Solana (SOL) Price Enters ‘No Go Area,’ Points to Sub-$130 Levels

Since falling from $160 on September 30, the Solana (SOL) price has continued to hit lower levels. Recent data suggests that the token might drop to a region it has not reached in almost a month.

As of this writing, Solana’s price is $135.52. But with a grim outlook, here is why SOL could fail to notch a quick recovery.

Buying Solana Now Looks Risky

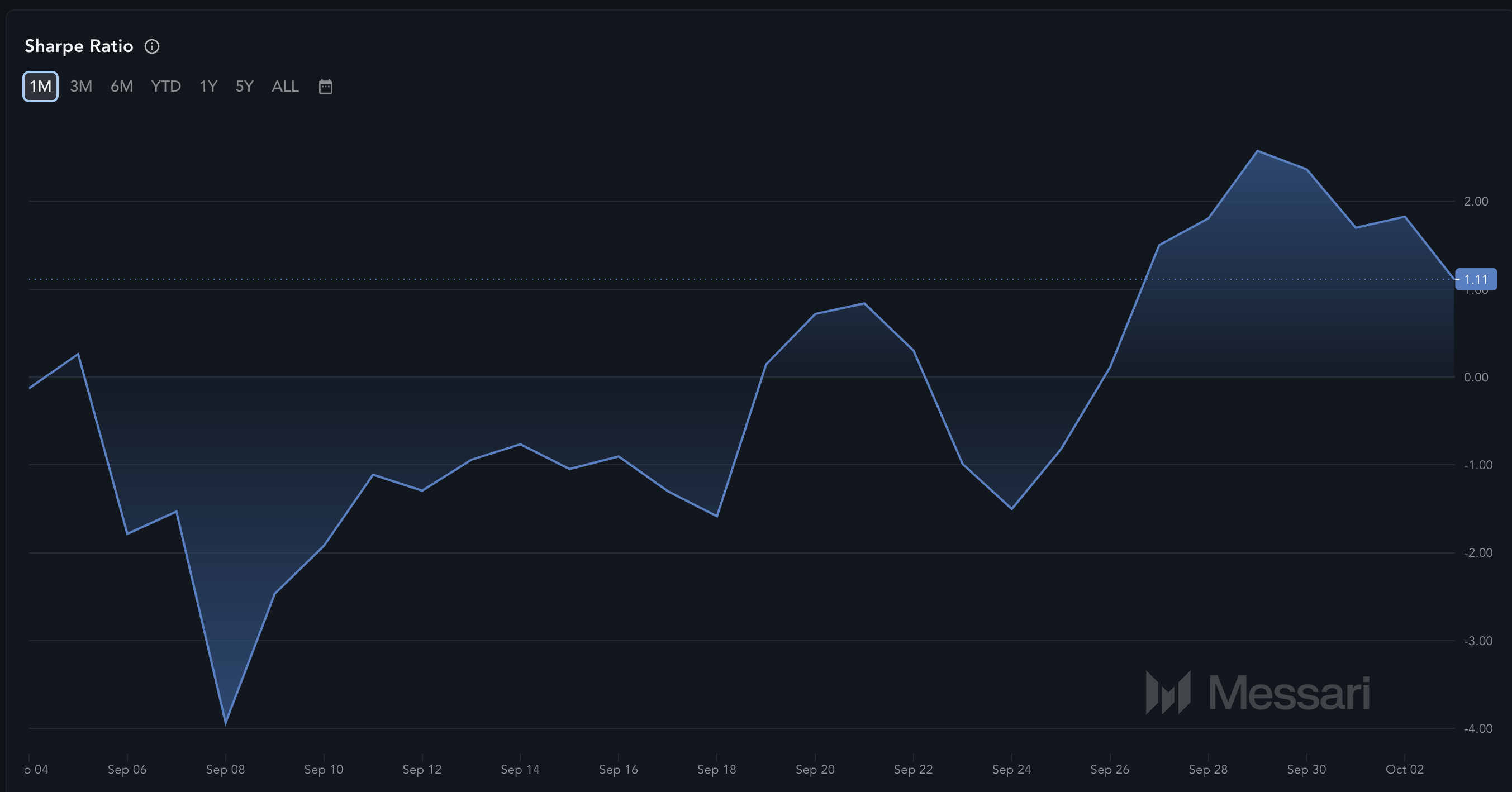

Data from crypto intelligence platform Messari shows that Solana’s Sharpe ratio has fallen. The Sharpe ratio measures a cryptocurrency’s potential risk-adjusted return.

When it rises, it implies that the potential reward of investing in the asset could be worth the risk. But for Solana, the ratio has dropped to -1.11. Five days ago, this same metric had a reading of 2.57, which suggested a possible SOL price increase.

Currently, since the ratio is on the brink of falling into negative territory, it suggests that buying SOL at the current value might not bring a positive return on investment.

