enabling fee switches and token dividends to benefit token holders economically. This, in turn, could divert investor interest away from meme coins.

“Meme coins are simple and people like them because their initial distribution is more fair. But they have little benefit or value. My point is that in a world where coins that have more utility aren’t regulated to death meme coins are less appealing.” – Omid Malekan explained.

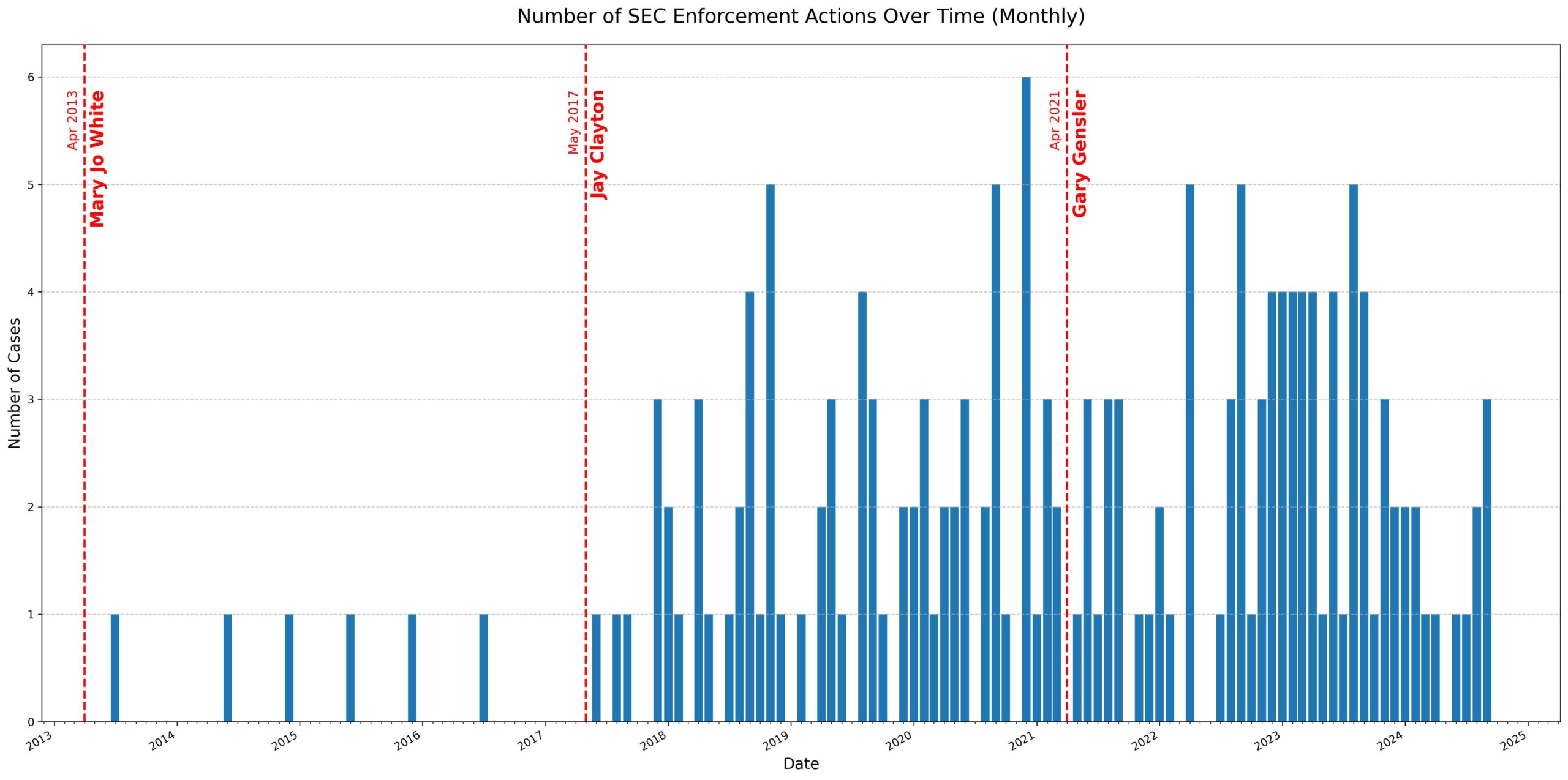

Additionally, Investor Nic Carter agrees with Professor Malekan, stating that the rise in meme coins is partly a reaction to the SEC’s oppressive regulations. Brendan Malone, Head of Policy at Paradigm, has reported an uptick in SEC legal actions under Gary Gensler’s leadership.

