Asia & MENA Crypto Roundup: South Korea Investigates Upbeat, and More

BeInCrypto’s Asia Crypto Roundup dives into the region’s most crucial updates and developments. Covering key markets like China, South Korea, Japan, and Singapore, our roundup offers insights into Asia’s regulatory shifts, blockchain innovations, major project launches, and market trends.

Last week’s notable events include South Korea’s investigation into Upbit, OKX’s launch in UAE and other stories.

South Korea Opens Antitrust Investigation Against Upbit

South Korean lawmakers have launched an investigation into Upbit, the country’s largest cryptocurrency exchange. The probe focuses on the monopoly structure Upbit has built within the virtual asset market. As the leading exchange in South Asia by trading volume, Upbit is widely used by South Korean traders.

Kim Byung-hwan, chair of South Korea’s Financial Services Commission, announced plans to investigate the monopoly structure of the virtual asset market centered around Upbit. He made this commitment on Thursday, October 10, following concerns raised by Democratic Party lawmaker Lee Kang-il.

“Upbit, the largest virtual asset exchange in Korea, is second in the world…the phenomenon of excessive concentration in one company and Upbit’s monopoly began after the business partnership with K Bank,” local media reported, citing Lee Kang-il.

Read more: 17 Best No KYC Crypto Exchanges: Top Choices in 2024

Lee Kang-il revealed that Upbit’s deposits make up a significant portion of K Bank’s holdings. The online bank aims to raise up to 984 billion won ($731.64 million), potentially one of 2024’s biggest IPOs.

Lee criticized K Bank for offering 2.1% interest on Upbit deposits despite its slim profit margin. He raised concerns about the relationship between Upbit and K Bank, which contradicts the principle of separating finance and industry.

In response, Financial Services Commission chair Kim Byung-hwan pledged a further review of the matter through the Virtual Asset Committee.

Consecutive Crypto Scams Targeting the Elderly in Japan

Japan is witnessing a troubling rise in scams targeting the elderly, with crypto asset fraud becoming a prominent issue. In Hyogo, a 59-year-old woman in Nishinomiya City was defrauded of approximately 2.45 million yen by men posing as police officers. The scammers falsely claimed her bank account was involved in money laundering and convinced her to open a crypto account. The Hyogo Prefectural Police are investigating the case as a special fraud.

A similar scam occurred in Nagasaki, where a man in his 70s transferred 32.5 million yen worth of crypto assets. A woman he met on a social networking site convinced him to invest in crypto assets by promising returns seven times his investment. Over time, the man sent funds 13 times to a wallet she controlled.

Read more: 15 Most Common Crypto Scams To Look Out For

While the number of fraud cases has slightly decreased in Japan, the financial losses have surged. As of now, there were 12,362 reported cases, a slight decline of 1.5% year-on-year, but the amount of damage skyrocketed to 35.03 billion yen —a 28.9% increase from the previous year.

UAE Exempts Digital Transactions from VAT Retroactive to 2018

The United Arab Emirates (UAE) has announced that cryptocurrency-related transactions will be exempt from value-added tax (VAT), effective retroactively from 2018. This decision strengthens the UAE’s position as a leading destination for fintech and digital assets in the Middle East.

However, companies may need to make voluntary disclosures to the Federal Tax Authority (FTA) to ensure compliance. As part of this retroactive exemption, past transaction records will be reviewed, and businesses could face penalties if fraud or discrepancies are found. Companies must audit their records to confirm that all transactions and disclosures are accurate.

According to a recent report from Chainalysis, the UAE received over $30 billion in cryptocurrency between July 2023 and June 2024. This placed the UAE among the top 40 countries globally in terms of crypto inflows.

