Crypto Today: Bitcoin breaks $63,500, Ethereum closer to $2,500, XRP holds steady above $0.58

- Bitcoin rallies to $63,500 for the first time in nearly a month, likely in response to the Federal Reserve’s 50 bps rate cut on Wednesday.

- Ethereum eyes return above $2,500, gains nearly 3% on day.

- XRP holds steady above $0.5870, climbing slightly.

Bitcoin, Ethereum and XRP updates

- Bitcoin trades at $63,118 at the time of writing. The largest cryptocurrency by market capitalization reached a high of $63,500 early on Thursday. Bitcoin has gained nearly 7% since Monday’s open of $59,132 this week.

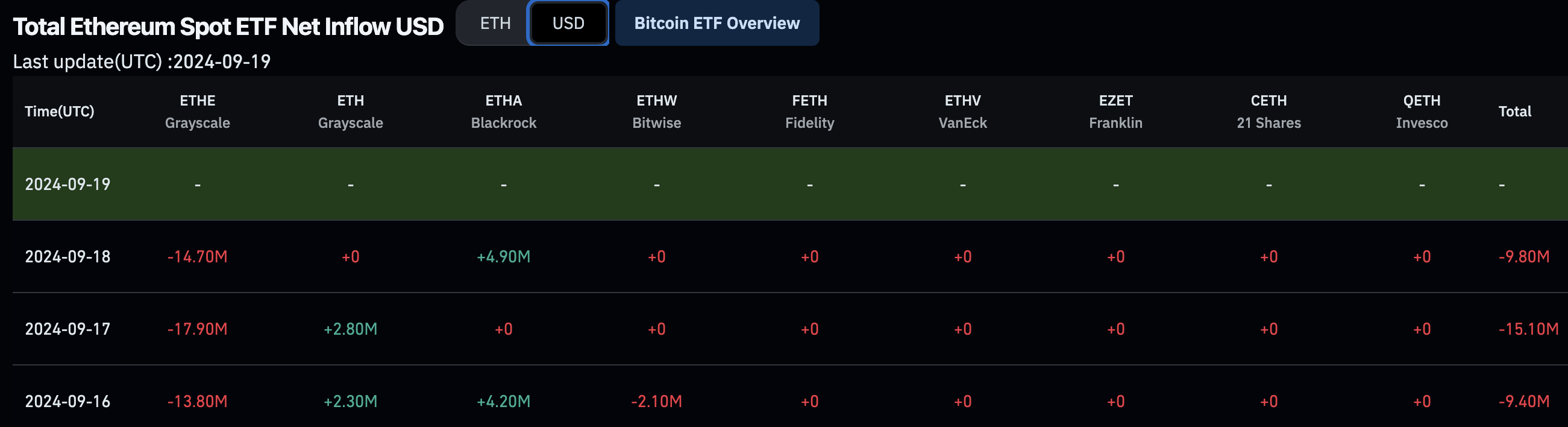

- Ethereum hovers around $2,500, gains nearly 3% on the day. The altcoin’s Spot ETFs have noted negative flows for three consecutive days this week. According to data from Coinglass, Spot Ethereum ETF netflow was between $9.4 and $15 million.

Ethereum Spot ETF flows

- XRP has held onto recent gains, climbing to $0.5870 on Thursday. Key market movers for XRP Ledger’s native token are Ripple’s preparedness for stablecoin RUSD’s launch and the altcoin’s legal clarity in transactions on exchange platforms.

