XRP Exchange Outflows Signal a 12% Price Surge Ahead

On Sunday, 30 million XRP tokens valued at $17.40 million were withdrawn from the leading Korean exchange, Upbit. Outflows from cryptocurrency exchanges are often interpreted as a bullish indicator; hence, this has sparked a wave of optimism among Ripple’s XRP holders.

XRP’s technical setup indicates its price could rise by 12% if selling activity remains low.

Ripple Sees Surge in Buying Pressure As Sentiment Improves

XRP’s recent whale outflow from the Upbit exchange signals growing confidence in the token’s price among traders in the region. This sentiment was highlighted by a sharp rise in XRP trading volume, which exceeded $106.6 million on Sunday, almost double Bitcoin’s volume on the platform.

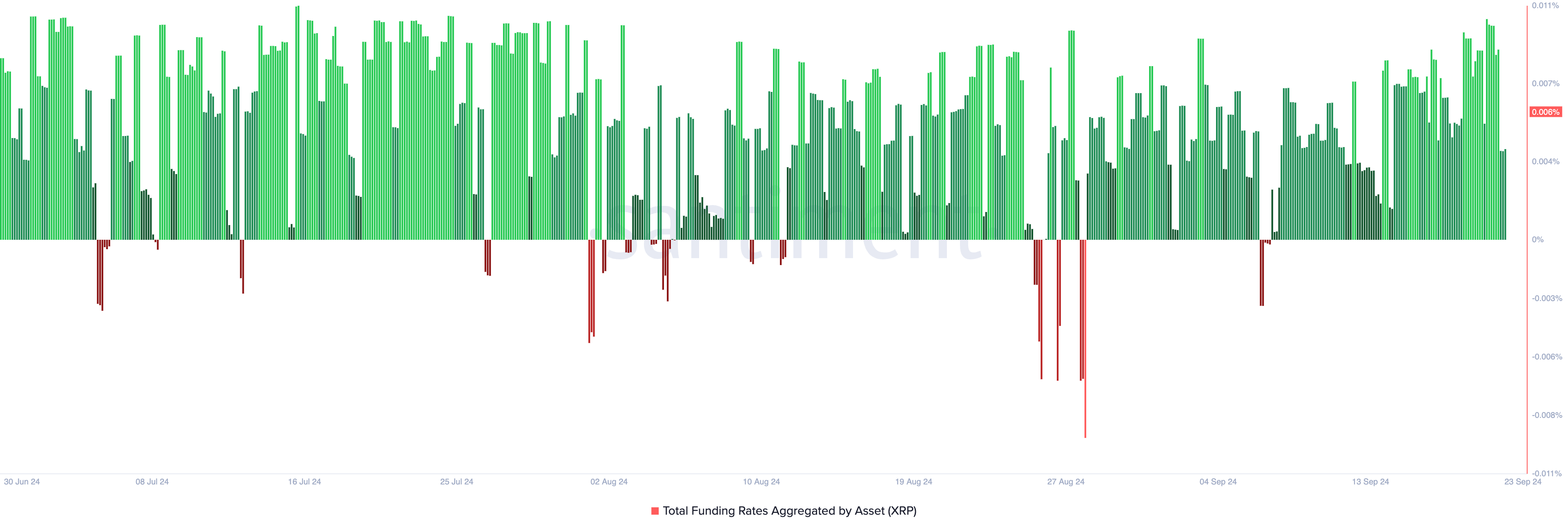

Broader market sentiment around XRP is improving, as evidenced by its positive funding rate across exchanges. Currently, XRP’s funding rate is at 0.006%, indicating continued optimism among traders in maintaining contract and spot price alignment.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

XRP Funding Rate. Source: Santiment

XRP Funding Rate. Source: Santiment

According to Santiment, XRP’s funding rate has remained positive since September 7, indicating bullish market sentiment. A positive funding rate reflects higher demand for long positions, with traders willing to pay a premium in anticipation of a price rally.