Read more: How to Reduce Your Crypto Tax Liability: A Comprehensive Guide

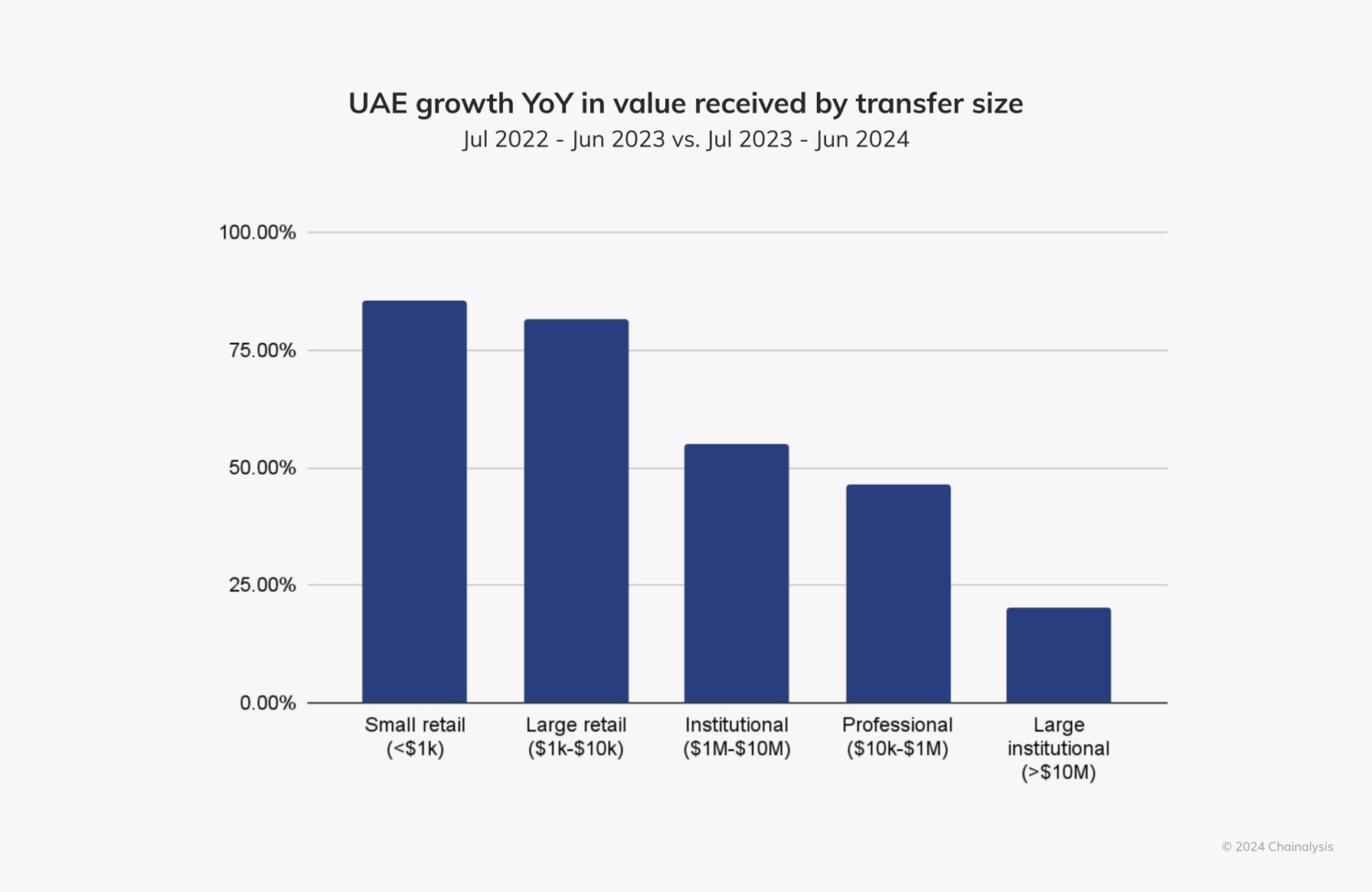

UAE YoY Growth in Value Received by Transfer Size. Source: Chainalysis

UAE YoY Growth in Value Received by Transfer Size. Source: Chainalysis

The report also highlighted significant growth in decentralized finance (DeFi) services within the UAE. The total value of DeFi services increased by 74% year-on-year, from $2.3 billion to $3.4 billion. Decentralized exchanges (DEXs) saw an 87% rise, with values climbing from $6 billion to $11.3 billion.

National Bank of Bahrain Launches First Structured Bitcoin Investment in the GCC

The National Bank of Bahrain (NBB) has introduced the first structured Bitcoin investment in the Gulf Cooperation Council (GCC), developed in partnership with ARP Digital. The NBB revealed this product at the Future of Fintech 2024 forum.

Designed for accredited investors, the investment product allows participants to capitalize on Bitcoin’s long-term growth. Investors can benefit from Bitcoin’s rising performance, subject to a pre-set limit, combining growth potential with risk mitigation.

“We are proud to offer this structured and customized investment that combines the desire for digital assets with the assurance of capital protection. This product underscores our focus on providing safe and innovative ways for wealth management clients to diversify their portfolios in an evolving investment landscape,” said Hisham El Kurdi, Group Chief Executive Officer of Capital Markets and Client Banking Solutions.

Read more: Crypto vs. Banking: Which Is a Smarter Choice?

The initiative aligns with NBB’s strategy to expand its wealth management services. This move strengthens Bahrain’s position as an innovative financial hub in the GCC and showcases NBB’s commitment to integrating traditional wealth management with modern financial trends.

OKX Launches Licensed Crypto Exchange for Retail and Institutional Investors in the UAE

OKX has launched a licensed cryptocurrency exchange catering to both retail and institutional investors in the UAE. This move follows the intensified efforts by Dubai’s Virtual Assets Regulatory Authority (VARA) to safeguard the virtual asset ecosystem by targeting unlicensed firms operating without proper licenses.

The new platform debuted with a gala event titled “A New Alternative for Dubai” at the Museum of the Future. Notable attendees included OKX CEO Star Xu, Manchester City manager Pep Guardiola, SkyBridge Capital’s Anthony Scaramucci, Polygon co-founder Sandeep Nailwal, Stacks co-creator Muneeb Ali, and CEO of the Dubai Blockchain Center Dr. Marwan Al Zarouni.

“We’re thrilled to be the first global crypto exchange to launch with a full operating license for retail and institutional clients in the UAE. Tonight’s celebration is just the beginning of a long-term journey,” said Rifad Mahasneh, General Manager of OKX Middle East.

Read more: OKX Review 2024: A Comprehensive Guide to the Leading Crypto Exchange

UAE residents who complete the necessary onboarding steps on the OKX app and website can now access a range of services, including spot trading, express buy and sell, convert features, and on-chain earning products. Qualified and institutional investors can also engage in derivatives trading, provided they meet specific requirements.

To qualify as ‘qualified’ investors, individuals must pass a knowledge test, undergo a suitability assessment, and prove they hold AED 500,000 in liquid assets. Institutional investors are subject to additional Know Your Customer (KYC) checks and must meet specific financial thresholds.