2 Key Signals Driving Toncoin (TON) Traders to Position for a Price Drop

After sliding below $5 for a while, Toncoin’s (TON) price broke above the level again. This recent increase has given hints that the token’s value could continue to close in on its all-time high.

However, with increasing volatility and shift trends, traders appear to be reassessing their positions. This analysis reveals the key driver behind this changing sentiment and what could be next for TON’s price.

Toncoin Traders See Red Flags

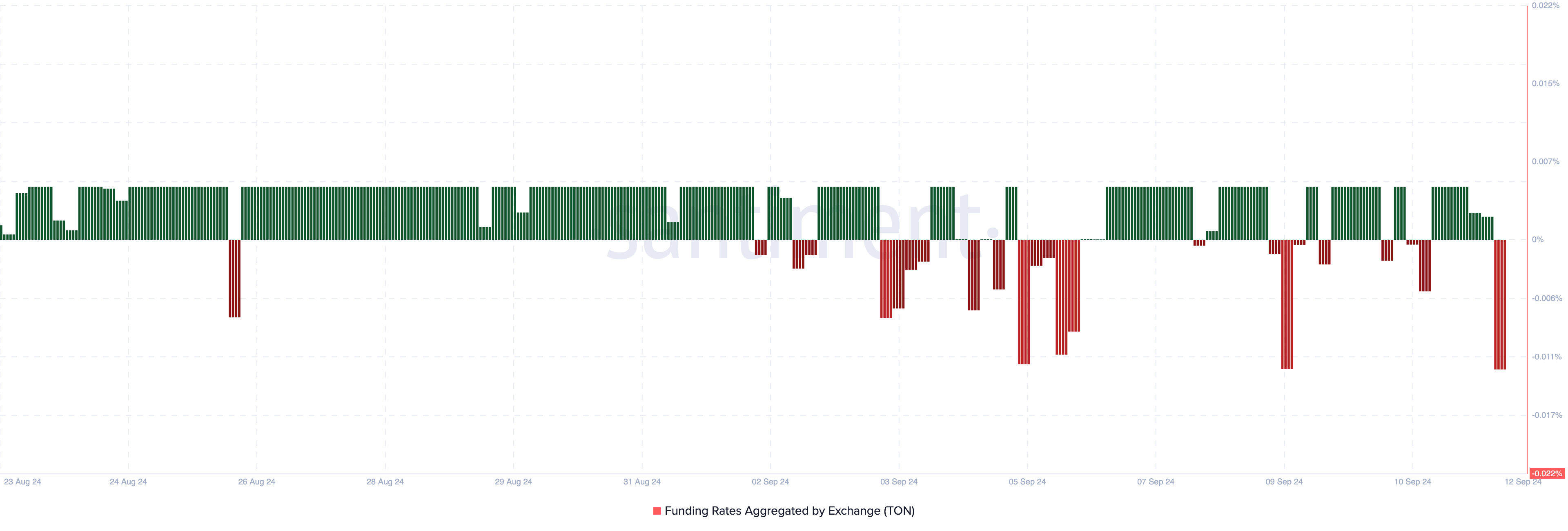

Data from Santiment shows that Toncoin’s Funding Rate has turned negative. The Funding Rate represents the cost of holding an open futures position.

When it’s positive, longs pay shorts, indicating bullish sentiment. However, since TON’s rate is negative, shorts are paying the fees, suggesting traders expect the price to drop.

This shift, coupled with TON’s recent price rise, hints at a potentially bearish outlook. If this pattern continues, the token could see a price decline, targeting underlying support in the short term.

Read more: 7 Best Exchanges To Buy and Sell Hamster Kombat (HMSTR) in 2024

Toncoin Funding Rate. Source: Santiment

Toncoin Funding Rate. Source: Santiment

The bearish scenario for Toncoin could also be linked to broader investor behavior. IntoTheBlock data shows that the Large Holders Netflow has dropped by 204% over the past seven days.

This metric tracks whether large investors are accumulating or distributing tokens. A decline suggests more tokens are being sold than purchased by these key stakeholders. If this trend continues, Toncoin’s price could face a significant downturn, making it unlikely for the token to reach the $7 mark in the short term.

Toncoin Large Holders Netflow. Source: IntoTheBlock

Toncoin Large Holders Netflow. Source: IntoTheBlock

TON Price Prediction: More Bearish Signals

Looking at the daily chart, Toncoin’s attempt to reach $6 has been hindered by a roadblock at $5.68. This price level also halted a similar move on September 15.

As a result, the $5.68 price level has become a notable resistance that requires intense buying pressure to surpass. However, at press time, TON does not seem to have the strong volume to help break through the resistance.

Due to this circumstance, Toncoin risks falling to $5.21. In a highly bearish market conditions, the price could go as low as $4.88.

Read more: 6 Best Toncoin (TON) Wallets in 2024

Toncoin Daily Price Analysis. Source: TradingView

Toncoin Daily Price Analysis. Source: TradingView

On the flip side, this prediction might be invalidated if the token rises above the abovementioned resistance. In that scenario case, TON’s price could climb to $6.71.