Read more: Solana ETF Explained: What It Is and How It Works

Solana Sharpe Ratio. Source: Messari

Solana Sharpe Ratio. Source: Messari

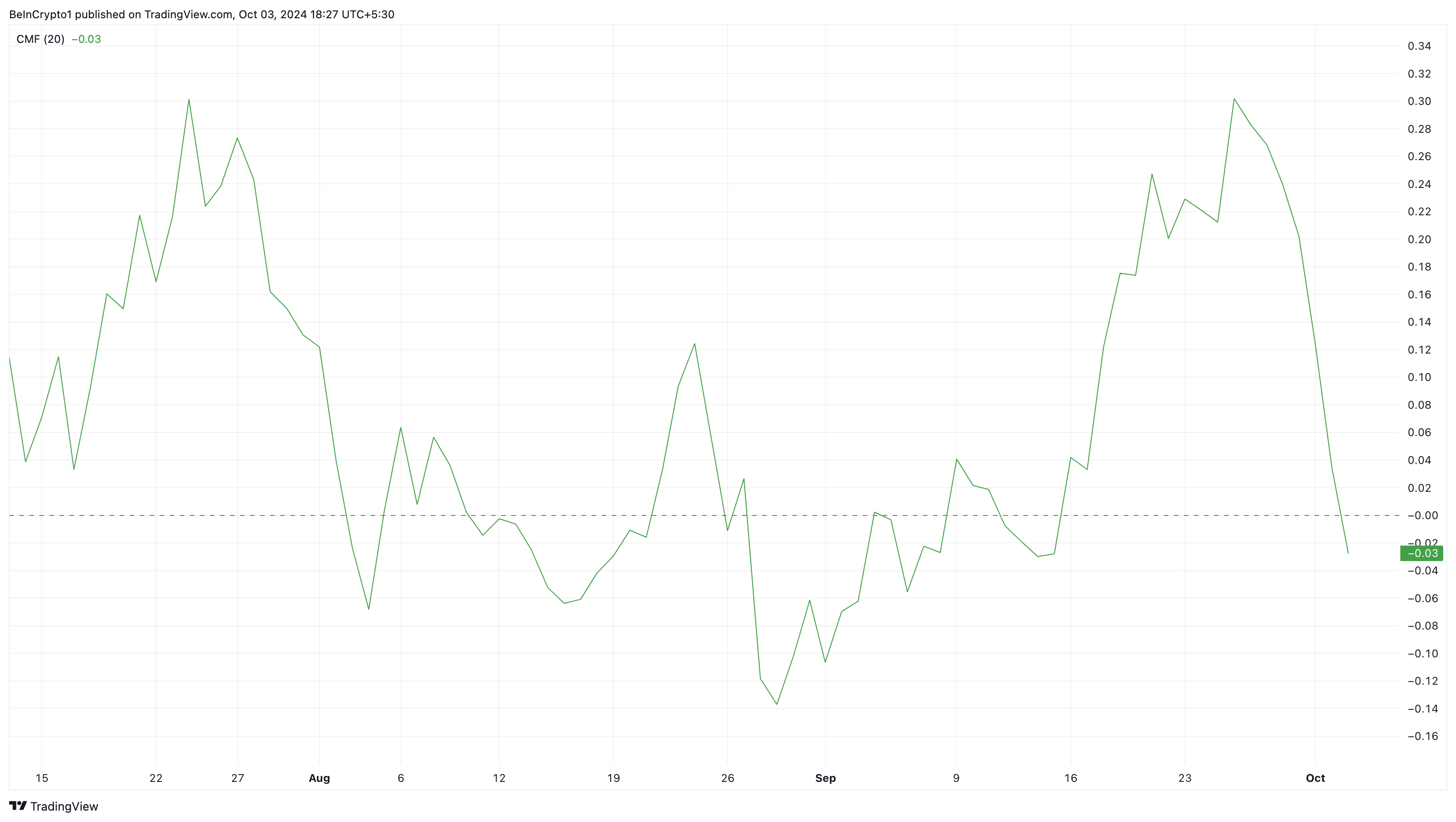

Beyond this metric above, the Chaikin Money Flow (CMF) is another indicator reinforcing the bearish thesis. The CMF considers the volume up or down at the end of a trading day. With this data, the indicator can tell whether the market is accumulating more of a token or distributing it.

When the CMF increases, accumulation takes place. On the other hand, a decline in the indicator’s reading suggests distribution. According to the daily SOL/USD chart, the CMF has dropped to the negative region, suggesting that sellers are dominant, and Solana’s price could evade a quick bounce.

Solana Chaikin Money Flow. Source: TradingView

Solana Chaikin Money Flow. Source: TradingView

SOL Price Prediction: No Rebound Yet

On September 30, Solana’s price was $158.53, with expectations high that October would produce more gains. But since then, SOL has lost almost 15% of its value and is currently priced at $135.52.

According to the daily chart, SOL could not hold the $142.21 support, so the token dropped below the threshold. Currently, the altcoin is about to hit the 23.6% Fibonacci retracement.

If this happens, Solana’s price might hit $130, possibly falling below the zone in the short term. Failure to hold the $130 support line could lead SOL down to $124.92.

Read more: How to Buy Solana (SOL) and Everything You Need To Know

Solana Daily Price Analysis. Source: TradingView

Solana Daily Price Analysis. Source: TradingView

On the other hand, if bulls defend the $130 region, this prediction might not come to pass. Instead, SOL’s price could jump to $161.95.