Bitcoin is not a safe haven against geopolitical tensions, says Standard Chartered

Bitcoin isn’t going to save us from geopolitical uncertainties. That’s what Geoff Kendrick, Standard Chartered’s global head of digital assets research, believes.

With tensions in the Middle East rising, he expects Bitcoin to fall way below $60,000 before the weekend. But he also believes this could be a prime buying opportunity.

Kendrick points out the connection between geopolitical issues and self-proclaimed pro-crypto Donald Trump’s chances.

This week, his odds of winning the November elections have increased by about 1%, while Kamala Harris’s chances dropped by the same. Trump now sits at 50%, slightly ahead of Harris, who has 49%.

According to Kendrick, there’s a “circularity” in how these tensions affect Bitcoin. When geopolitical risks like the Middle East flare up, Bitcoin drops.

But, oddly enough, these same risks seem to favor Trump’s chances. A Trump victory is considered bullish for Bitcoin, while a Harris win will have the opposite effect.

Trump’s crypto play could change Bitcoin’s fate

Trump’s reappearance on the political stage comes with a twist for the crypto community as he did a complete 180 on the matter.

Analysts expect that a Trump administration would speed up pro-crypto policies, which could send prices flying in the months following the election.

Regulatory advancements could slow down under a Harris administration, ruining market sentiment. But Kendrick believes investors will eventually “buy the dip” when they realize that progress on regulation is inevitable, just delayed.

Despite it all, the market has been seeing a surge in Bitcoin call option positions. Open interest for call options expiring on December 27 with a strike price of $80,000 surged by 1,300 Bitcoin in just two days.

Bitcoin is no gold

While Bitcoin has long been pitched as “digital gold,” Kendrick believes it’s not the safe haven some make it out to be. He said:

“Gold is a geopolitical hedge. Bitcoin is a hedge against traditional finance issues like bank collapses or U.S. Treasury problems.”

When looking at Bitcoin’s price performance from past market cycles, Kendrick says there’s a weird consistency. Despite drastically different conditions, Bitcoin’s behavior is oddly similar across these cycles.

Analysts debate why this happens, but the fact remains that BTC tends to follow similar patterns, making its dynamics predictable to some extent.