Read more: Who Is Gary Gensler? Everything To Know About the SEC Chairman

Number of SEC Enforcement Actions Over Time. Source: Brendan Malone

Number of SEC Enforcement Actions Over Time. Source: Brendan Malone

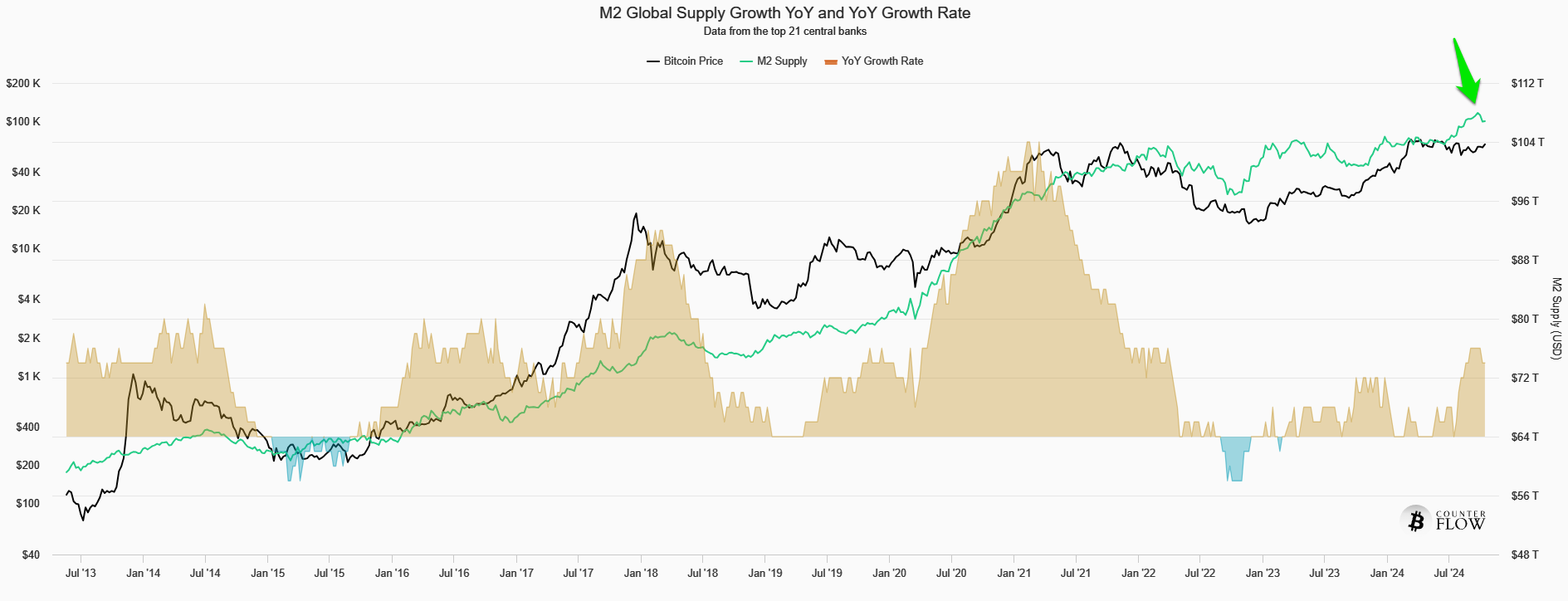

However, many industry experts disagree with Malekan. Analyst Murad argues that meme coins are unrelated to politics, and their growth is instead driven by the increasing global money supply.

“Meme coin buyers don’t even care about buying things with legit revenues and turned on fee switches either. In fact turning on fee switches accelerates the collapse of the altcoin complex because no one comes to crypto because they want to trade equities. Everyone comes to crypto to find parabolas. As Global Money Supply increases, the importance of Attention will increasingly predominate over Fundamentals and Cashflows. This road only goes one way.” – Murad commented.

M2 Global Supply Growth YoY And YoY Growth Rate. Source: BitcoinCounterFlow

M2 Global Supply Growth YoY And YoY Growth Rate. Source: BitcoinCounterFlow

The global M2 money supply has now surpassed $107.1 trillion, up from $104 trillion at the beginning of the year. Its year-over-year growth rate is 7%, the highest since December 2021.

Solana Labs Co-Founder Toly also disagrees with Malekan, offering a perspective that leans more on trading psychology.

“Trading meme coins is entertainment. It’s a Keynesian beauty contest of what people will find the most entertaining. Trading everything else is work. If anything people are gonna want to do less work.” – Toly commented.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

At the time of these discussions, meme coin market capitalization exceeded $56 billion, maintaining stability above $50 billion throughout October.

Meme Coins Market Cap & Volume. Source: CoinMarketCap.

Meme Coins Market Cap & Volume. Source: CoinMarketCap.

Investors continue to focus on Solana meme coins and AI meme coins as Bitcoin Dominance (BTC.D) reaches over 59.7%.