Dogecoin (DOGE) Rally Toward $0.13 Hits Another Setback

Dogecoin, a leading meme coin, has once again struggled to break out of its trading range. The crypto asset has tried to rally above its horizontal resistance line for the third time this month but continues to face selling pressure.

This has occurred despite a broader market recovery and a decrease in selling activity from DOGE traders. Why is this happening?

Dogecoin Paper Hands Keep Its Price At Bay

Dogecoin has traded within a horizontal channel since August 4. The balance between buying and selling pressures has kept its price range-bound for over 30 days.

The upper line of this channel sets resistance at $0.11, while the lower line provides support at $0.09. Last weekend, DOGE made its third attempt in seven weeks to break above the resistance. However, increased selling pressure at that level caused the attempt to fail.

Read more: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

Dogecoin Horizontal Channel. Source: TradingView

Dogecoin Horizontal Channel. Source: TradingView

Despite improvements in the broader crypto market and fewer sell-offs from DOGE traders, this resistance remains intact. Notably, DOGE whales have increased their accumulation over the past month, as seen in the rising netflow of large holders.

Large holders are addresses that hold more than 0.1% of an asset’s circulating supply. DOGE’s large holders’ netflow, which measures the difference between the number of coins its whales have bought and sold over a specific period, has surged by 179% in the past month, signaling a notable spike in accumulation among this cohort of holders.

Dogecoin Large Holders’ Netflow. Source: IntoTheBlock

Dogecoin Large Holders’ Netflow. Source: IntoTheBlock

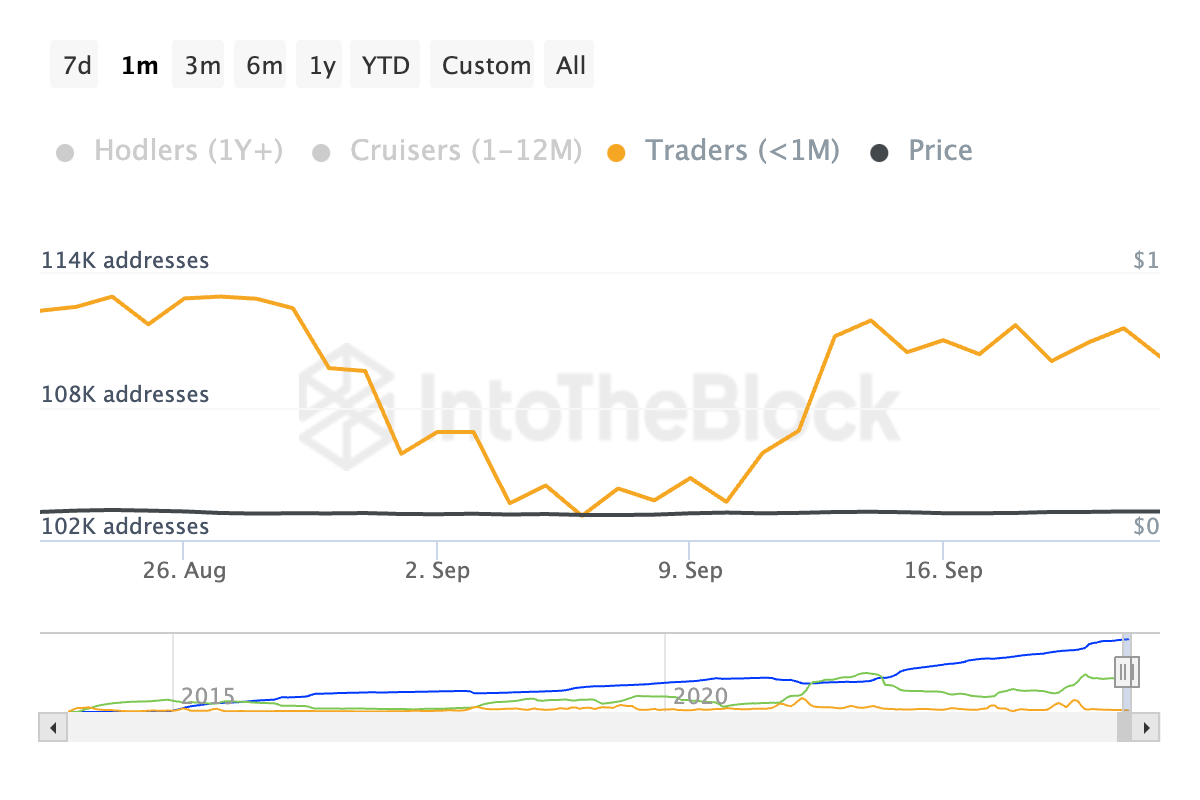

However, Dogecoin’s sideways price movement has left retail traders unimpressed. While DOGE whales have increased their accumulation, retail traders — those holding coins for less than 30 days — have sold off part of their holdings over the past month.

