Hamster Kombat (HMSTR) Sinks 50% Post-Airdrop, Bears Signal Further Trouble

Hamster Kombat’s (HMSTR) performance since its airdrop and subsequent listing on cryptocurrency exchanges has been underwhelming. Despite the initial hype and excitement surrounding the project, the profit-taking activity that followed has caused HMSTR price to plummet significantly over the past week.

With growing bearish sentiment toward HMSTR, the Toncoin-based token is poised to extend its decline. This analysis delves into what you need to know.

Hamster Kombat Fails To Impress Holders

On September 26, Hamster Kombat distributed 60 million HMSTR tokens to its game players, after which it began trading on cryptocurrency exchanges at $0.014.

However, massive selloffs quickly caused its price to plummet within minutes. The token has since continued its downtrend, declining 50% over the past six days. As of this writing, HMSTR trades at $0.0047, marking an 11% drop in the last 24 hours.

Since the airdrop, HMSTR has faced a bearish bias, reflected in its negative weighted sentiment, currently at -0.16. This metric tracks the overall market mood, and negative sentiment suggests that most social media discussions are driven by fear, uncertainty, and doubt—often a precursor to a prolonged downward trend.

Read more: Top 8 Hamster Kombat Alternatives in 2024

HMSTR Weighted Sentiment. Source: Santiment

HMSTR Weighted Sentiment. Source: Santiment

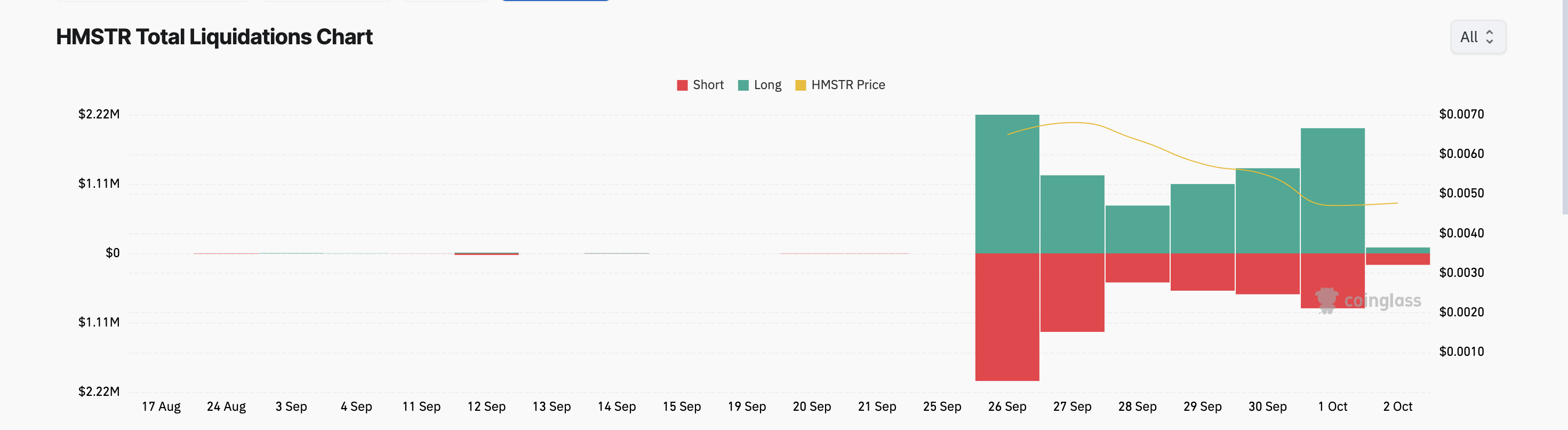

Despite HMSTR losing half its value in under a week, its futures traders remain optimistic. Coinglass data shows that since HMSTR became tradeable, its funding rates have stayed positive, indicating that more traders are betting on a price rally than on a decline.

However, many of these long positions have not been profitable, as liquidations continue. Since September 26, $9 million worth of HMSTR long positions have been liquidated due to the token’s ongoing price drop.

HMSTR Total Liquidations. Source: Coinglass

HMSTR Total Liquidations. Source: Coinglass

HMSTR Price Prediction: More Decline on the Horizon

Readings from HMSTR’s hourly chart signal that the token is poised to extend its decline. Its Directional Movement Index (DMI), which measures the strength of a trend, supports this bearish outlook. At press time, the token’s positive directional indicator (blue) rests below its negative directional indicator (red).

When positioned this way, the asset’s price is experiencing more downtrends than upward movements. Traders view this as a bearish signal, suggesting that sellers are stronger than buyers. If the bears remain in control, they may cause HMSTR’s price to plummet to a low of $0.0010.

Read more: 7 Best Exchanges To Buy and Sell Hamster Kombat (HMSTR) in 2024

HMSTR Price Analysis. Source: TradingView

HMSTR Price Analysis. Source: TradingView

However, if market sentiment shifts from bearish to bullish, HMSTR’s price could surge by 59%, reaching the resistance level at $0.0075.