Dogecoin’s (DOGE) 60% Rally Likely Delayed—Here’s What’s Causing It

Dogecoin (DOGE) price has been trading within a descending wedge for the past five months, a pattern often associated with potential breakouts.

While the meme coin is on the verge of exiting this pattern, a significant price rally may not follow immediately. Various market factors suggest that profits might be limited even if a breakout occurs.

Dogecoin Is Favoring the Bears

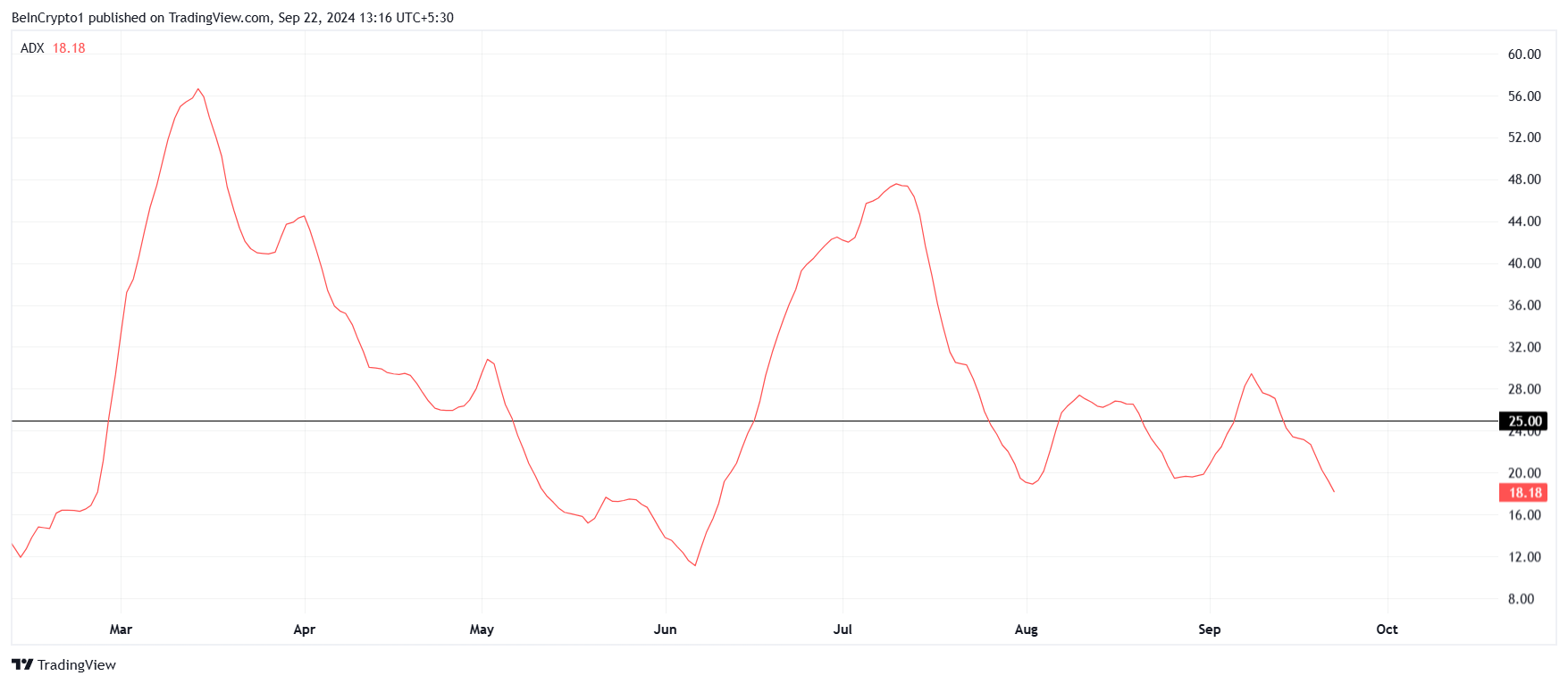

Dogecoin’s macro momentum reveals signs of weakness, especially when analyzing technical indicators like the Average Directional Index (ADX). The ADX shows that the active uptrend for DOGE has lost strength and is now very weak. A weak ADX typically indicates that the cryptocurrency is struggling to maintain upward momentum, making it difficult for DOGE to sustain any bullish gains.

Given the weakening uptrend, even a breakout from the descending wedge may not lead to significant gains. Without strong market support, Dogecoin may fail to capitalize on the expected price surge, limiting its potential to rally.

