Toncoin (TON) Holders Dump Their Bags, Price Sets $4.42 Target

The Open Network has experienced a sharp increase in user demand recently. However, users appear reluctant to hold its native coin, leading to heightened selling pressure. As a result, TON has lost some of its recent gains.

TON’s technical setup suggests that the altcoin may drop to $4.42, representing a 24% decline from its current market value. This analysis explains why this is plausible.

Toncoin Sees Rise in Demand, Thanks To Hamster Airdrop

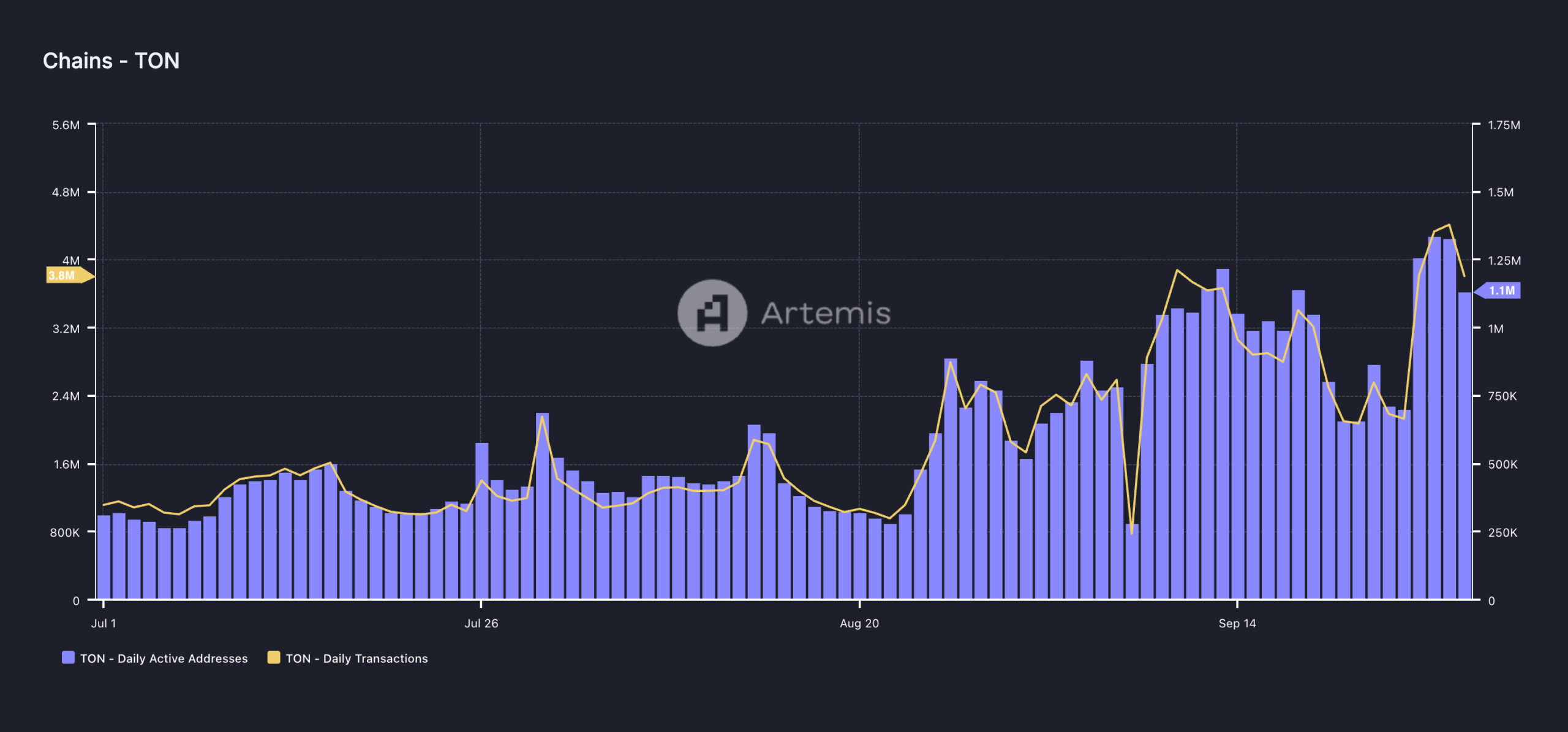

TON has experienced a surge in network demand over the past month, with Artemis data revealing a 74% increase in unique active addresses conducting at least one transaction in the last 30 days. In the same period, 4 million transactions were completed, reflecting a 67% growth in the daily transaction count on the network.

