Bittensor (TAO) Price Could Fall Short of Matching 100% Increase in “Uptober”

In September, Bittensor’s (TAO) price surged 111%, rising from $264 to $587. However, as October begins, several indicators suggest that TAO’s price may encounter resistance, potentially limiting further gains.

Popularly called “Uptober,” due to its historically bullish performance, the broader market expected many cryptos to end the month with positive returns. While TAO could do the same, this analysis explains why the altcoin may struggle in the first few days.

Bittensor May Soon Be Overbought

TAO’s impressive performance in September is closely tied to several developments in Artificial Intelligence (AI) sector. This surge in interest has caused significant price swings, as evidenced by the widening of the Bollinger Bands (BB) on the daily chart.

Bollinger Bands typically expand during periods of high volatility, and TAO’s case is no exception. Furthermore, the indicator also shows if an asset is overbought or oversold. When the upper band of BB touches the price, it is overbought, and when the lower band does, it is oversold.

The chart below shows that TAO’s price at $585.50 is close to tapping the upper band. Considering the momentum around the altcoin, the price might increase to $660. Once it does, it will be overbought, and a pullback could be on the cards.

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

Bittensor Bollinger Bands. Source: TradingView

Bittensor Bollinger Bands. Source: TradingView

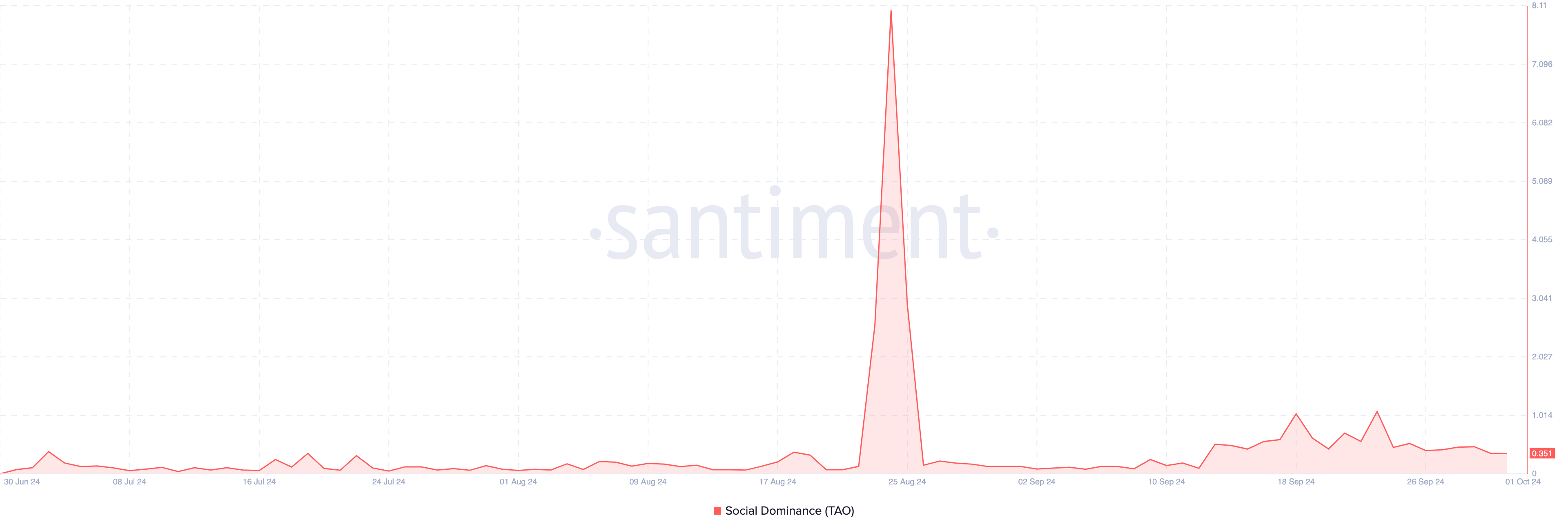

From an on-chain perspective, Bittensor’s social dominance is one metric supporting the prediction. Social dominance compares the rate of discussions around a cryptocurrency to other assets in the top 100.

When it increases, it means that the market is paying more attention to the asset, which could help increase demand. A decrease, on the other hand, indicates that most investors are overlooking the assets, which could lead to consolidation or, in a worst-case scenario, drag TAO’s price down.

As of this writing, TAO’s social dominance has fallen, indicating that investors are starting to look in another direction. Should this linger for some days, the altcoin’s price might decrease.

Bittensor Social Dominance. Source: Santiment

Bittensor Social Dominance. Source: Santiment

TAO Price Prediction: Token Could Drop to $520

On the daily chart, the Relative Strength Index (RSI), an indicator that measures momentum, shows that TAO is overbought. As seen below, the RSI on the daily chart is above 70.00. This position aligns with the earlier notion that TAO’s price might decrease in the short term.

Using the Fibonacci retracement indicator, BeInCrypto observes that TAO might initially decline to $520.65 (the 78.6% Fibonacci level). If the token fails to hold this level, it could drop further, with the next support region around $445.63.

Read more: Which Are the Best Altcoins To Invest in October 2024?

Bittensor Daily Price Analysis. Source: TradingView

Bittensor Daily Price Analysis. Source: TradingView

However, TAO could defy this bias and run toward $700 if demand for the token significantly increases. In that case, the potential drawdown might not last, and October’s performance could get close to a 100% hike.