Microsoft Shareholders to Vote on Potential Bitcoin Investment as Board Urges Caution

Microsoft’s upcoming shareholder meeting on December 10 is shaping up to be a closely watched event. The tech giant’s board of directors (BOD) and shareholders are facing a proposal for the company to invest in Bitcoin.

According to a Securities and Exchange Commission (SEC) filing released late Thursday, the “Assessment of Investing in Bitcoin” has been proposed as an official voting item. This has sparked anticipation in both tech and financial circles, including crypto.

Why Microsoft May Start Investing In Bitcoin

The proposal, filed with the US SEC, has already met with resistance from Microsoft’s board. The board clarified its recommendation against the proposal, arguing that it is “unnecessary.”

They also reasoned that the company’s management already gives due consideration to a wide range of investment assets. Noteworthy, in the past, this has also included Bitcoin.

Microsoft’s Global Treasury and Investment Services team routinely evaluates options with an eye toward diversification. Additional considerations also include inflation protection and risk management.

The board maintained that management has the expertise to decide on assets that would benefit Microsoft’s operational stability. This is without the need for a shareholder-mandated directive on Bitcoin.

Read More: How To Buy Bitcoin (BTC) and Everything You Need To Know

Bitcoin has sparked debate among institutions in recent years, with some seeing it as a hedge against inflation and a potential diversification tool. Meanwhile, others view it as too volatile for corporate balance sheets.

The proposal to consider Bitcoin comes at a time when some major institutional investors, like BlackRock, have made substantial moves into cryptocurrency markets. BlackRock, which is Microsoft’s second-largest shareholder with a 5.7% stake, recently made headlines for its $680 million purchase of Bitcoin via its iShares Bitcoin ETF (exchange-traded fund).

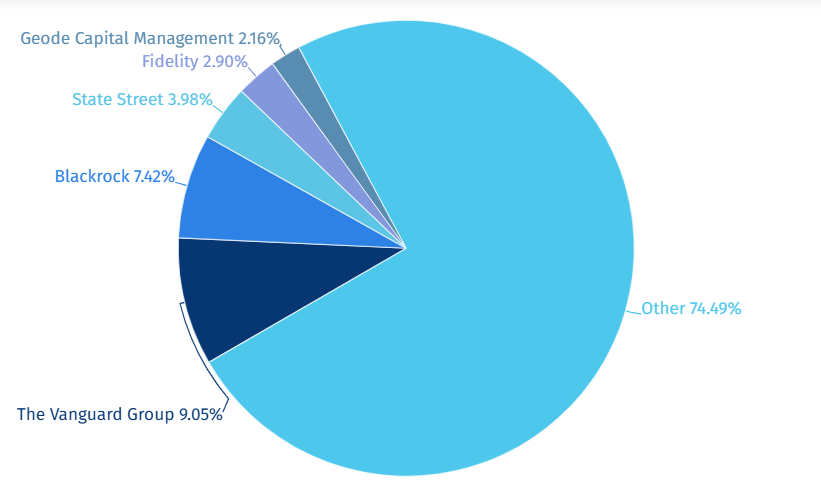

Against this backdrop, there is speculation about whether BlackRock’s investment decisions could influence Microsoft’s shareholder vote on Bitcoin. Microsoft’s shareholder list includes several prominent institutional investors. The largest, Vanguard, holds a 9.1% stake, followed by BlackRock, State Street, Fidelity, and former CEO Steve Ballmer.

“Guess who Microsoft’s second-largest shareholder is? Guess who made the Bitcoin ETFs happen?” Terrence Michael, author of the Bitcoin book Proof of Money, quipped.

The varied interests among these key stakeholders could make the upcoming vote a critical gauge of institutional sentiment toward Bitcoin adoption by established tech companies.

Microsoft Shareholder List, Source: techopedia

Microsoft Shareholder List, Source: techopedia

For now, however, BlackRock’s pro-Bitcoin stance signals a potential swing in favor of the proposal among some shareholders. The possibility stands despite the board’s recommendation against it.

BlackRock CEO Larry Fink has recently expressed a positive outlook on Bitcoin, calling it an independent asset. This suggests that the firm might advocate for Microsoft’s involvement in the cryptocurrency space.

However, it remains uncertain if BlackRock would go as far as to support the proposal openly. Analysts are watching the situation closely. The general sentiment is that a shareholder vote in favor of exploring Bitcoin investments could set a significant precedent, and other tech giants may follow suit.

“…the board must consider the proposal, confer with advisors, record discussions in the minutes of the board, and face pressure and questions from shareholders and press on BTC as a reserve asset,” said Jesse, a business lawyer serving companies, entrepreneurs, and investors.

Read more: Who Owns the Most Bitcoin in 2024?

Nevertheless, if the proposal gains traction, it could embolden similar actions within other corporations, opening the door to further institutional adoption of digital assets.