Read more: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

Dogecoin ADX. Source: TradingView

Dogecoin ADX. Source: TradingView

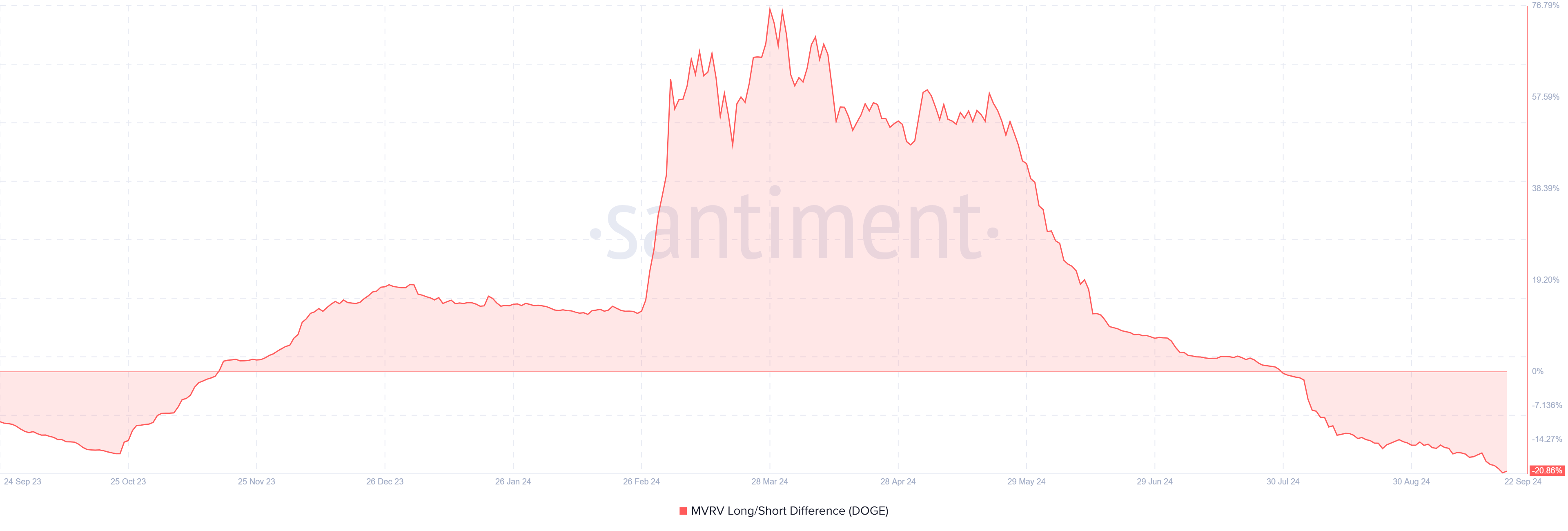

Another factor impacting Dogecoin’s potential rally is its MVRV Long/Short Difference, which is currently sitting at -20%. This indicator assesses profitability by comparing short-term and long-term holders.

As seen with DOGE, a negative value suggests that short-term holders are in profit while long-term holders are not. This is typically a bearish sign because short-term holders are more likely to sell their assets to lock in profits, adding downward pressure on the price.

The current market sentiment indicates that short-term traders are in control, which could lead to increased selling pressure. If short-term holders decide to cash out, Dogecoin’s price could remain suppressed, further delaying any potential rally.

Dogecoin MVRV Long/Short Difference. Source: Santiment

Dogecoin MVRV Long/Short Difference. Source: Santiment

DOGE Price Prediction: A Wait Ahead

Dogecoin is currently trading at $0.107 and is nearing a breakout from the descending wedge pattern. While this setup traditionally signals a 60% rally to $0.176, the breakout may not happen as quickly as anticipated.

Given the weak macro momentum and bearish market sentiment, Dogecoin could fail to breach the key resistance at $0.118. If this happens, the meme coin will likely remain in consolidation between $0.094 and $0.118 for the foreseeable future.

Read More: Dogecoin (DOGE) Price Prediction 2024/2025/2030

Dogecoin Price Analysis. Source: TradingView

Dogecoin Price Analysis. Source: TradingView

However, if Dogecoin manages to break above $0.118 and flip the $0.130 level into support, it could regain bullish momentum. This would invalidate the bearish outlook and open the door for potential profits, pushing the price higher.