This uptick was primarily fueled by the Hamster Kombat token airdrop conducted on September 26. For context, within the first hour after the airdrop, the network processed over 1 million transactions.

By September 27, its daily network fees had skyrocketed to an all-time high of $349,000. This spike in fees coincided with a record-breaking 1.6 million active users within the 24-hour period.

Read more: What Are Telegram Bot Coins?

Toncoin Network Activity. Source: Artemis

Toncoin Network Activity. Source: Artemis

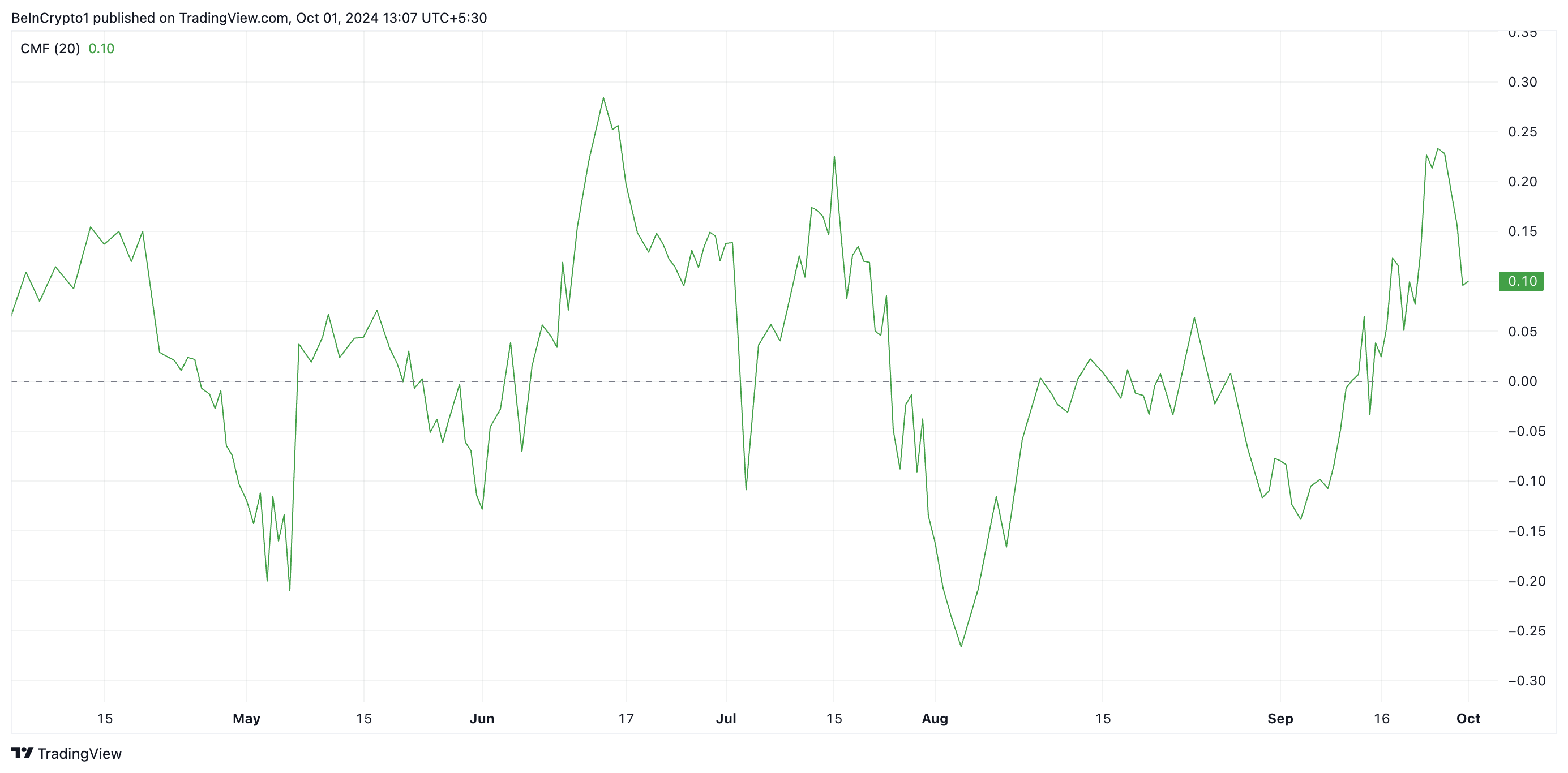

Despite the rise in TON’s demand over the past few days, traders do not share the same sentiment for its native coin. The altcoin is currently trading at $5.82, noting a 4% decline in the past three days.

Readings from its downward-trending Chaikin Money Flow (CMF) confirm the drop in market participants’ demand for Toncoin. As of this writing, this indicator stands at 0.10. Although still positive, the declining CMF suggests that buying pressure is weakening. It indicates that fewer funds are flowing into the TON market as profit-taking activity strengthens.

