Monero price is poised for a decline following rejection from key resistance

- Monero price faces rejection from the daily resistance level of $180.79, eyeing a decline ahead.

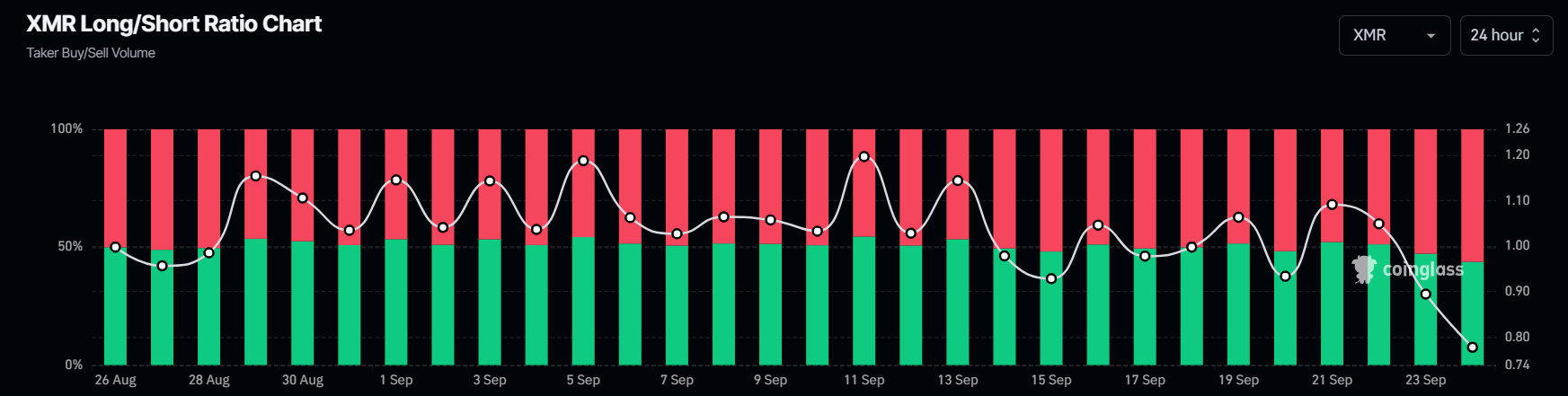

- On-chain data paints a bearish picture as XMR’s long-to-short ratio is below one, the lowest level in one month.

- A daily candlestick close above $180.79 would invalidate the bearish thesis.

Monero (XMR), a privacy-centric cryptocurrency, continues to decline on Tuesday after facing rejection for resitance barrier on Monday. On-chain data hints at a bearish sentiment among XMR’s traders as its long-to-short ratio trades below one, suggesting a decline in Monero’s price ahead.

Monero price could react lower off key resistance

Monero's price has retested and faced difficulties multiple times around its daily resistance level of $180.79 since September 20, which declined 2.78% on Monday. As of Tuesday, it continues to trade down at $169.13, breaking below the ascending trendline (drawn by joining multiple low levels from early August).

If the daily resistance at $180.79 continues to hold as resistance, and Monero closes below the ascending trendline, the drop could extend by 10% to retest its 61.8% Fibonacci retracement level at $152.73 (drawn from an early August low of $135.95 to its September high of $179.84).

The Moving Average Convergence Divergence (MACD) indicator further supports Monero’s decline, signaling a bearish crossover on the daily chart. The MACD line (blue line) has moved below the signal line (yellow line), giving a sell signal. It also shows red histogram bars below the neutral line zero, suggesting that Monero’s price could experience downward momentum.

Additionally, the Relative Strength Index on the daily chart trades at 48, below its neutral level of 50, and points downward. A cross to levels below the neutral level generally indicates bearish momentum is gaining traction.

XMR/USDT daily chart

Monero’s On-chain data also supports a bearish outlook. Coinglass’s Monero long-to-short ratio is at 0.766, the lowest level in one month. This ratio below one reflects bearish sentiment in the market as more traders are betting for the asset price to fall.

Monero long-to-short ratio chart

However, the bearish thesis would be invalidated if Monero’s daily candlestick breaks and closes above the daily resitance level of $180.79. This scenario could lead to a rise in Monero’s price to retest its psychologically important level of $190.