4 US Economic Events That Could Impact Crypto Market This Week

Four key US economic events are expected to capture the attention of cryptocurrency markets this week. Economists, traders, and investors across the financial sector are closely monitoring these developments to gauge the health of the American economy.

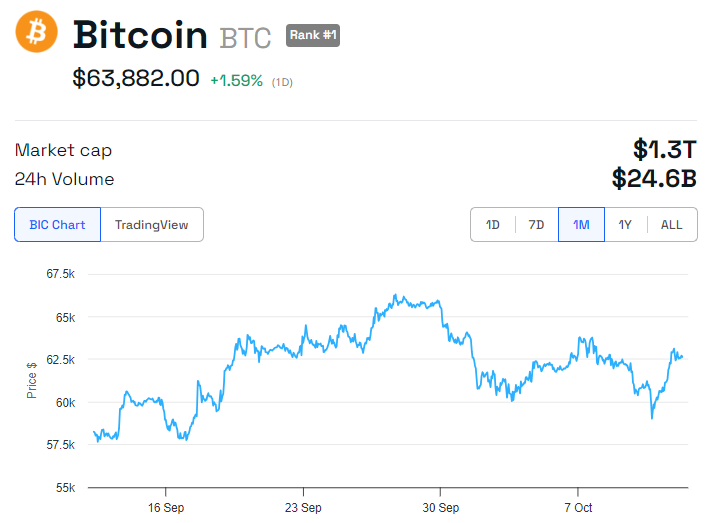

Bitcoin (BTC) remains steady above $63,900, signaling a positive outlook for the leading cryptocurrency. With October off to a strong start, the fourth quarter (Q4) is shaping up to be favorable for Bitcoin.

Initial Jobless Claims

Thursday’s initial jobless claims report will offer insights into the US labor market’s condition. While the job market has softened, unemployment rates remain low. Typically, strong job growth and rising wages signal a tightening labor market, which can increase inflationary pressures.

With jobs data in focus, the Federal Reserve is weighing its next interest rate move, considering its mandate to balance employment and price stability.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency.

High initial jobless claims may indicate economic hardship and a weakening labor market. As a result, reduced consumer spending and investment in stocks and bonds could push some investors to explore cryptocurrencies.

US Retail Sales

Retail sales will also be a key focus of US economic data releases this week. Almost similar to the employment data, this report will provide investors and economists with an important look at inflation and give insights into consumers’ ability and willingness to spend money.

The Thursday data will report on September’s retail sales, after rising by a meager 0.1% in August, or 0.2% with motor vehicles and gasoline exempted. This was better than expected, considering total July sales rose significantly by 1.1%, as did e-commerce sales, which picked up by 1.4%.

Economists expect retail sales to rise by 0.7% month-over-month (MoM), which would be significant following market participants’ concerns over the economy heading for a recession or a soft landing. Retail sales accelerating considerably could shift further toward a ‘no landing’ or even re-acceleration.

As regards crypto implication, strong retail sales figures would suggest robust consumer spending, signifying a healthy economy. Increased retail sales could signal confidence among consumers, potentially leading to increased investment in riskier assets like Bitcoin. Conversely, weak retail sales may indicate economic softness, prompting investors to seek alternative investment opportunities.

Industrial Production

Industrial production data provides insights into the strength of the manufacturing sector, which is a key driver of economic growth. The Federal Reserve’s monthly index of this data and the related capacity indexes and utilization rates would cover manufacturing, mining, and electric and gas utilities.

Notably, the industrial sector, together with construction, accounts for the bulk of the variation in US national. Based on this, the industrial production data would reflect structural developments in the economy.

Strong industrial production data would suggest a positive sign for the overall economy. This would potentially boost investor sentiment across various asset classes, including Bitcoin and crypto in general.

Corporate Earnings

Several corporate earnings reports are scheduled this week, starting Tuesday, October 15. Among them are Bank of America (BAC), Citigroup (C), and Charles Schwab (SCHW). These data releases would provide a glimpse into the financial health of companies across different sectors in the US.

Strong corporate earnings often translate to positive market reactions, driving up stock prices and investor confidence. This optimistic market sentiment can spill over to the cryptocurrency market as investors seek higher returns in a buoyant economic environment.

The interplay between these traditional economic indicators and the crypto markets can be complex and multifaceted. A generally positive economic outlook, as signaled by strong retail sales, declining jobless claims, strong industrial production, and upbeat corporate earnings, could potentially fuel investor interest in cryptocurrencies as a form of diversification or risk mitigation.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

BTC Price Performance Ahead of US Economic Events. Source: BeInCrypto

BTC Price Performance Ahead of US Economic Events. Source: BeInCrypto

Conversely, any negative surprises in these economic data points may lead to heightened volatility and risk aversion in both traditional and digital asset markets. Investors should closely monitor these economic indicators alongside developments in the crypto space this week to make informed decisions and effectively navigate potential opportunities and risks.

As crypto braces for volatility due to these events, Bitcoin (BTC) is trading for $63,882 as of this writing, up by a modest 1.59% since Monday’s session opened.