Tether CEO Rejects WSJ’s Allegations of Federal Money Laundering Investigation

Tether’s CEO, Paolo Ardoino, refuted claims by the Wall Street Journal that US federal authorities are investigating the company for potential money laundering.

The WSJ published an exclusive report earlier today claiming the U.S. Attorney’s Office in Manhattan is investigating the stablecoin provider. The potential charges allegedly center on whether third parties used Tether’s platform to facilitate illegal activities like drug trafficking, terrorism financing, hacking, or to disguise proceeds from such crimes.

WSJ’s Accusations Against Tether Briefly Tanks the Market

Shortly after WSJ’s report, Ardoino stated that Tether had not observed any indications of a federal probe. However, the publication, citing unnamed sources, suggested that investigators are looking into whether the stablecoin has indirectly supported sanctioned entities.

More specifically, they are looking into whether the stablecoin allowed Russian arms dealers and groups, such as Hamas, to move funds covertly.

“As we told to WSJ there is no indication that Tether is under investigation. WSJ is regurgitating old noise. Full stop,” Paolo Ardoino wrote.

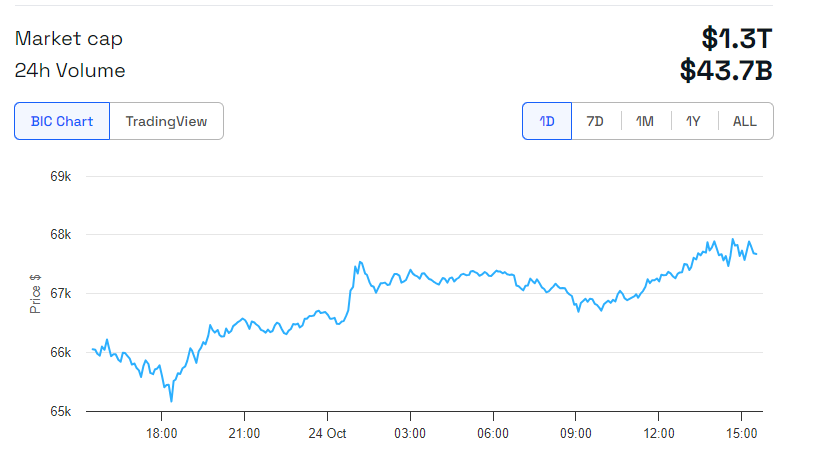

The report stirred immediate volatility in the cryptocurrency market. Bitcoin, which had been nearing the $70,000 threshold, dropped significantly from $67,000 to $65,000 following the news. However, Ardoino’s quick denial helped stabilize the market, and Bitcoin prices rebounded to approximately $66,700.

Read more: A Guide to the Best Stablecoins in 2024

Bitcoin’s Price Movements on October 25. Source: BeInCrypto

Bitcoin’s Price Movements on October 25. Source: BeInCrypto

Tether has faced increased criticism and scrutiny from various quarters in recent months. In September, the consumer advocacy organization Consumers’ Research released a report condemning Tether for its continued lack of transparency.

The report criticized the company for failing to conduct a complete audit of its dollar reserves, a promise made as far back as 2017. Consumers’ Research raised concerns about Tether’s possible involvement in bypassing international sanctions, particularly in countries such as Venezuela and Russia.

The report even compared Tether’s operational practices to FTX, heightening concerns about the stablecoin issuer’s business model and regulatory compliance.

Despite these ongoing scrutinies, the stablecoin issuer is eyeing several developments in the coming year. Recent reports also suggested that Tether is exploring a move into the commodity sector. If successful, the company could profit from credit-starved business ventures.