Toncoin CMF. Source: TradingView

Toncoin CMF. Source: TradingView

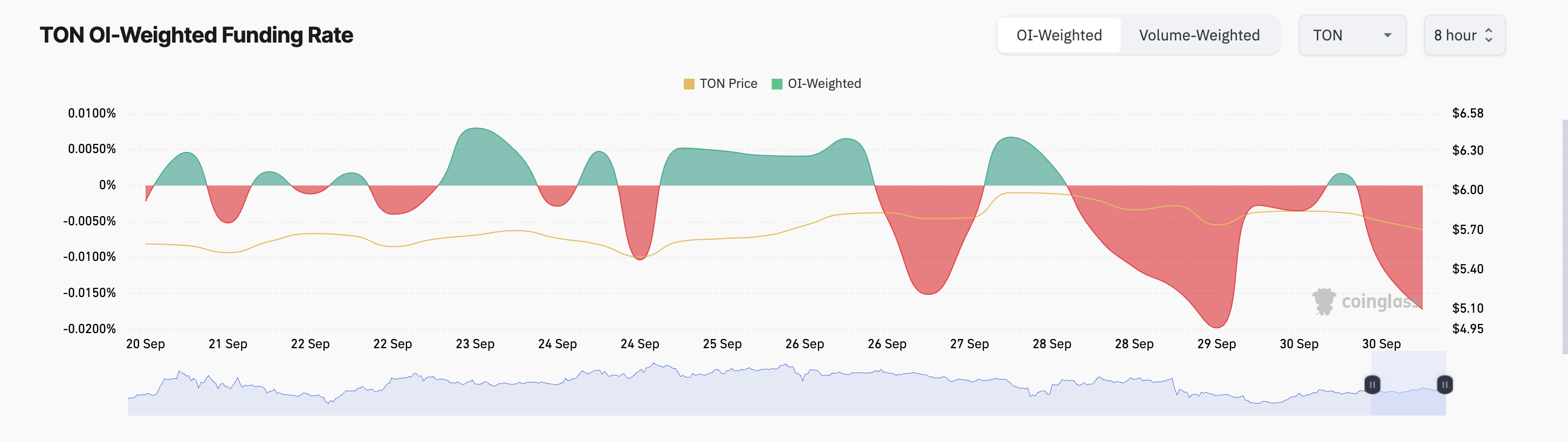

The bearish bias toward TON is also reflected in its negative funding rates over the past few days. When an asset’s funding rate is negative, there is more demand for short than long positions. More traders anticipate a decline in the asset’s price, leading to increased shorting activity. This usually reflects bearish sentiment in the market.

Toncoin Funding Rate. Source: Coinglass

Toncoin Funding Rate. Source: Coinglass

TON Price Prediction: A 24% Drop Imminent

If buying activity continues to drop, Toncoin’s price will fall to the resistance level of $5.25. Should this level fail to hold, the altcoin’s price may plunge further toward the support floor formed at $4.42, a 24% dip.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

Toncoin Price Analysis. Source: TradingView

Toncoin Price Analysis. Source: TradingView

However, if TON witnesses a resurgence in demand, its price may climb toward $7.37, representing a 26% jump from its current market value.