Dogecoin Targets $0.15 as Whale Demand and Profits Soar

Leading meme coin Dogecoin (DOGE) has been on a roll this week, with its price rising nearly 5%. A combination of increasing demand and a rise in whale inflows fuels this surge.

If this momentum continues, DOGE could be on track to hit $0.15, a level it last traded at in June. Its technical setup on a one-day chart suggests that this may be possible. Here is how.

Dogecoin Sees Surge in Demand

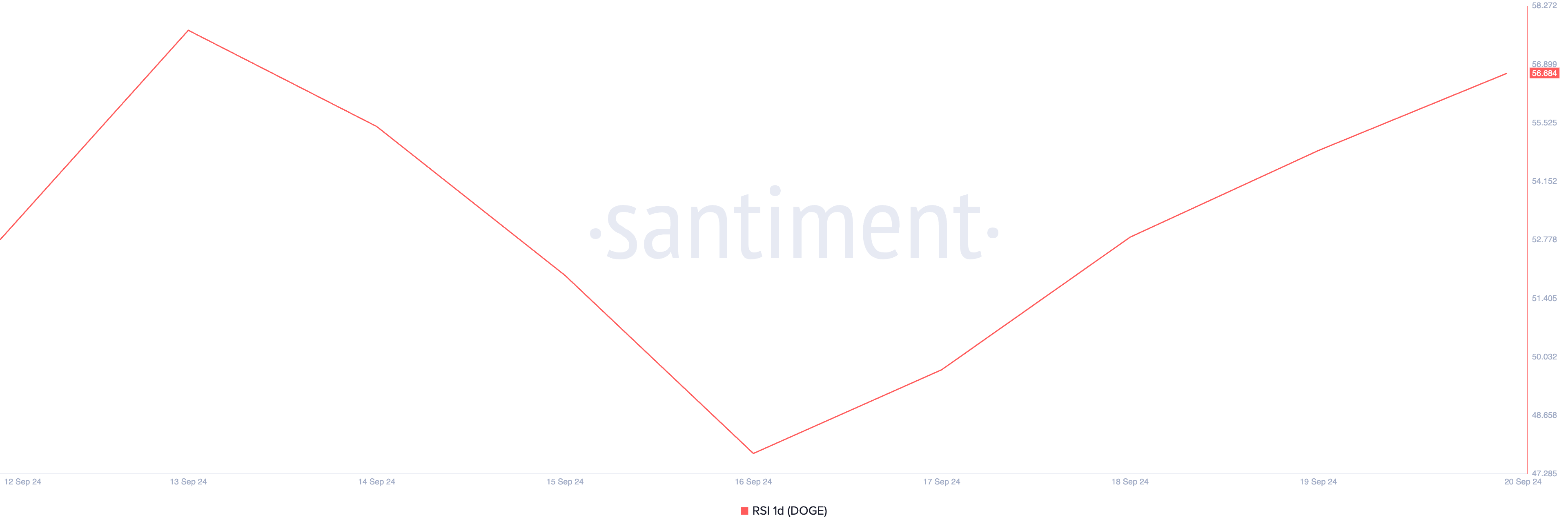

Dogecoin’s rising Relative Strength Index (RSI) is a good indicator of the uptick in the demand for the meme coin. This momentum indicator, which measures the coin’s oversold and overbought market conditions, is at 56.68 and in an uptrend at press time.

Read more: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

Dogecoin Relative Strength Index. Source: Santiment

Dogecoin Relative Strength Index. Source: Santiment

An RSI of 56.68 suggests that DOGE is in a moderately bullish zone where buying pressure has started to outweigh selling activity. At this level, DOGE is not yet in the overbought territory, so it may still have room to rise further without an immediate risk of a reversal.

Additionally, the actions of DOGE whales stand out during the week in review. On-chain data shows a significant increase in large holders’ inflow for the meme coin. Addresses holding over 0.1% of DOGE’s circulating supply are considered large holders. Over the past seven days, this group has boosted their coin accumulation by 39%, contributing to a rise in DOGE’s price.

Dogecoin Large Holders Inflow. Source: IntoTheBlock

Dogecoin Large Holders Inflow. Source: IntoTheBlock

Due to DOGE’s rally, the percentage of its circulating supply held in profit has spiked. Santiment’s data shows that 102 billion DOGE, representing 70% of the meme coin’s circulating supply of 146 billion DOGE, is now held in profit. For context, only 97 billion tokens were in profit four days ago.

Dogecoin Percent of Total Supply in Profit. Source: Santiment

Dogecoin Percent of Total Supply in Profit. Source: Santiment

DOGE Price Prediction: Profit-Taking May Put Coin in Trouble

At press time, DOGE is trading at $0.10. The moving average convergence/divergence (MACD) indicator shows a bullish trend for the leading meme coin. The MACD line (blue) sits above both the signal (orange) and zero lines, indicating strong buying pressure that could support the ongoing price rally.

If demand for DOGE increases, it may climb toward the key resistance level of $0.15, which has held since April. A successful breakout above this level could push the price higher, potentially reaching $0.19.

Read more: Dogecoin (DOGE) Price Prediction 2024/2025/2030

Dogecoin Price Analysis. Source: TradingView

Dogecoin Price Analysis. Source: TradingView

However, if profit-taking activity commences, this will force a downtrend toward $0.08, invalidating the bullish projection above.