This Week in Crypto: Trump’s WLFI, Coinbase cbBTC Drama, Binance’s Tap-to-Earn Game Leaked

This week in crypto, major developments occurred across DeFi, Bitcoin, and GameFi. Donald Trump’s new DeFi venture, WLFI, introduced bold plans for decentralized banking, though skepticism lingers. Coinbase faced scrutiny over its Bitcoin-wrapped product, cbBTC, amid accusations it was being used to manipulate Bitcoin’s price.

Meanwhile, Binance made headlines by teasing a new tap-to-earn game, Moonbix, set to launch on Telegram’s Mini App platform. Together, these events highlight the ongoing innovation—and controversy—within the crypto ecosystem.

Coinbase’s Bitcoin Wrapped Token cbBTC Under Scrutiny Amid Rumors

Coinbase, the largest public crypto exchange in the US, is embroiled in controversy over its Bitcoin-wrapped token, cbBTC. Accusations suggest that Coinbase issued Bitcoin IOUs to BlackRock. This move could enable the asset management giant to short Bitcoin without needing to hold an equivalent amount of BTC.

This speculation intensified when TRON founder Justin Sun criticized cbBTC for lacking transparency, raising concerns about the product’s potential impact on the market. He speculated that BlackRock might be using its partnership with Coinbase to suppress Bitcoin’s price and maximize profits. Furthermore, Sun referred to cbBTC as a “trust me” Bitcoin, warning that a lack of Proof of Reserve and vulnerability to government seizure could harm Bitcoin’s decentralized nature.

“cbBTC = central bank BTC. There is no more ridiculous combination in the world than putting central banks and Bitcoin together,” he stated.

Crypto analyst Tyler Durden further fueled the fire. He suggested that Coinbase’s buying and selling patterns at market peaks and valleys were signs of manipulation.

However, Coinbase CEO Brian Armstrong addressed these claims, explaining that ETF mints and burns are processed on-chain within one business day and that cbBTC operates transparently. He also clarified that institutional client addresses, including BlackRock’s, remain confidential.

Read more: Coinbase Review 2024: The Best Crypto Exchange for Beginners?

WLFI Launches: Crypto Enthusiasts Weigh In on Trump’s DeFi Venture

On Monday, the Trump family introduced the World Liberty Financial token (WLFI), a new decentralized finance (DeFi) project designed to transform cryptocurrency banking. Donald Jr. and Eric Trump, sons of former US President Donald Trump, spearhead this project.

The project aims to facilitate decentralized lending, borrowing, and investment activities. WLFI also plans to operate as a Reg D token under SEC guidelines. This approach will allow it to raise capital without registering as a security.

However, the project’s token allocation has sparked skepticism among the crypto community. Many of them questioned whether WLFI can deliver on its promises. Critics pointed out that the project’s launch event lacked details about its business model.

Furthermore, previous leaks indicated that a larger share would be set aside for the founding team, leading to worries about the Trump family’s financial interests. Yet, the final proposal designates 20% for the founders and sets aside 17% for user rewards, with 63% remaining available for the public. These uncertainties raise concerns about the project’s sustainability in the long run.

Crypto Market Gains Momentum Following Federal Reserve Rate Cut

The Federal Reserve’s decision to cut interest rates by 50 basis points at this week’s FOMC meeting has spurred a rally in the crypto market. Bitcoin surged past $63,500, while Ethereum climbed to over $2,482, as the rate cut buoyed investor sentiment across financial markets.

Despite the immediate gains, analysts have observed a sharp decline in implied volatility (IV), with short-term options seeing a 25% drop. This suggests that while the rate cut initially lifted prices, the market remains cautious about long-term volatility. With additional rate cuts expected later this year, the upcoming months could see further market fluctuations, especially as the US election draws near.

Binance Teases Tap-to-Earn Game “Moonbix” for Telegram

Binance is gearing up for the launch of its new tap-to-earn game, “Moonbix,” on Telegram’s Mini App platform. Although details of the game were leaked earlier than expected, Binance officially teased the game’s release this week.

Moonbix is a TON blockchain-based game set in a space-themed environment. It allows players to earn rewards by moving through levels and collecting items using a claw-like manipulator—reminiscent of gold mining games.

While the official launch date remains unknown, excitement is building around Moonbix’s potential to attract new users to Binance’s platform, especially within the Telegram ecosystem. The game’s tap-to-earn model also aligns with Binance’s strategy to innovate within the crypto gaming space, offering users a new way to engage with blockchain-based gaming.

MicroStrategy Completes $1.01 Billion Bond Offering, Bitcoin Buying Continues

Virginia-based software company MicroStrategy made headlines on September 20 when it completed a $1.01 billion convertible bond offering. The company plans to use the proceeds to redeem $500 million of existing debt and acquire additional Bitcoin.

MicroStrategy’s notes are set to mature in 2028. They offer a 0.625% interest rate and allow conversion into cash, company shares, or both.

The convertible notes carry a conversion price of around $183.19 per share. This price is a 40% premium over the company’s stock price on the day of the announcement. With over $997 million in net proceeds after fees, MicroStrategy remains committed to expanding its Bitcoin holdings.

Read more: Who Owns the Most Bitcoin in 2024?

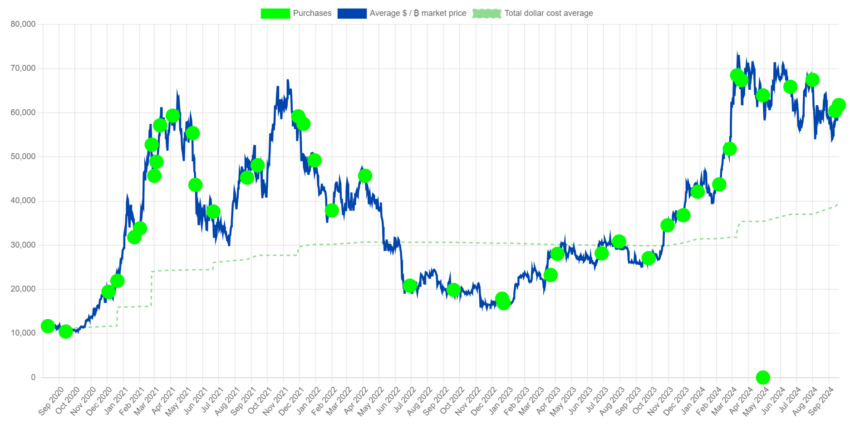

MicroStrategy Bitcoin Holdings. Source: saylortracker.com

MicroStrategy Bitcoin Holdings. Source: saylortracker.com

On the same day, MicroStrategy revealed that it had acquired an additional 7,420 Bitcoin for approximately $458.2 million at an average price of $61,750 per BTC. This purchase further shows the company’s aggressive Bitcoin acquisition strategy, which has made it one of the largest corporate BTC holders. At the time of writing, data from SaylorTracker shows that the firm holds 252,220 BTC, worth approximately $15.99 billion.