Binance market share declines for 2nd year as BNB remains best-performing exchange token

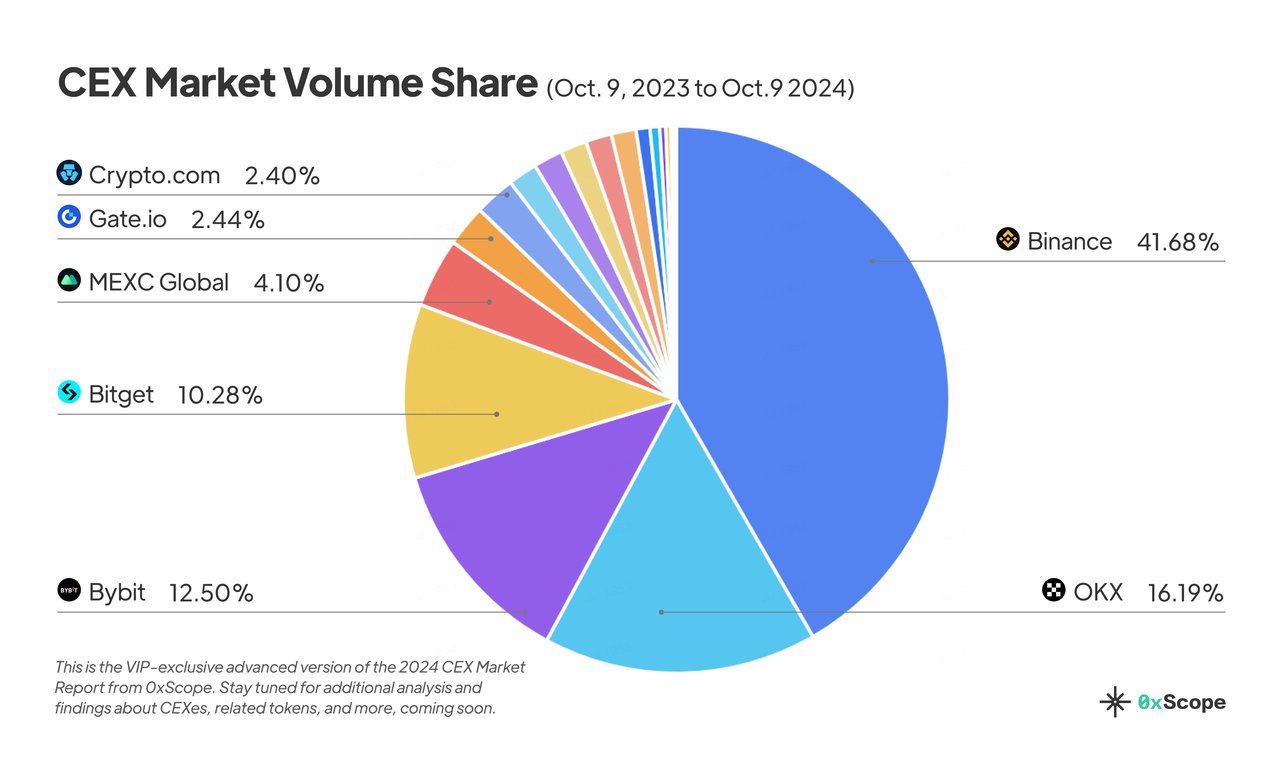

Binance, the biggest centralized exchange (CEX) by volume, continues to lose ground in market share for the second year in a row.

Right now, the exchange holds 39.54% of the total spot trading market, down from 52.5% last year — a 13% drop in just 12 months.

But Binance’s native token, BNB, is standing firm as the best-performing exchange token, according to a recent report by 0xScope.

Bybit rises as Binance struggles

Over the past year, the total spot trading volume across 22 exchanges hit $14.6 trillion. Binance still leads, with $5.78 trillion in trades, but the competition is heating up.

Bybit has taken advantage of Binance’s decline, jumping from the seventh spot last year to second place with an 8.51% share of the spot trading market, up from just 3.2%. OKX now sits in third place, with 6.38% of the market, up slightly from last year’s 5.4%.

Binance has been on a downward trajectory for the past two years. In October 2022, Binance held about 62% of the market. By November 2023, its market share had plunged to 30%, before recovering to over 40% for most of 2024.

While Bybit made impressive gains, other exchanges have not fared as well. Upbit, which held the second spot last year with 6.8% of the market, has now fallen to fourth, with a 5.77% share.

Coinbase also slipped from third place to fifth, dropping from 5.8% to 5.68%. OKX, on the other hand, managed to climb into third place, growing its share from 5.4% to 6.38%.

Meanwhile, weekly spot trading trends tell a similar story. Binance’s spot trading lead shrunk at the beginning of 2024, hitting as low as 34%, before clawing back to above 45% by the fourth quarter.

In contrast, Upbit, which had dipped to a low of 2%-4% market share at the end of 2023, slowly recovered, surpassing 5% by Q2 2024 and reaching as high as 10% by September.

Bybit, however, started to lose steam after peaking in January, with its share dropping from 10%-13% to just 5.2% by September.

OKX and Bybit shine in derivatives trading

In the derivatives market, the story is much the same for Binance. Out of the 22 major exchanges, 11 offer crypto derivatives trading, with a combined volume of $39.38 trillion, which is nearly three times the spot trading volume.

OKX and Bybit have solidified their positions as the second and third-largest derivatives exchanges, respectively. OKX’s share jumped from 15.5% to 19.83%, while Bybit grew from 11.3% to 13.98%.

Bitget, which holds the fourth spot, also gained ground, increasing its share from 8.2% to 12.73%. MEXC Global, which rounds out the top five, saw its share fall from 7.3% to just 4.27%.

The overall market volume for centralized exchanges has reached $54 trillion over the past 12 months, with Binance accounting for $22.5 trillion of that total.

Decentralized exchanges are gaining ground

While centralized exchanges have been duking it out, decentralized exchanges (DEXes) have quietly been making gains. The DEX market has expanded significantly, processing over $250 billion in trades in March 2024, a milestone not seen since December 2022.

This trend continued in June, with DEXes crossing the $250 billion mark once again. As of October 17, DEXes accounted for 13.6% of the total spot trading volume, up from 14.18% in May 2023.

For every $1 billion traded on CEXes, $136 million is being traded on DEXes. These developments are driven by new technologies and features in the DeFi space, such as liquid staking, cross-chain solutions, and real-world asset tokenization.

The rise of Layer-2 solutions on Ethereum and other networks has also contributed to the growth of DEX trading volumes.

Meanwhile, BNB remains one of the top five cryptocurrencies by market cap and is used not only on the Binance exchange but also on the BNB Chain, which powers thousands of projects.

BNB’s weekly trading volume peaked at $41.32 billion during the week of Bitcoin’s all-time high in March 2024. On average, BNB’s weekly volume sits around $8.57 billion, far outpacing other exchange tokens.

When it comes to price growth, BNB once again leads the pack. After starting at around $200 in October 2023, BNB climbed to $710 by June, which was an all-time high. Since March, prices has fluctuated between $500 and $600.