IMF Adopts Lighter Tone, Urges El Salvador to Narrow Bitcoin Support

The International Monetary Fund (IMF) has suggested that El Salvador reduce government support for Bitcoin. This is a far more conciliatory attitude than previous attempts to repeal the nation’s Bitcoin law.

Nevertheless, President Nayib Bukele seems committed to Bitcoinization.

Bitcoin and El Salvador

According to a recent report from Forbes, the International Monetary Fund (IMF) is trying a new tactic with El Salvador: if it won’t repeal Bitcoin’s status as a legal currency, it should reduce Bitcoin’s legal support. The IMF has remained an implacable enemy of El Salvador’s Bitcoin project since Bukele declared it legal tender in 2021.

“What we have recommended is a narrowing of the scope of the bitcoin law, strengthening the regulatory framework and oversight of the bitcoin ecosystem, and limiting public sector exposure to bitcoin,” IMF spokesperson Julie Kozack claimed via press conference.

Read more: Top 9 Crypto Friendly Countries For Digital Assets Investors

Before Bukele legalized Bitcoin as a legal tender in El Salvador, the country’s sole currency was US dollars. Bukele explicitly cast this turn towards decentralized currency as an attempt to gain national sovereignty and economic independence. The IMF has tried various tactics to reverse this legislation, such as tanking Salvadoran bonds, but their tune might be changing.

Bukele won re-election in June this year, promising an “economic transformation” through Bitcoin. In his second term, he began new ambitious projects to integrate it into the economy. Additionally, since his re-election, the IMF has seemed more conciliatory in their approach, and today’s statements seem to continue the trend.

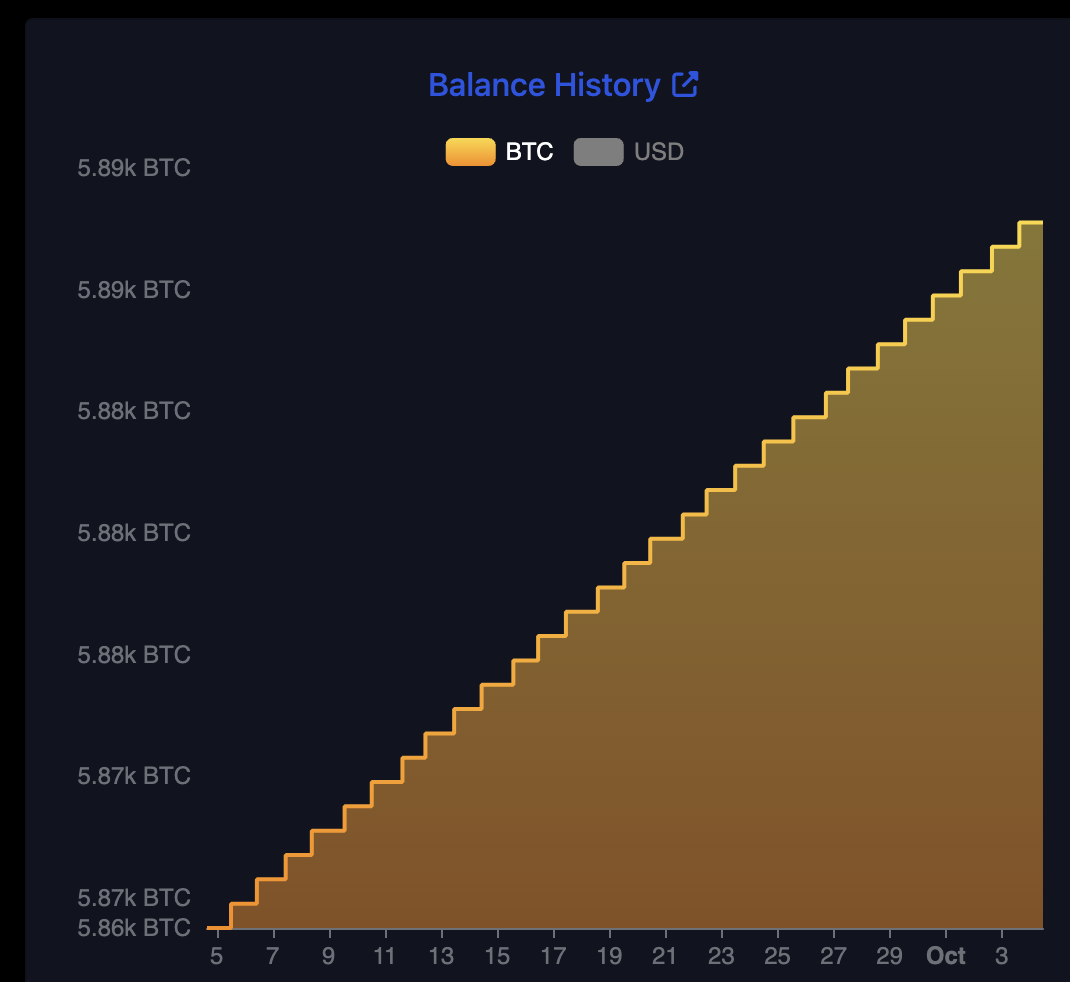

Simply put, the cat is out of the bag, thanks to Bukele’s successes. El Salvador has acquired a substantial stockpile of Bitcoin, and Forbes‘ analysis of the country’s 2025 budget suggests that the country will not require IMF loans. Slight reconciliation now might be the IMF’s best chance to rebuild a working relationship with the country.

El Salvador’s Bitcoin Supply. Source: Salvadoran Government Site

El Salvador’s Bitcoin Supply. Source: Salvadoran Government Site

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

The IMF’s incentives are not aligned with El Salvador’s, and El Salvador should forge its own path, independent of IMF interests. It was a very beneficial move to defy their previous advice regarding Bitcoin,” claimed John Dennehy, founder of Salvadoran NGO Mi Primer Bitcoin.

It seems unlikely that Bukele will accept this olive branch. His re-election was quite the political accomplishment, and he has a variety of plans to continue the nation’s Bitcoinization. El Salvador has made it this far by disregarding the financial establishment, and has little reason to stop now. Bitcoin is performing well, and the future looks bright.