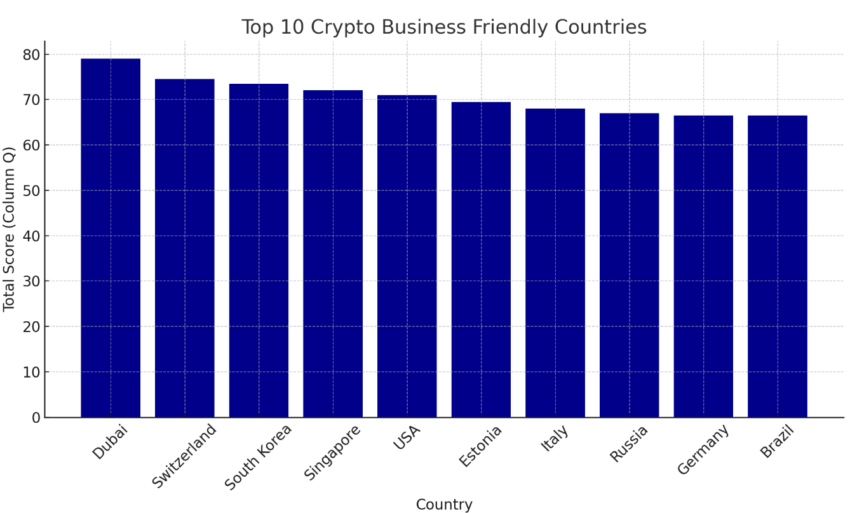

Dubai Ranks as Top Crypto Hub, Followed by Switzerland and South Korea in 2024

Dubai, Switzerland, and South Korea are leading the global crypto industry by offering a powerful mix of regulatory clarity, competitive tax structures, and well-developed market frameworks. This combination not only attracts crypto firms but also sets the standard for the future of digital assets.

According to a recent report by Social Capital Markets, these three nations rank as the world’s top crypto hubs. The study evaluated factors such as legal transparency, tax policies, and the rate of crypto adoption, along with the number of registered crypto firms and the widespread acceptance of digital currencies.

Dubai, Switzerland, and South Korea Dominate the Industry

Dubai claimed the top position with a score of 79 out of 100, thanks to its progressive regulatory stance and comprehensive support for blockchain ventures.

The Dubai Multi Commodities Centre (DMCC) serves as a key driver, offering both a dedicated crypto center and a launchpad for blockchain projects. The Virtual Asset Regulatory Authority (VARA) and the Dubai Financial Services Authority (DFSA) provide further regulatory oversight.

Meanwhile, Switzerland follows closely in second place with over 900 crypto companies and a score of approximately 75.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Switzerland’s tax policies, including a 7.8% capital gains tax for long-term investors and corporate tax rates ranging from 12% to 21%, create a competitive environment for both startups and established firms. Moreover, the country’s Financial Market Supervisory Authority (FINMA) provides clear, consistent regulatory guidance, fostering confidence among businesses.

Additionally, over 400 Swiss companies accept crypto payments, reflecting the nation’s broad embrace of digital currencies.

Crypto-Friendly Countries. Source: Social Capital Markets report

Crypto-Friendly Countries. Source: Social Capital Markets report

South Korea is third, thanks to its regulatory foresight and commitment to fostering financial innovation. The Asian country’s government has postponed corporate taxes on crypto firms until 2025 and waived capital gains tax on crypto trades, creating an attractive business environment.

The Korea Financial Intelligence Unit, under the Financial Services Commission, ensures transparency within the sector. With more than 376 active crypto firms and ongoing exploration of central bank digital currencies, South Korea is strongly committed to leading the next phase of financial innovation.

Other Crypto-Friendly Nations

Beyond the top three, other nations, including Singapore, the United States, and Portugal, have also earned recognition for their crypto-friendly environments.

Singapore ranked fourth with a score of 72, and it has established a $8.9 million blockchain grant to support crypto businesses. The United States and Portugal are gaining traction due to widespread crypto adoption.

Read more: How Does Regulation Impact Crypto Marketing? A Complete Guide

In the United States, nearly 6,000 businesses now accept cryptocurrencies such as Bitcoin and Ethereum, signaling widespread adoption. Portugal is also catching up, with over 100 companies embracing digital currencies and taking advantage of its crypto-friendly policies.

“The crypto industry is profitable and increasingly acknowledged by many countries as the future of digital investments. To join this crypto wave, countries are developing laws and regulations that support crypto businesses while protecting their citizens’ interests. G20 countries lead in creating crypto-supportive regulations, but even countries that aren’t G20 members are not far behind, offering intense competition,” Social Capital Markets concluded.