PEPE Price’s 32% Rally to Four-Month High May Stumble, Here’s Why

PEPE price has been riding an uptrend recently, showing promising signs of bullish momentum. However, despite the optimistic outlook, the price has struggled to realize its full potential.

Negative signals from key network indicators are also clouding the situation. These factors have led to uncertainty about whether PEPE can maintain its upward trajectory or face a correction in the coming days.

PEPE Exhibits Mixed Signals

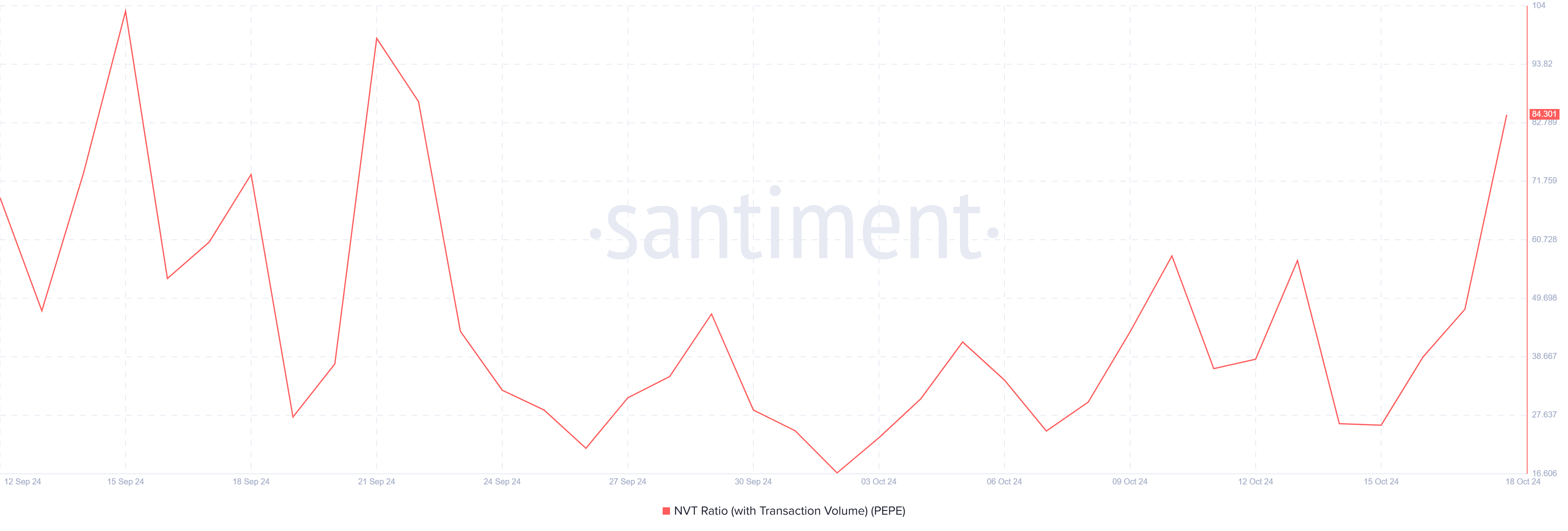

One of the most concerning indicators for PEPE is the spiking NVT (Network Value to Transactions) ratio, which has reached a four-week high. A high NVT ratio typically suggests that the network is overvalued relative to the number of transactions taking place.

This is often viewed as a bearish signal because it indicates that the price may not be supported by enough real-world activity on the network. With PEPE’s NVT ratio spiking, there’s a growing risk that its price could face downward pressure. This elevated NVT ratio could hinder PEPE’s ability to sustain its recent uptrend.

Read more: Pepe: A Comprehensive Guide to What It Is and How It Works

PEPE NVT Ratio. Source: Santiment

PEPE NVT Ratio. Source: Santiment

On the technical side, PEPE’s momentum looks stronger. The Relative Strength Index (RSI), a key indicator of market sentiment, shows that the coin’s bullish momentum is picking up.

After bouncing off the neutral 50 line, the RSI is now trending upward, which supports a potential price increase for PEPE. This suggests that despite some negative signals, the coin still has room to grow in the short term.

PEPE RSI. Source: TradingView

PEPE RSI. Source: TradingView

PEPE Price Prediction: Wait Ahead

PEPE has been in an uptrend over the last few weeks, but it is currently facing resistance at the $0.00001146 level. The meme coin has struggled to break through this barrier in the past, creating uncertainty about whether it can succeed this time. Overcoming this resistance is key to continuing its upward movement.

Despite the bullish momentum indicated by the RSI, the mixed signals from other indicators may keep PEPE subdued below the $0.00001146 mark. The coin has established an uptrend line as support, but if it loses this level, PEPE could fall to $0.00000839. This would represent a significant correction, reversing some of its recent gains.

Read more: Pepe (PEPE) Price Prediction 2024/2025/2030

PEPE Price Analysis. Source: TradingView

PEPE Price Analysis. Source: TradingView

However, should PEPE manage to breach the $0.00001146 resistance, it could rally towards $0.00001369, forming a new four-month high. This would invalidate the bearish-neutral outlook and reinforce the coin’s bullish trend, setting the stage for further growth in the weeks ahead.