Convex Finance (CVX) Reaches All-Time Low as Losses Galore

Convex Finance (CVX) has seen a continuous downtrend since the crash at the end of July, with its price steadily declining each day. This prolonged drawdown has resulted in CVX reaching a new all-time low.

The persistent losses have left investors wary, leading to further pessimism about the token’s recovery prospects.

Convex Finance Investors Give Up

Investor sentiment around CVX has been overwhelmingly negative in recent months. As losses continued to mount over the last two months, confidence among holders began to erode. Many investors who initially believed in the token’s potential recovery are now skeptical about its ability to bounce back, especially in light of the consistent price declines.

This growing pessimism has worsened as CVX fails to establish a stable support level. The lack of bullish momentum and the token’s inability to reverse its downtrend has compounded concerns, leaving many holders uncertain about the future of their investments.

Read More: What Is Convex Finance (CVX)?

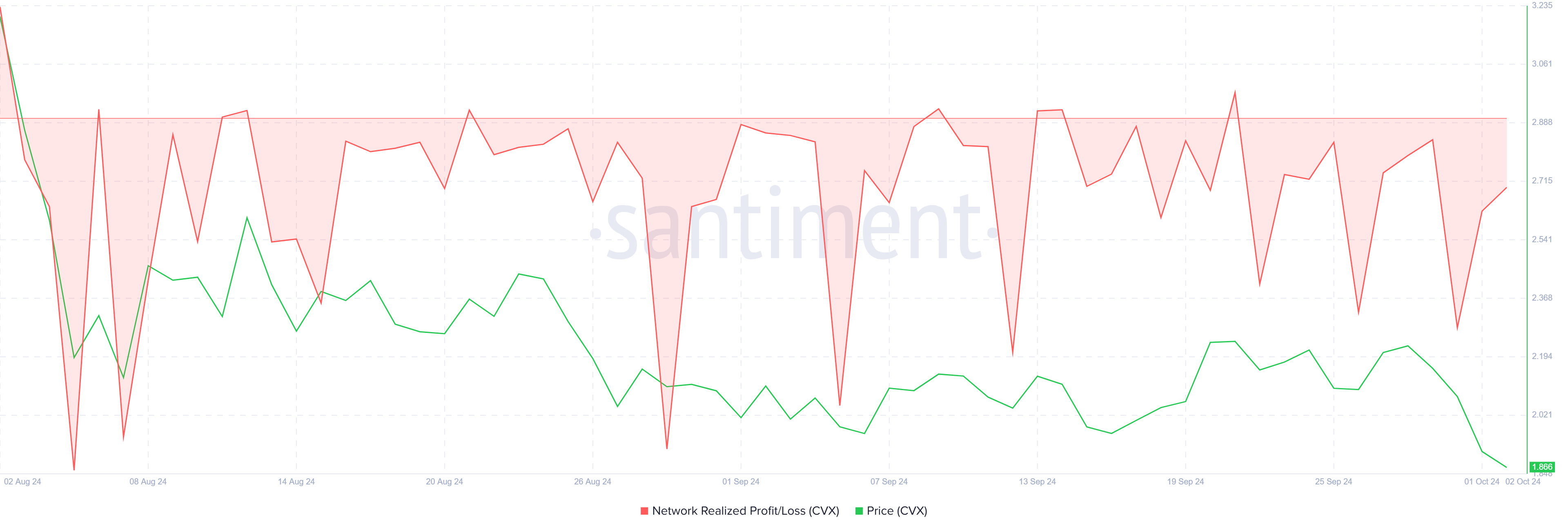

CVX Realized Losses. Source: Santiment

CVX Realized Losses. Source: Santiment

CVX’s overall macro momentum is also troubling. Historically, Convex Finance has maintained a correlation with Bitcoin, a trend that typically benefits altcoins. However, this correlation has proven to be a bearish signal for CVX.

Whenever the correlation between CVX and Bitcoin improves, the altcoin has experienced further price drops. The current situation is no different, with the increased correlation contributing to CVX’s decline to a new all-time low.

This bearish macro environment, coupled with the strong correlation to Bitcoin’s price movements, has placed additional downward pressure on CVX. As the cryptocurrency struggles to recover, it remains vulnerable to further losses unless significant bullish sentiment returns to the market.

CVX Correlation to Bitcoin. Source: TradingView

CVX Correlation to Bitcoin. Source: TradingView

CVX Price Prediction: What After a New Low

Over the last four days, CVX has experienced a 16% drop, creating intense bearish pressure. This resulted in the token hitting a new all-time low, with an intra-day decline of 6%, bringing CVX down to $1.72. At the time of writing, CVX is trading slightly higher at $1.86, just above the critical support level of $1.81.

CVX would need to reclaim the local support level of $1.97 to regain momentum. However, given the current bearish sentiment and ongoing selling pressure, this may prove not easy in the near term. Without a significant change in the market conditions, CVX could struggle to break above key resistance levels and face consolidation above $1.81.

Read More: What are Crypto Airdrops?

CVX Price Analysis. Source: TradingView

CVX Price Analysis. Source: TradingView

On a more optimistic note, if CVX manages to bounce off the $1.97 level, it could push back above $2.00. A successful breach of $2.12 would invalidate the bearish-neutral outlook and potentially trigger a recovery, although this remains a challenging scenario given the token’s recent performance.