Chainlink Partners with Financial Giants to Create AI Blockchain Record of Corporate Data

Chainlink has announced a major AI initiative in partnership with financial institutions like Franklin Templeton, Swift, and Euroclear. The initiative aims to use AI to aggregate corporate data onto a single blockchain, creating a “golden record.”

This blockchain-based record would validate and consolidate vast amounts of data in real-time, streamlining processes and enhancing data accuracy across industries.

Chainlink’s Financial AI Experiment

In a press release shared with BeInCrypto, Chainlink announced a new AI initiative focused on corporate finance. The company has teamed up with major financial institutions like Franklin Templeton, Swift, and Euroclear to research how AI and blockchain technology can work together to improve data management and operations in the finance sector.

Read More: What Is Chainlink (LINK)?

The plan is straightforward: Chainlink aims to use its decentralized oracles alongside AI large language models (LLMs) to identify and gather key corporate actions. This data would then be recorded on blockchains, creating what Chainlink calls an “interoperable, unified golden record.”

“The combination of AI and oracles is a powerful tool for taking corporate actions data and turning it into highly reliably structured data. Turning various pieces of… data into…a definitive, single source of truth is truly a huge step forward in how financial markets deal with critical and error-prone data,” Chainlink co-founder Sergey Nazarov claimed.

Nazarov added that this record would significantly improve efficiency for individual and institutional actors all across the finance sector. Immense corporate investments have poured into AI this year, so it makes sense that these prominent financial institutions would join the experiment. Chainlink, for its part, has been making new partnerships in several areas.

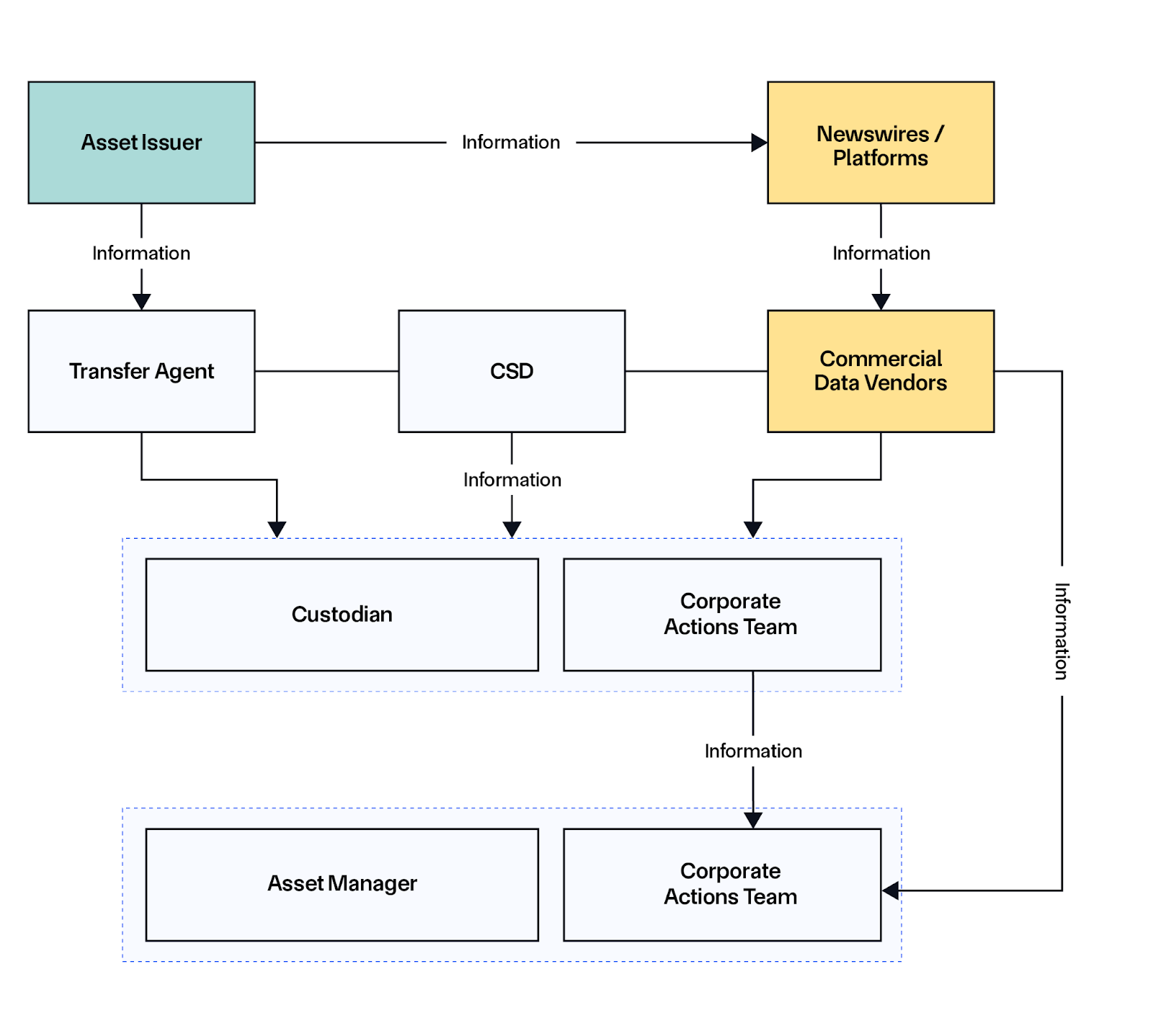

Chainlink also released an in-depth study outlining their approach to creating this “golden record.” The main issue these firms aim to solve is the inconsistent quality of corporate actions data, which is often released in various formats and through non-standardized channels. Chainlink’s oracles would quickly scan and collect relevant information from these diverse sources.

Read more: How Will Artificial Intelligence (AI) Transform Crypto?

Corporate Data Distribution. Source: Chainlink

Corporate Data Distribution. Source: Chainlink

The various oracles and LLMs in this data trawling operation function in decentralized nodes that must reach consensus before passing data along. This prevents any potential data garbling, whether through faulty translation or hallucination. Chainlink’s industry-standard CCIP protocol then disseminates this aggregated blockchain record through its interoperable system.

According to Chainlink’s results, the experiment has been successful in validating, aggregating, and transmitting corporate data in real-time. Although the initiative doesn’t yet have an official name, the term “unified golden record” is mentioned repeatedly in the documents. Looking ahead, the focus will shift to standardizing the process and preparing for a broader rollout.