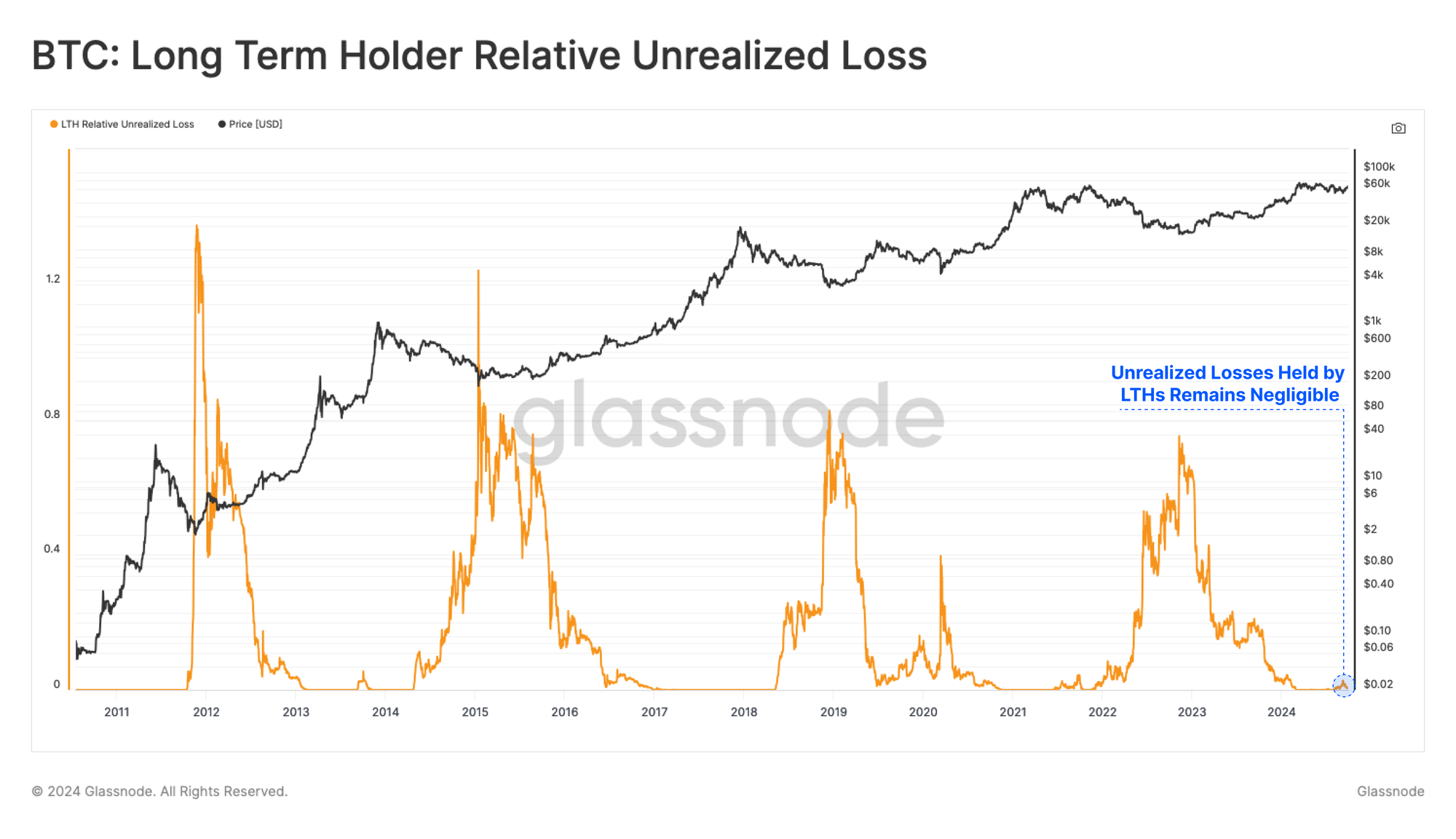

Meanwhile, the percentage of Bitcoin supply held by long-term investors has hit its highest level since mid-2021.

But many of these holders are sitting on unrealized losses. Coins bought near Bitcoin’s all-time high of $73,000 have now crossed the 155-day threshold and are being held at a loss.

Around 47.4% of all Bitcoin in loss right now is held by long-term holders. But the losses aren’t severe enough to cause panic.

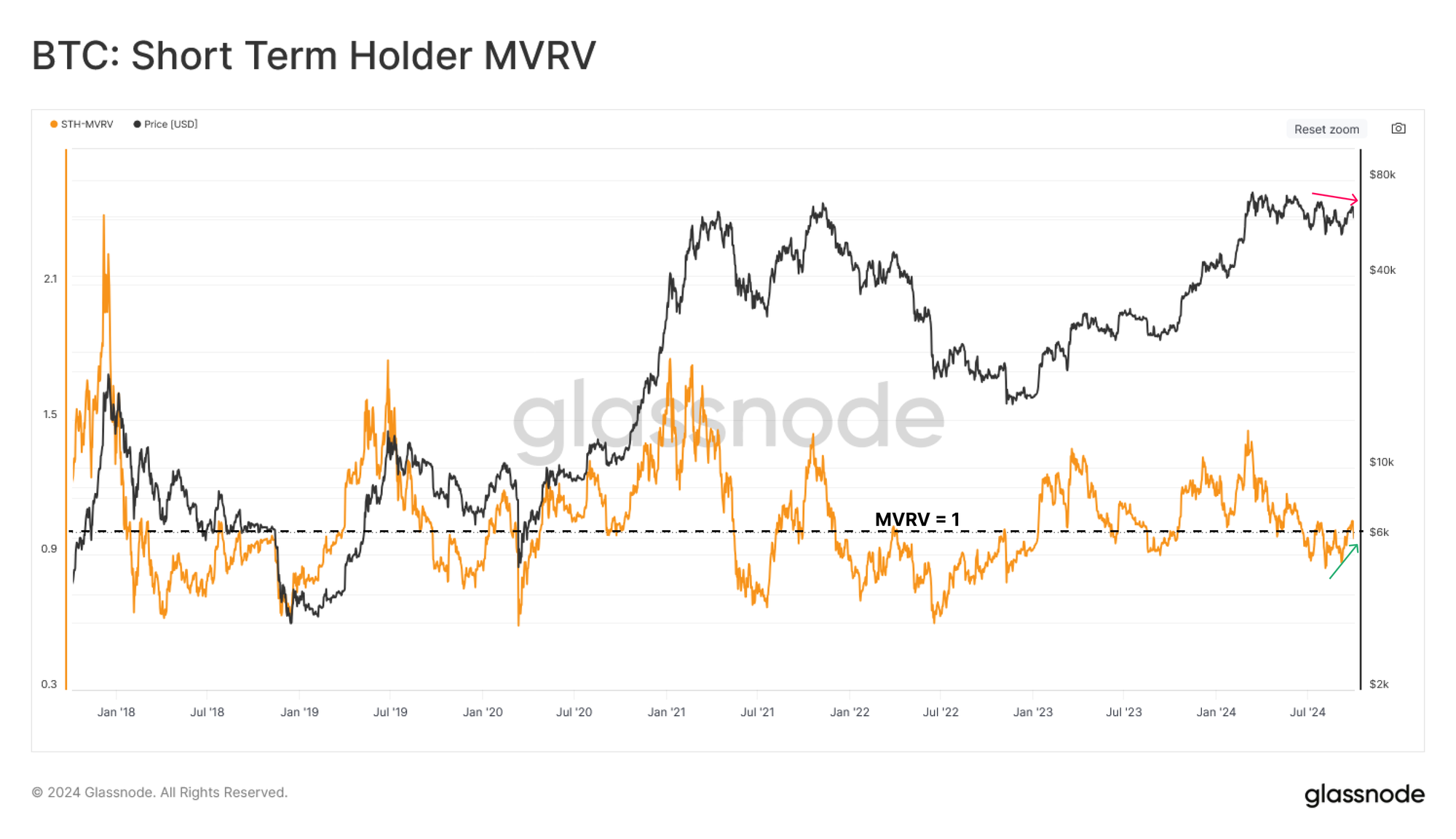

Short-term holders, on the other hand, are doing a bit better. Over the past few weeks, short-term holders have seen a slight improvement in profitability.

The percentage of short-term supply in profit has risen to over 62%. Also, profit-taking volumes are 14.17 times higher than loss-taking, showing that investors are cashing out when they can.

This aligns with the idea that while short-term holders are quick to react to market conditions, they’re starting to see better days ahead.