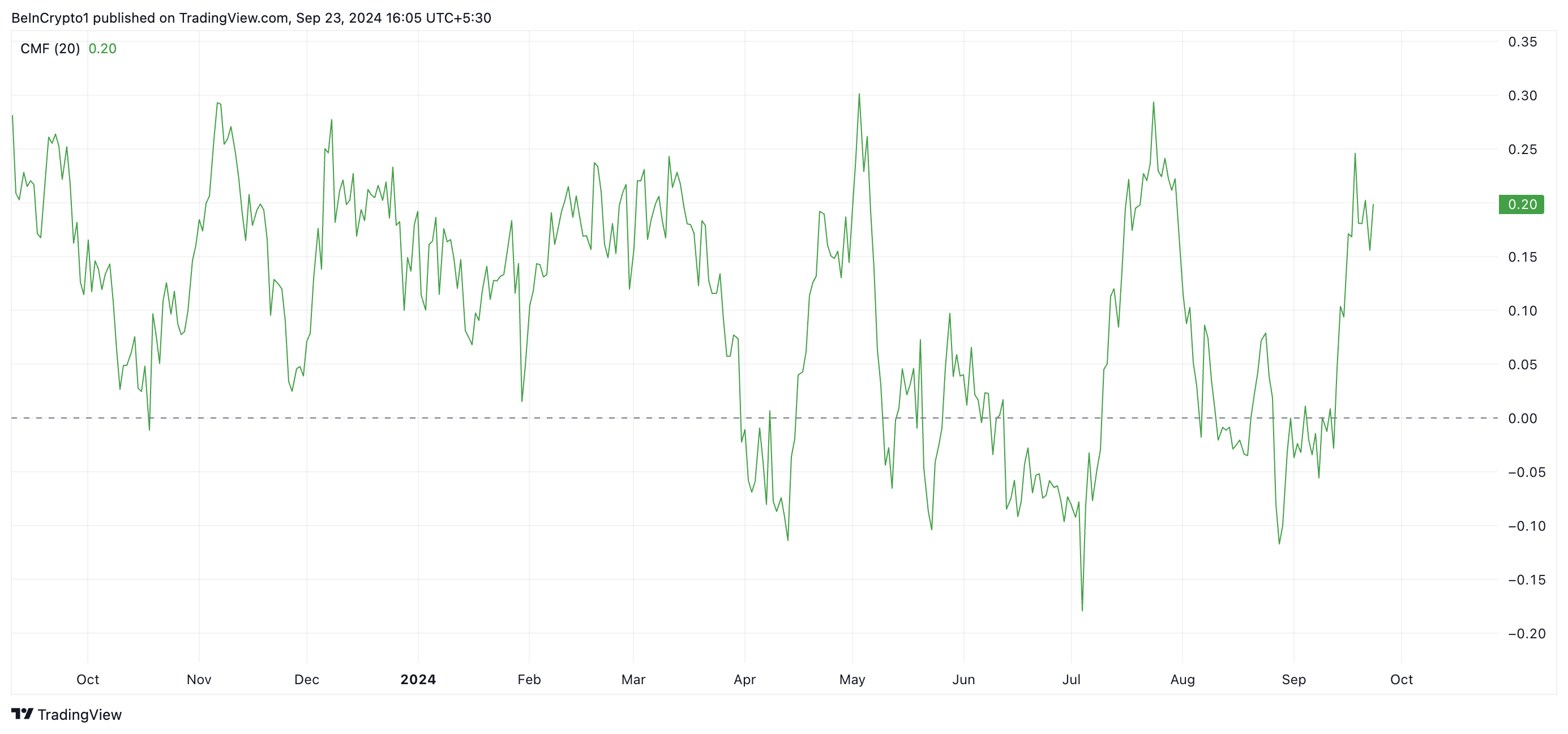

Supporting this outlook is XRP’s Chaikin Money Flow (CMF), which currently stands at 0.20. Token accumulation is high when an asset’s CMF value is above zero. This is a bullish signal for XRP, as it reflects positive market sentiment and can indicate that the token’s price is likely to continue rising.

Coin XRP Chaikin Money Flow. Source: TradingView

Coin XRP Chaikin Money Flow. Source: TradingView

XRP Price Prediction: 12% Price Hike Is Possible

If buying pressure continues, XRP’s price could rise by 12%, reaching $0.65, a level last seen on August 1. A breakout above $0.65 could push the price to $0.74, marking a six-month high.

Read more: XRP ETF Explained: What It Is and How It Works

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

However, these bullish projections may be invalidated if traders begin taking profits. In that case, XRP could drop to the support level at $0.52. If bulls fail to defend that, the price could fall further to $0.45.