Ethereum Team Lead Says ETH Was Never Meant to Be Money

Ethereum team lead Péter Szilágyi said that ETH was never intended to be money. Instead, it was designed to support a decentralized applications.

A key selling point for long-term ETH holders has been its deflationary nature, but that narrative has gradually faded since the Dencun Upgrade in March.

Ethereum Was Never Meant To Be Money: Péter Szilágyi

Szilágyi’s statement suggests that Ethereum holds greater value as a utility token than as a form of money. Viewing it solely as money is limiting, as its true potential lies in supporting decentralized applications and systems.

“ETH was never meant to be money. ETH was meant to support a decentralized world, which does entail ETH having value. That said, none of the OGs wanted ETH to be money, ever. Bring forth the tar and feathers,” Szilágyi wrote.

DCinvestor, a popular user on X (formerly Twitter), agrees, saying the value prop of most digital assets, including Ethereum, emerges based on their usage. This subject continues to stir debate, with some saying ETH is money.

This debate is not new. In 2019, during a panel in Tel Aviv with Ethereum co-founders Vitalik Buterin, Joe Lubin, and eToro executive Yoni Assia, the sentiment was expressed that “Ethereum can be money if the community wants it to be.”

Read more: What Is the Ethereum Cancun-Deneb (Dencun) Upgrade?

The Future of Ethereum with eToro’s Yoni Assia at the Ethereal Tel Aviv 2019 Blockchain ConferenceElsewhere, Ethereum co-founder Vitalik Buterin seized the opportunity at the Token2049 in Singapore to explain the network’s growth. He highlighted how Layer-2 networks continue to reduce transaction fees and improve confirmation times. Buterin also emphasized the importance of balancing mainstream adoption with Ethereum’s core values of decentralization and open-source development.

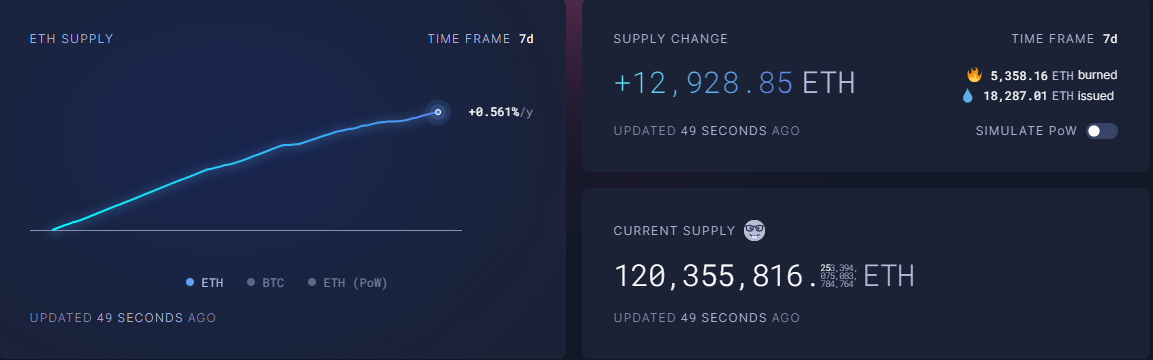

Meanwhile, the main selling point for ETH among long-term holders, its deflationary status, continues to fade. The new supply of ETH has become positive again, often increasing to its highest daily rate since the Merge.

Following the Dencun Upgrade in March, which helped reduce transaction fees, the supply of Ethereum is increasing. Data also shows Ethereum is currently issuing more units than it burns, which contradicts the earlier deflationary narrative.

Ethereum Supply. Source: Ultrasound.Money

Ethereum Supply. Source: Ultrasound.Money

It is no longer ultra-sound money, therefore, with almost 13,000 ETH tokens added to the supply in the last seven days. This supply pressure continues to weigh down on the Ethereum price.

“At the current rate of network activity, Ethereum will not be deflationary again. The narrative of ‘ultra-sound’ money has probably died or would need much higher network activity to come back to life,” CryptoQuant analysts highlighted.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

ETH Price Performance. Source: BeInCrypto

ETH Price Performance. Source: BeInCrypto

BeInCrypto data shows ETH is trading for $2,546 as of this writing, up by almost 5% since Friday’s session opened.