Arthur Hayes Dumps PENDLE, Accumulates ATH Instead

BitMEX founder Arthur Hayes has had a complex relationship with Pendle (PENDLE), as demonstrated by his interactions with the protocol during the last few months.

Historically, Hayes’s actions have aligned with notable price movements in the PENDLE token, raising speculation that this pattern could soon extend to Aethir (ATH).

Arthur Hayes Shills PENDLE

BitMEX founder first mentioned Pendle during the April Token 2049 event in Dubai. Speaking with Crypto Banter’s Ran Neuner, Hayes praised Pendle as the future of decentralized derivative exchanges. He lauded the protocol’s innovative ability to integrate native crypto protocols into decentralized finance (DeFi), highlighting its role in the evolution of interest rate trading in the crypto market.

At the time, Hayes believed Pendle’s mechanism would revolutionize crypto by enabling a “farm-to-table economy.” This concept would allow investors to borrow or lend with clarity on trading rates, while also offering the ability to hedge risks.

Pendle’s novel yield structure has significantly impacted its total value locked (TVL), which surged by an astounding 42,746% over a year. According to DefiLlama, Pendle’s TVL grew from $15.67 million in January 2023 to $6.714 billion by June 2024.

Read more: Top 11 DeFi Protocols To Keep an Eye on in 2024

Hayes’ endorsement of Pendle during the April Token 2049 event spurred a 10% surge in the PENDLE token price. Trading volume also jumped by 61% that day, as traders acted on his comments, trusting his track record of accurate predictions.

Hayes had previously made similar forecasts at the October 2023 Token 2049 event in Singapore, where he predicted a rise in Bitcoin, AI-related projects, and Filecoin. These projections later proved correct, further solidifying his reputation as a market influencer.

BitMEX Founder Eyes DePin Token

At the climax of the recent Token 2049 event in Singapore, Lookonchain revealed that Arthur Hayes sold 1.27 million PENDLE tokens between September 19 and 21, valued at around $4.4 million. This sale marked a significant 61% reduction in Hayes’ PENDLE holdings, leaving him with 820,000 tokens, worth approximately $2.85 million.

In a recent post on X (formerly Twitter), the BitMEX founder explained his sales, citing a “special situation. This hinted at a new project on his radar.

“As you can see Maelstrom Fund [Crypto Hayes family office] is reducing its PENDLE position. Even after the reduction it is still one of our largest positions. We still fully believe that PENDLE will be the leader in crypto interest rate derivatives. And we plan to profit off of their success. We have reduced our position to fund a special situation. Those who monitor our wallets will get a glimpse as to what that is very soon,” Hayes wrote.

Reports suggest that his “special situation” might be linked to Aethir (ATH). On-chain insights provider Spotonchain revealed that Hayes now holds more ATH than PENDLE. Over the past three days, he withdrew 16.478 million ATH tokens, valued at $1.02 million, from exchanges like OKX, Bybit, and KuCoin.

Read more: A Comprehensive Guide on Tracking Smart Money in the Crypto Market

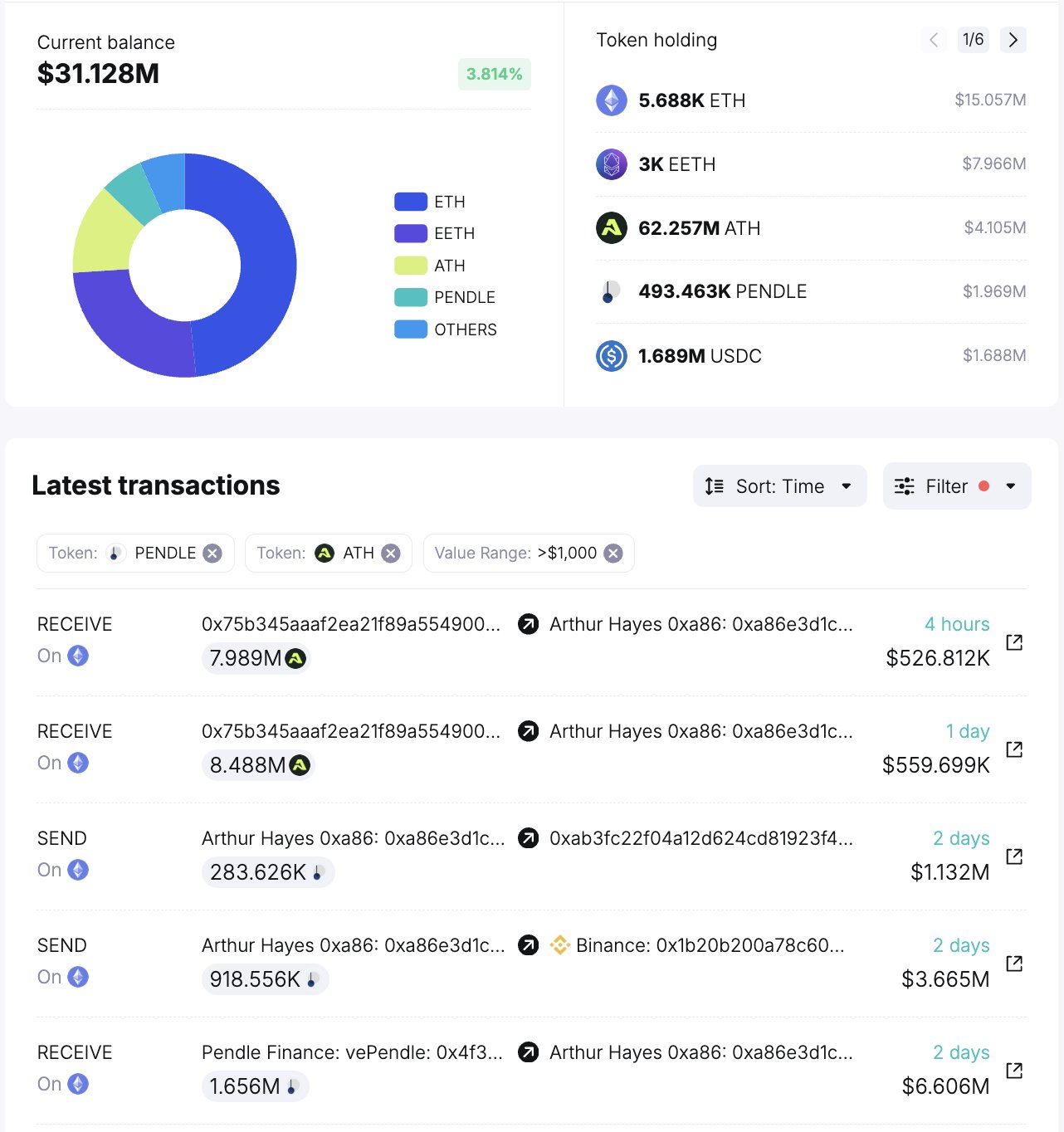

Arthur Hayes Holdings. Source: Spotonchain

Arthur Hayes Holdings. Source: Spotonchain

Hayes now holds 62.257 million ATH tokens worth $4.1 million, marking his second-largest holding. His third-largest position is 493,463 PENDLE tokens, worth $1.98 million, with an estimated profit of $1.15 million, or 19%.

With these positions, Hayes appears to be pivoting toward both the DePIN (decentralized physical infrastructure network) narrative through ATH and the real-world asset (RWA) narrative via PENDLE. According to BeInCrypto, ATH has risen nearly 5% since Monday’s session opened, currently trading at $0.066.