Shiba Inu Eyes 40% Rally After 7-Week Consolidation: Bullish Signs Emerge

Shiba Inu’s (SHIB) price has been in a consolidation phase for nearly seven weeks, and it is struggling to break out of it. Previously, the meme coin briefly escaped the consolidation but failed to sustain its upward momentum.

Despite this, Shiba Inu has generated enough bullish sentiment that could propel it toward a potential rally in the coming days.

Shiba Inu Is Looking at a Rise

Shiba Inu’s macro momentum has shown positive signs. The Chaikin Money Flow (CMF) indicator has consistently increased since July, with stronger inflows observed in mid-August.

Currently, the netflows remain positive, which is a bullish signal for SHIB. The sustained inflows indicate that investors are optimistic, adding to the chances of a significant price increase in the near term.

This increase in momentum, supported by the positive netflows, suggests that SHIB could be on the verge of breaking out of its consolidation phase. If the bullish momentum continues, the meme coin may see a price surge, potentially leading to gains for its holders.

Read more: How To Buy Shiba Inu (SHIB) and Everything You Need To Know

Shiba Inu CMF. Source: TradingView

Shiba Inu CMF. Source: TradingView

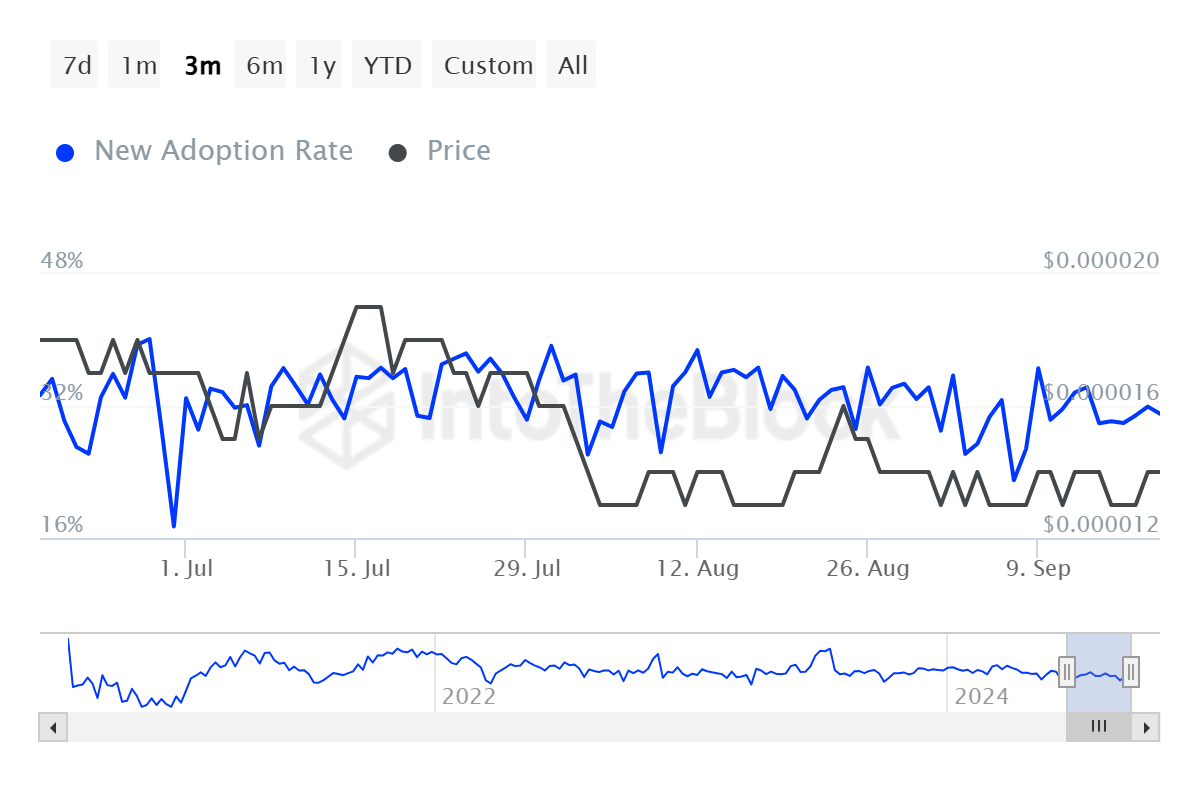

Furthermore, despite Shiba Inu’s price fluctuations, its adoption rate has remained stable at 32%, indicating strong traction. This metric calculates the percentage of new addresses making their first transaction out of all active addresses, showing sustained demand for SHIB.

A strong and stable adoption rate is crucial for Shiba Inu’s long-term growth, as it shows resilience despite market volatility. The demand for SHIB remains consistent, bolstering its potential for a price rally if other market conditions align.

Shiba Inu Adoption Rate. Source: IntoTheBlock

Shiba Inu Adoption Rate. Source: IntoTheBlock

SHIB Price Prediction: Aim to Escape

Shiba Inu is currently aiming to break out of its consolidation phase, with resistance at $0.00001462 and support at $0.00001271. A breach of this resistance could send SHIB toward $0.00001699, and flipping this level into support may trigger a rally to $0.00001961, marking a 40% rise.

The Bollinger Bands indicate a squeeze, and should the volume note a surge, it would confirm incoming volatility. Combined with bullish momentum, SHIB holders could see significant profits.

Read more: Shiba Inu (SHIB) Price Prediction 2024/2025/2030

Shiba Inu Price Analysis. Source: TradingView

Shiba Inu Price Analysis. Source: TradingView

However, failure to breach $0.00001462 may result in continued consolidation or a potential fakeout, as seen in August. A drop to $0.00001271 could invalidate the bullish outlook, leaving SHIB holders susceptible to losses.