XRP slips to $0.58 amidst possibility of SEC appeal in Ripple lawsuit

- The US SEC “will probably” appeal the July 2023 lawsuit ruling against Ripple, according to a former SEC lawyer.

- Pro-Ripple attorney John Deaton explains why the SEC could lose any appeal and how it could impact the status of XRP as a security.

- XRP trades broadly unchanged on Friday after losing more than 1% earlier in the day.

Ripple (XRP) trades with minor losses on Friday as holders weigh the impact of a likely appeal by the US Securities & Exchange Commission (SEC) in the Ripple lawsuit.

While the final ruling in the SEC vs. Ripple lawsuit was considered as a partial victory for both parties, aFox Business journalist Eleanor Terret said on X that the regulator is likely to appeal, citing a former SEC lawyer as a source. An appeal could impact XRP price as it brings into question the legal clarity of the altcoin as a non-security in transactions on crypto exchange platforms.

Daily digest market movers: XRP legal clarity at risk

- A former SEC lawyer told Fox Business journalist Eleanor Terret that the SEC will “probably” appeal the ruling in the lawsuit, raising concerns among XRP traders.

NEW: A former @SECGov lawyer who recently left the agency tells me the SEC will ‘probably’ appeal Judge Torres’s July 2023 ruling concerning the $XRP programmatic sales in the @Ripple case partly because: “everyone over there [at the SEC] truly believes that the decision is…

— Eleanor Terrett (@EleanorTerrett) September 26, 2024

- The SEC vs. Ripple lawsuit ended on what was considered a positive note for both parties. While the regulator obtained over twelve times the penalty proposed by Ripple ($125 million vs. $10 million), Ripple continued with its business and gained legal clarity on XRP as a non-security when sold through exchanges.

- In July 2023, Judge Analisa Torres ruled that XRP is not a security in its transactions on cryptocurrency exchanges. However, if the SEC appeals, it questions the legal clarity of XRP as a non-security and requires the Judge to apply the Howey Test yet again to determine whether it satisfies the criteria to be considered a security, pro crypto attorney John Deaton said on X.

- Deaton concludes that it would be “a total waste of taxpayer money” to go through with the appeal since XRP fails to fulfill the requirements of the Howey Test, specifically the “common enterprise” factor, making it unlikely that the SEC appeal changes the initial ruling.

As someone who knows the @Ripple case very well, considering I was an active litigant for over 2 1/2 years, and considering Judge Torres cited my Amicus Brief, and the 3,800 XRP Holder Affidavits I submitted, as well as my efforts, as Amicus Counsel, in the @LBRYcom case (see… https://t.co/Ot7AgoFQh7

— John E Deaton (@JohnEDeaton1) September 26, 2024

- However, the uncertainty surrounding the process could impact sentiments of XRP traders as they digest the possible outcomes of an appeal.

Technical analysis: XRP could sweep liquidity at $0.5581

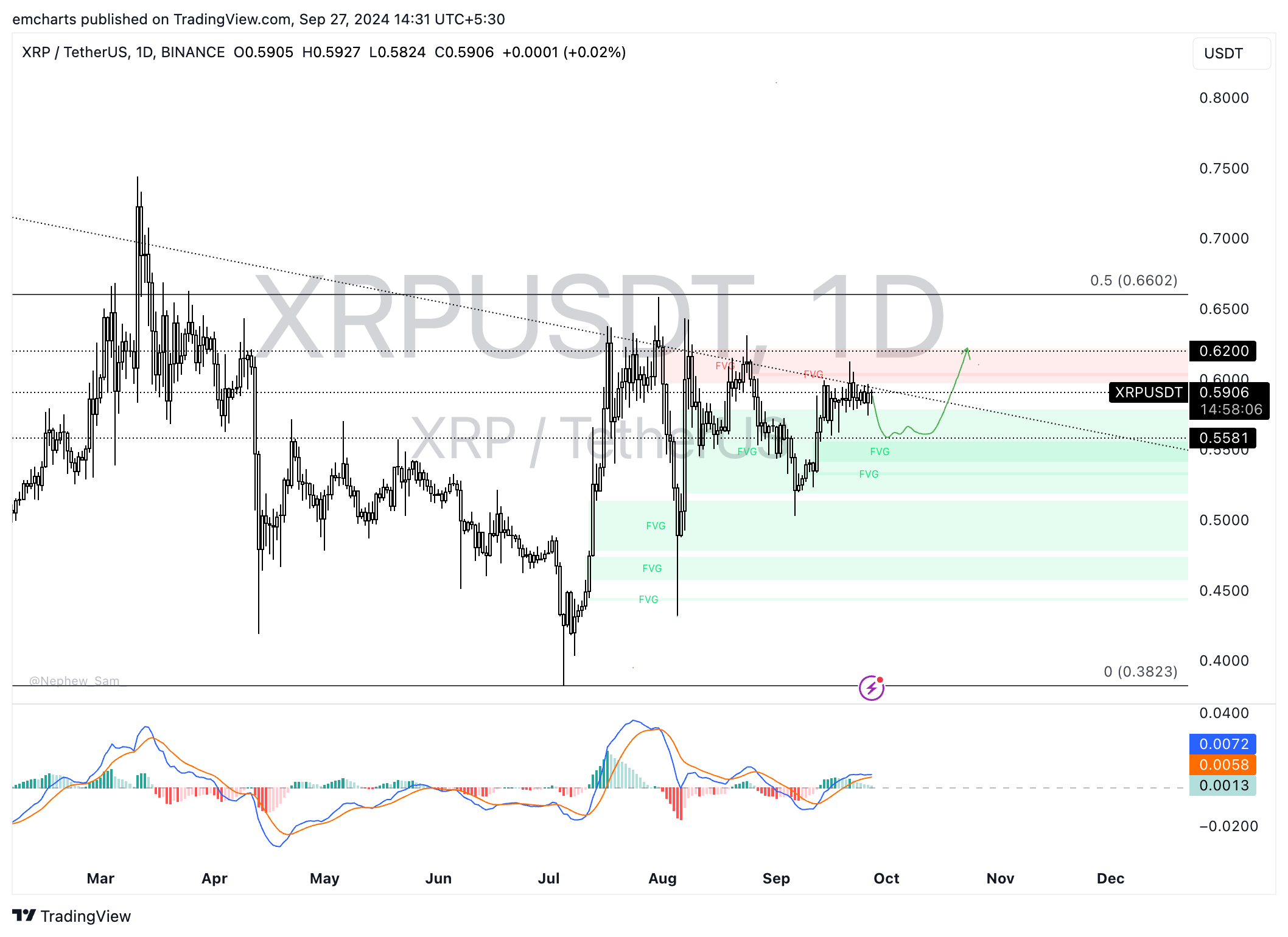

XRP is in a multi-month downward trend, but the altcoin has been trading sideways in the past few days, broadly holding above key support at $0.5800.

The Moving Average Convergence Divergence (MACD) indicator shows there is underlying positive momentum in XRP price trend, however green histogram bars are getting shorter, meaning it is likely waning. The MACD line could cross below the signal line, making it a bearish sign that traders need to watch out for.

In case of a downturn, XRP could sweep liquidity at $0.5581, a key level that acted as support throughout September. If it fails to hold this level, the next support emerges in the Fair Value Gap (FVG) between $0.5413 and $0.5556.

In an upside scenario, XRP could rally towards the $0.6200 level, the upper boundary of an FVG and a key resistance for the altcoin, once it sweeps liquidity in the imbalance zone.

XRP/USDT daily chart

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.