These 2 Crucial Factors Could Drive Toncoin (TON) to $6

Toncoin (TON) has faced challenges in breaching the $6.00 barrier, leading to an 11% decline in the altcoin’s price.

The Telegram-linked cryptocurrency is now trading at $5.36 and attempting to reclaim a crucial support level.

Toncoin Sees Hope

One key factor affecting Toncoin’s market sentiment is the percentage of investors in profit. Observing the active addresses by profitability, it is evident that less than 3% of the participating investors are currently in profit.

Typically, a higher number of profitable investors would be prone to selling, which could trigger a price decline. However, the fact that there are so few profitable holders means the selling pressure is low, which is a bullish sign for Toncoin.

The lack of profit-taking suggests that investors may be holding on to their positions, expecting a future rally. This creates a supportive environment for Toncoin, reducing the likelihood of sudden drops and potentially allowing the cryptocurrency to regain its lost ground.

Read more: What Are Telegram Bot Coins?

Toncoin Active Addresses by Profitability. Source: IntoTheBlock

Toncoin Active Addresses by Profitability. Source: IntoTheBlock

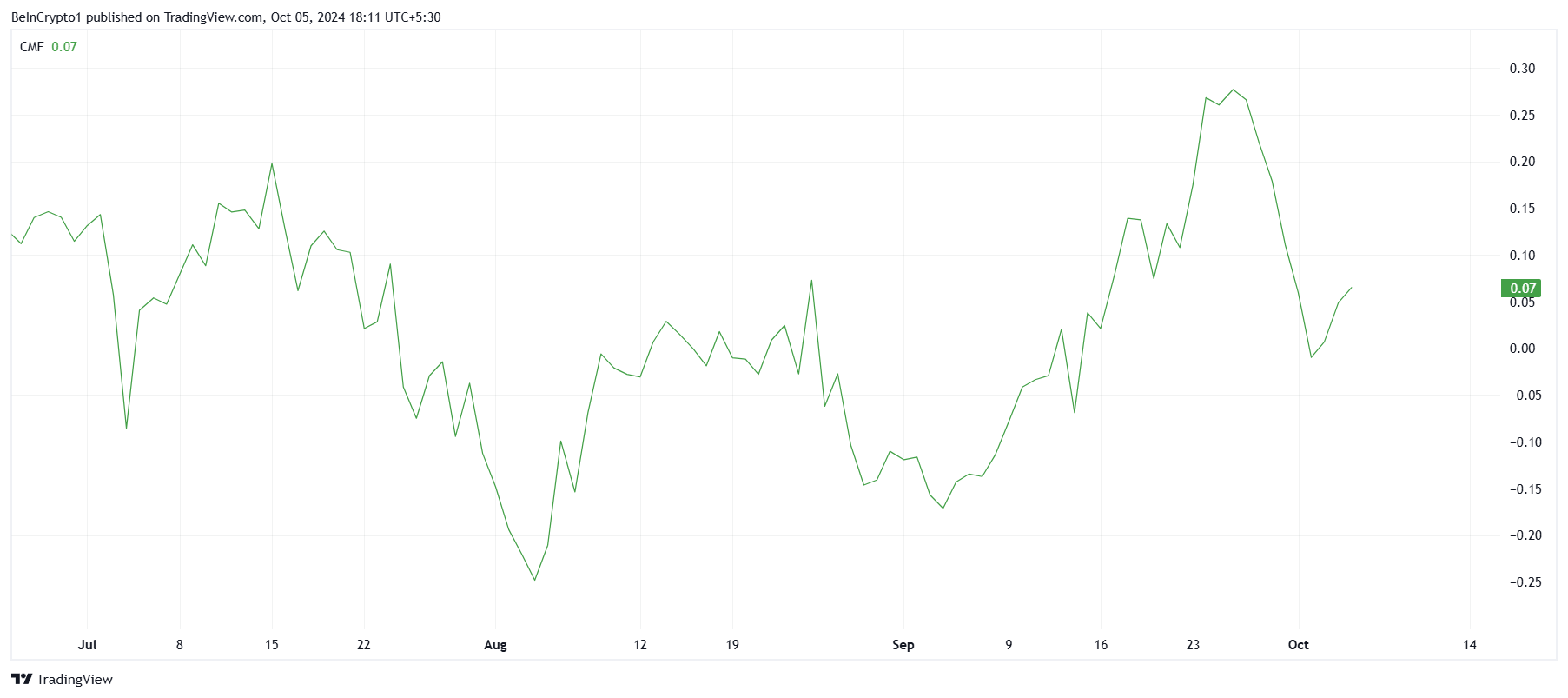

From a macro perspective, technical indicators are starting to show signs of recovery. The Chaikin Money Flow (CMF) indicator, which tracks the flow of money in and out of the asset, has bounced back from the zero line. This suggests that inflows into Toncoin are making a comeback, a crucial factor for the altcoin’s price recovery.

A sustained inflow of capital could help bolster Toncoin’s market position, indicating that investors are regaining confidence in the asset. The return of positive momentum, reflected in the CMF, is a sign that bullish pressure is starting to build, making it possible for Toncoin to push past its resistance levels.

Toncoin CMF. Source: TradingView

Toncoin CMF. Source: TradingView

TON Price Prediction: A Steady Rise

Toncoin is currently attempting to reclaim the $5.37 level as support. Successfully flipping this level is essential for the asset to attempt a rise toward $5.96, a key resistance point. Breaching this level would leave only the $6.00 barrier standing between Toncoin and a stronger upward rally.

The current market and macro factors support the possibility of Toncoin breaching $5.96, provided it can maintain its bullish momentum over the next few days. A steady inflow of capital and the low selling pressure create a favorable environment for recovery.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

Toncoin Price Analysis. Source: TradingView

Toncoin Price Analysis. Source: TradingView

However, any profit-taking by investors following the flip of $5.37 into support could disrupt the bullish momentum. This could keep Toncoin subdued under the $6.00 mark, delaying its potential for further gains.