Ethereum outperforms top 20 cryptos as it targets $2,817

- Ethereum is outperforming cryptocurrencies in the top 20 since the Fed reduced rates.

- The top altcoin's 16% rise comes after months of underperforming Bitcoin and Solana.

- Ethereum overcame the $2,595 resistance as traders set sights on the $2,817 key level.

Ethereum (ETH) is up nearly 4% on Monday following its impressive rally in the past five days since the Federal Reserve (Fed) cut rates by 50 basis points. ETH is currently attempting to reclaim a key support level at $2,817.

Daily Digest Market Movers: Ethereum's 16% rise and open interest growth

Ethereum has put up a strong performance against Bitcoin and other top 20 cryptocurrencies by market capitalization since the Federal Reserve (Fed) reduced interest rates by 50 basis points on Wednesday. In the past five days since the cut, the top altcoin has risen by over 16%, while Bitcoin and Solana have only managed gains of 7% and 10%, respectively.

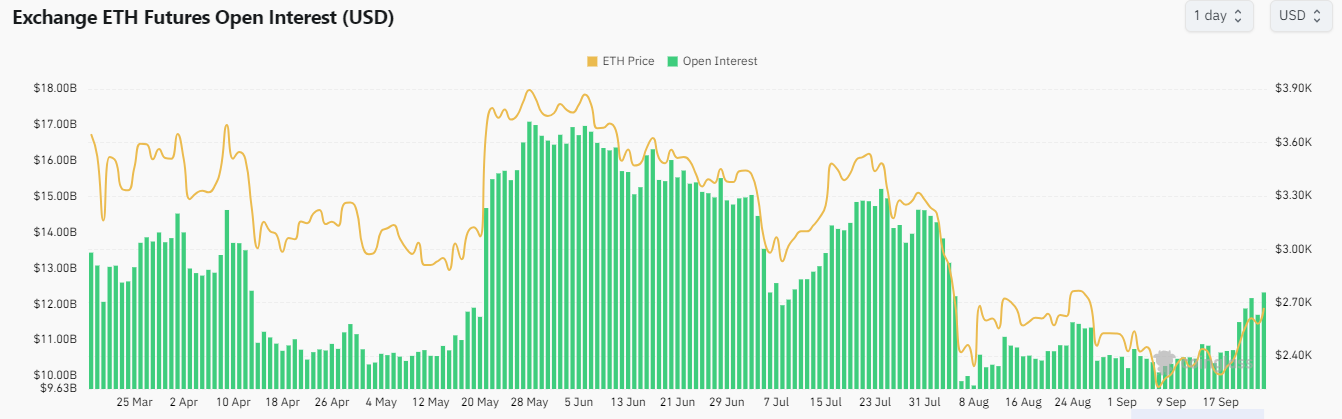

The rally is also supported by ETH's rising open interest (OI) in the past week. Open interest is the total number of unsettled long and short contracts in a derivatives market.

ETH's OI crossed $12.37 billion at press time and is approaching levels last seen before the market crash in early August, per Coinglass data. Rising open interest, alongside price increases, suggests confidence among investors.

ETH Open Interest

ETH's rise comes after months of underperforming Bitcoin and Solana. The ETH/BTC ratio notably reached a low last seen in April 2021 earlier last week.

Bitfinex analysts noted in a report released on Monday that ETH's recent outperformance is due to the "extreme depression in altcoin valuations and open interest that has been observed since March 2024." However, the analysts also noted that the increased open interest signals the potential for heightened volatility in the altcoin market, which ETH leads.

Meanwhile, Ethereum exchange-traded funds (ETF) posted $28.5 million in net outflows last week despite ending the week with inflows, per CoinShares data.

Ethereum targets $2,817 following move above upper rectangle boundary

Ethereum is trading around $2,670 on Monday, up 3.7% on the day. In the past 24 hours, ETH has seen over $37 million in liquidations, with long and short liquidations accounting for $16.06 million and $21.39 million, respectively.

On the 4-hour chart, the top altcoin overcame the $2,595 rectangle's resistance over the weekend and is attempting a move to retest the $2,817 key price level.

ETH/USDT 4-hour chart

A successful move above this level could help the bullish momentum, considering the $2,817 price level has previously established itself as critical support between April and August. Such a move would see ETH cross above the $3,000 psychological level and target the next resistance at $3,057.

However, a decline below the $2,595 level could cause ETH to sustain a correction toward the $2,395 support level.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are attempting to move below their oversold region, indicating a potential price correction.

In the short term, ETH could rise to $2,706 to liquidate positions worth $56.35 million.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.