Dogecoin whale activity takes a hit, will DOGE price plummet?

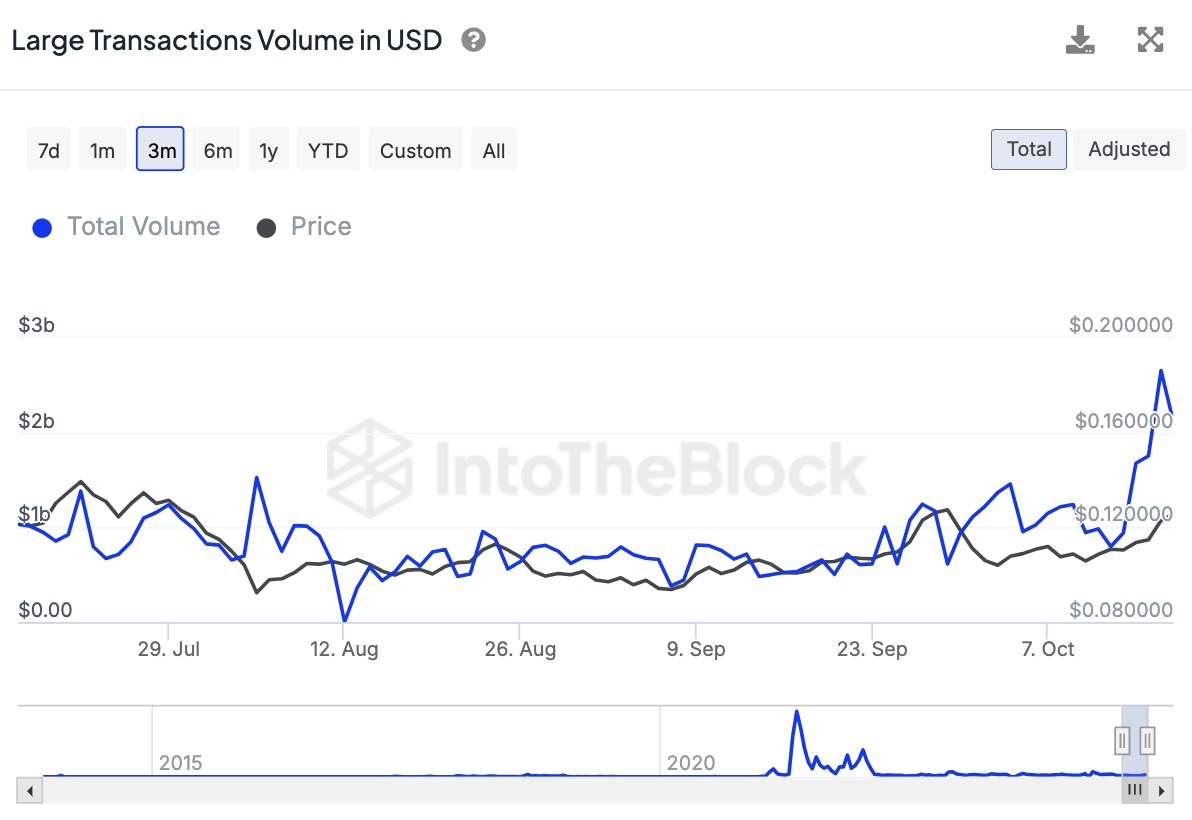

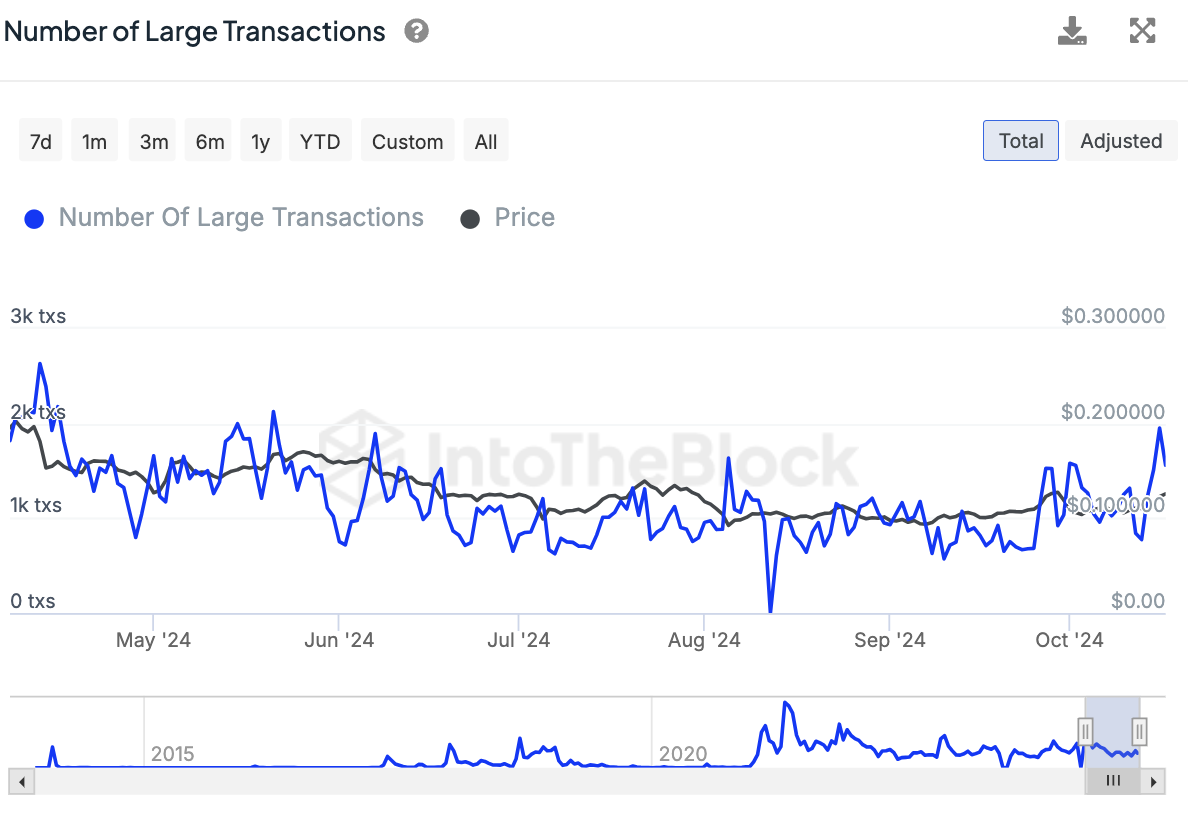

- Dogecoin’s large volume transactions hit a peak on Wednesday, October 16.

- DOGE whale activity has slowed down, both the number and volume of large transactions noted a dip.

- DOGE could correct nearly 12% as a technical indicator generates a sell signal.

Dogecoin (DOGE) notes a drop in the count and volume of whale transactions in the last two days. On-chain data from IntoTheBlock shows that whales have likely slowed down their activity.

DOGE adds nearly 3% to its value on the day and the largest meme coin trades at $0.1329 at the time of writing.

Dogecoin whales slowdown, DOGE price could react

Large wallet investors (whales) typically influence an asset’s price trend. A slowdown in their activity on-chain is typically considered a sign of likely correction in the token. When whales accumulate, it fuels demand and pushes price higher. Similarly, profit-taking increases selling pressure on DOGE.

As large transactions in DOGE reduce it is either a sign of a loss in trader interest or a slowdown in activity in the meme coin. Data from IntoTheBlock shows the spike and the drop in large transactions, in terms of volume and number both.

Large transactions volume in USD

Number of large transactions

DOGE gears up for price drop

Dogecoin broke out of its multi-month downward trend on September 18. Since then the meme coin climbed to a peak of $0.1364 on Friday, October 18. The Relative Strength Index (RSI) generated a sell-signal on the DOGE/USDT daily chart. RSI reads 72.74, it crossed above the 70 level, meaning that the meme coin is “overbought.”

Traders typically consider this a sign to take profits and exit their positions in the token.

DOGE could correct 11.79% and sweep liquidity at $0.1171, the 200-day Exponential Moving Average (EMA) and a key support.

DOGE/USDT daily chart

A daily candlestick close above the high of $0.1364 could invalidate the bearish thesis and send DOGE to test the resistance zone in the Fair Value Gap (FVG) between $0.1583 and $0.1489. DOGE could rally towards the 50% Fibonacci retracement of its decline from the March 28, 2024 high of $0.2288 to the August 5, 2024 low of $0.0805.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.