Justin Sun Sends $500,000 in TRX to Ty Dolla Sign After SUNDOG Transfer Error

Tron founder Justin Sun rescued American singer, songwriter, and record producer Ty Dolla Sign from losing his Sundog (SUNDOG) meme coin bag.

SUNDOG is one of the Tron network’s leading meme coins, boasting a market capitalization above $265 million. It is fueled by large investments and vocal support from the controversial Tron executive.

Justin Sun Bails Out Ty Dolla Sign’s $409,000 SUNDOG Mishap

The American celebrity Ty Dolla Sign mistakenly sent 1.66 million SUNDOG tokens, valued at $409,000, to a contract address instead of his TRX account. To assist him, Justin Sun, founder of Tron, stepped in by sending 3,194,887 TRX tokens (worth $500,000) from his HTX4 wallet to Ty Dolla Sign, stating that this would help him “get back in the game.”

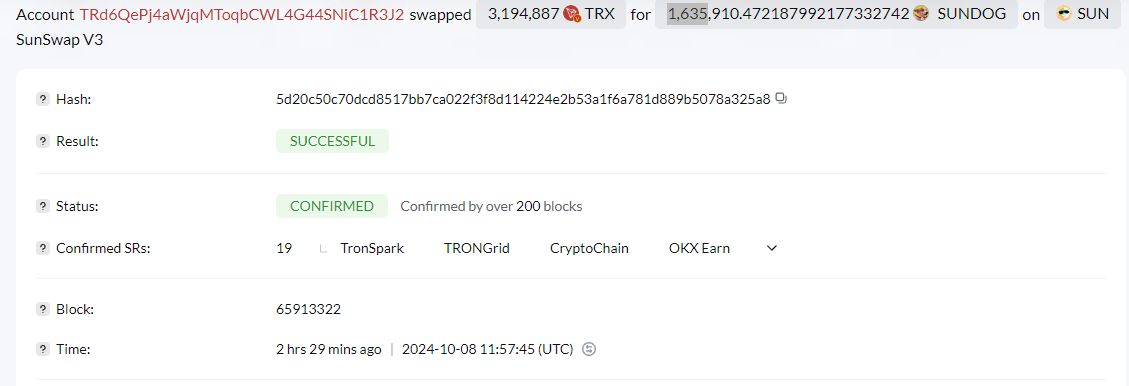

Ty Dolla Sign then used the TRX tokens to re-invest in the SUNDOG meme coin. According to data on Tronscan, the artist swapped the 3,194,887 TRX tokens for 1,635 SUNDOG coins on SunSwap V3, effectively channeling the funds back into the meme coin market.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

Ty Dolla Sign Swaps TRX For SUNDOG. Source: Tronscan

Ty Dolla Sign Swaps TRX For SUNDOG. Source: Tronscan

Lookonchain data supports the report on Ty Dolla Sign’s token recovery. However, the incident sparked conversations around token recovery after such massive losses.

“You are telling me that if I’m dumb enough to burn my $400k I’ll get $500k back? Where do I sign?” Dead Cat Bounce, a pseudonymous user on X commented.

It remains unclear whether Ty Dolla Sign’s celebrity profile played a role in attracting Justin Sun’s attention. Nevertheless, it is worth noting that the behavior and outcome when one sends tokens to a contract address varies. Specifically, it depends on the contract’s design, with one of five outcomes possible:

- Rejection. Some contracts’ designs are such that they reject incoming token transfers. In this case, the tokens sent to the contract address are not accepted, and the transaction may fail.

- Fallback Function Execution. If the contract has a fallback function or a receive function defined, it may execute certain code logic when one sends tokens to the address. This function could handle the incoming tokens in a specific way defined by the contract creator.

- Token lockup. The contract’s programming may be such that it locks up or stores the tokens sent to it for specific purposes outlined in its code. These tokens could be held in escrow or used for certain functionalities within the contract.

- Token Swap/Exchange. Some contracts allow for token swaps or exchanges. One can then exchange the tokens sent for other tokens or assets, depending on the contract’s rules.

- Loss of Tokens. In some cases, sending tokens to a contract address may result in the loss of those tokens if the contract does not handle incoming tokens properly or if the contract code has vulnerabilities.

Ty Dolla Sign’s incident highlights the need for caution when performing crypto transactions. It also stresses the importance of reviewing a contract’s code and functionality before sending tokens to a contract address, to avoid potential losses.

Read more: 7 Best Tron Wallets for Storing TRX

SUNDOG Price Performance. Source: BeInCrypto

SUNDOG Price Performance. Source: BeInCrypto

Against this backdrop, however, SUNDOG’s price is up by 5.45%. It has effectively outperformed leading meme coins like DOGE, SHIB, and PEPE, which are down between 6% and 10%. As of this writing, the Tron-based meme coin is trading for $0.2588.