Although on-chain data shows that the balance held by these traders has dropped by only 2%, this shift is significant because these “paper-handed” holders control a substantial portion of DOGE’s total supply. Their risk aversion leads them to sell quickly at any sign of trouble, so even a small reduction in their holdings can slow DOGE’s upward momentum.

Dogecoin Addresses by Time Held. Source: IntoTheBlock

Dogecoin Addresses by Time Held. Source: IntoTheBlock

DOGE Price Prediction: Market Sentiment Must Improve

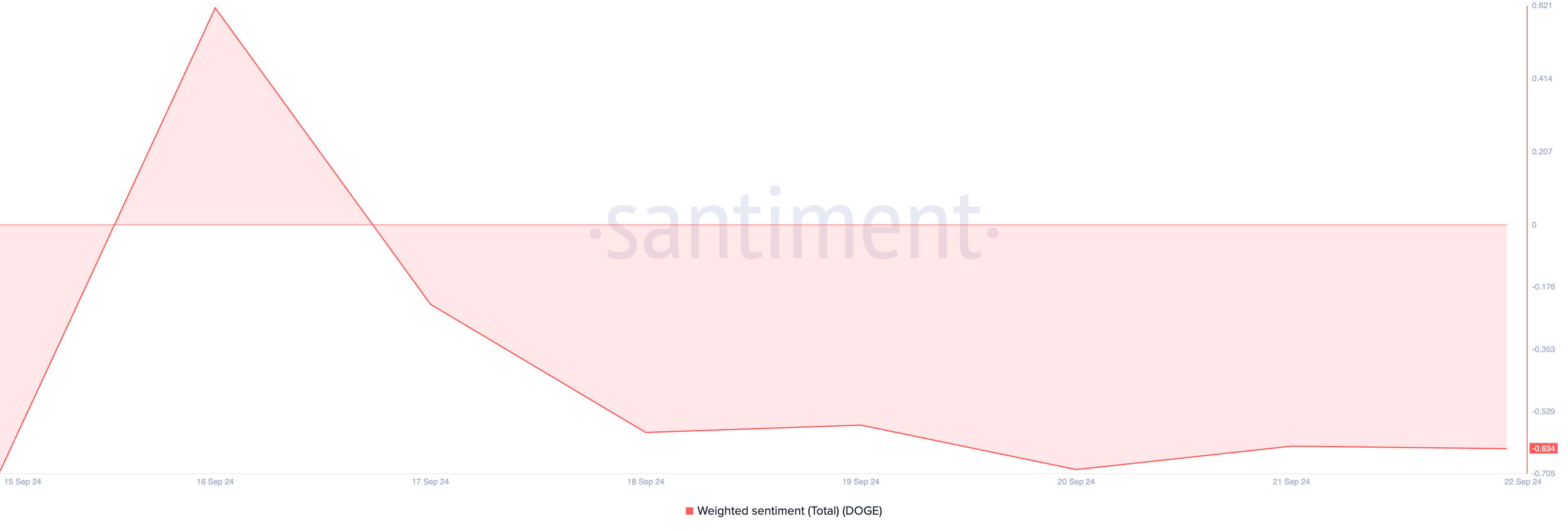

For Dogecoin’s price to break above $0.11 successfully, its market sentiment has to improve. Currently, the meme coin’s weighted sentiment, which tracks the mood of the general market regarding it, is -0.63 and has been negative since September 18.

Dogecoin Weighted Sentiment. Source: Santiment

Dogecoin Weighted Sentiment. Source: Santiment

This indicates that negative emotions fuel most social media discussions about the meme coin, preventing its price from initiating a clear uptrend.

If market sentiment improves and retail traders reduce their selling, DOGE could break above $0.11 and successfully retest this level. If that occurs, its price may rise by 25%, potentially reaching $0.13.

Read more: Dogecoin (DOGE) Price Prediction 2024/2025/2030

Dogecoin Price Analysis. Source: TradingView

Dogecoin Price Analysis. Source: TradingView

However, if sentiment worsens and retail traders continue to sell, Dogecoin’s price will likely remain within a horizontal channel, invalidating the bullish projection. In this scenario, it could slip below support and drop toward $0.08.