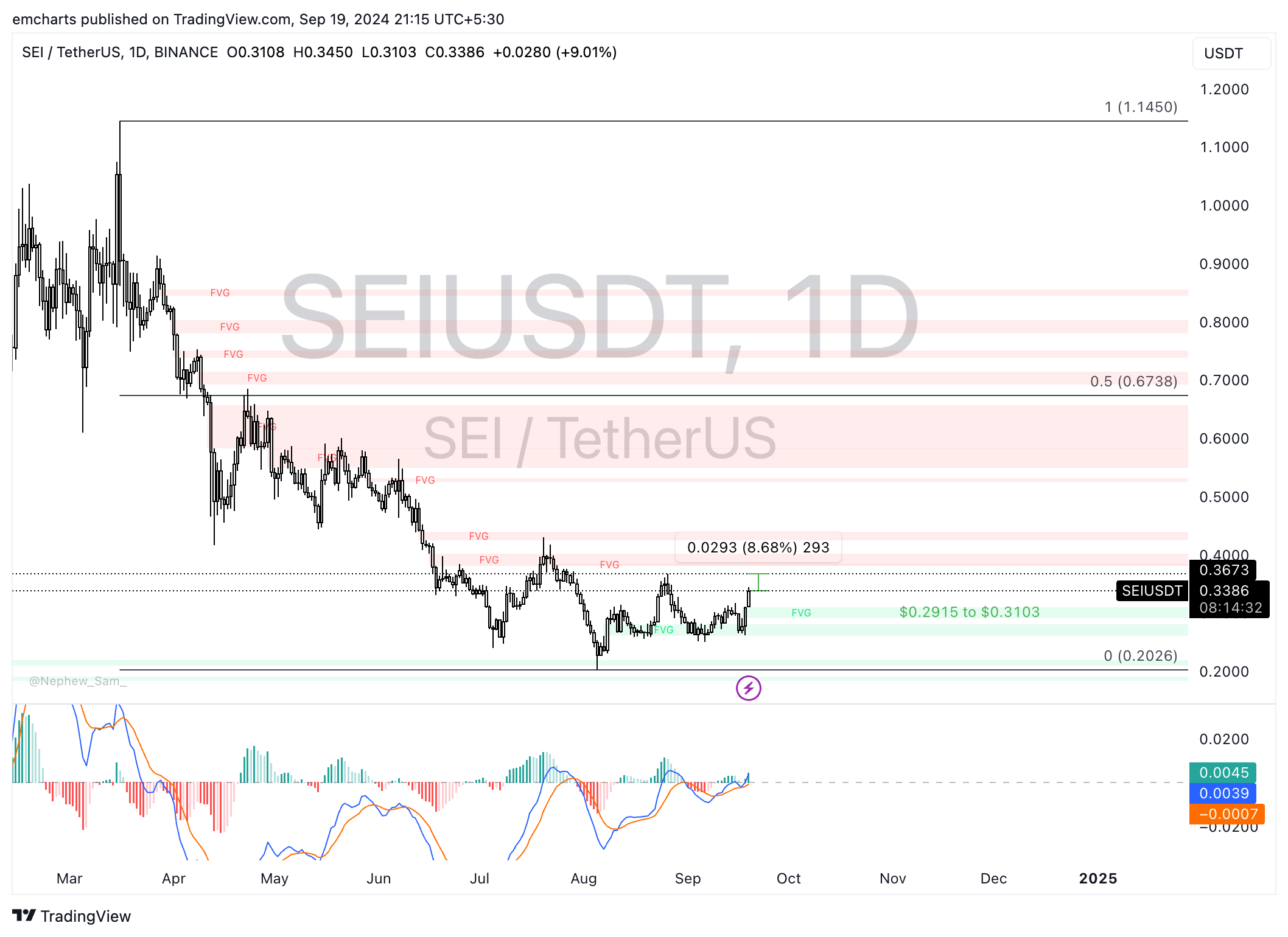

Chart of the day: SEI

SEI/USDT daily chart

SEI noted a large gain in daily active users compared to a month prior. In August the number of daily active users crossed 50,200, per data shared by the project in an official tweet on X. SEI ranks among trending coins on Binance on Thursday.

SEI is likely to extend gains as the asset rallies nearly 9% on the day. At the time of writing the price is $0.3386, and SEI could hit its August 26 high of $0.3673.

The green histogram bars on the Moving Average Convergence Divergence (MACD) momentum indicator support the bullish thesis. It signals underlying positive momentum in SEI’s price trend.

SEI could find support in the Fair Value Gap (FVG) between $0.2915 and $0.3103, looking down on the daily chart.

Market updates

- Amberdata’s report on Bitcoin vs Ethereum ETF comparison shows that in contrast to BTC gains from ETF approval, Ether suffered a decline in price. Spot Ethereum ETF launched on July 23, 2024, and since then the price dropped 29%. Netflows for Spot Ethereum ETFs have not shown the same trajectory as Bitcoin, and experts examine whether the interest in Ether ETFs will pick up in 2024.

- Bitcoin noted gains in response to the US central bank’s 50-basis-point rate cut on Wednesday. David Morrison, senior market analyst at Trade Nation, considers the development “encouraging” for the asset.

- Morrison told FXStreet:

"Crypto prices surged following the Fed’s 50 basis point rate cut. Bitcoin pushed back above $60,000 on Tuesday in a move which helped to lift sentiment after a difficult summer. It built on those gains yesterday, as did other risk assets, after the Fed kicked off what should be a series of rate cuts with a hefty, and until last Friday, unexpectedly large cut. Bitcoin is up around 5% today, and, unlike gold, has held on to its gains so far. This is encouraging, particularly as the Fed has signaled more rate cuts this year. If Bitcoin can take out August’s high of $65,000 convincingly, then we may see a resumption of the bull market. If it can’t, then it’s worth noting the significant band of support which was formed in February this year, roughly between $51-52,000."

Industry updates

- TokenTerminal data shows 80% senders of the stablecoin Tether (USDT) are on the Tron chain. For crypto traders, this means that Tron is onboarding a large volume of new users to cryptocurrency markets or Tether is driving adoption of Tron among traders.

Tether has an emerging markets focus

— Token Terminal | @ TOKEN2049 (@tokenterminal) September 18, 2024

80% of USDT senders are on @trondao. pic.twitter.com/mPbermQT9a

- The Threshold Network, a decentralized protocol, has integrated Chainlink Price Feeds on Arbitrum, Base, Ethereum and Optimism chains to secure tBTC (Bitcoin backed token, pegged to the price of BTC) markets.

.@TheTNetwork has integrated #Chainlink Price Feeds on @arbitrum, @base, @ethereum, and @Optimism to support secure markets around tBTC.

— Chainlink (@chainlink) September 19, 2024

Price Feeds drive innovation in DeFi and advance the Web3 ecosystem by enabling novel applications. pic.twitter.com/81Q63docnr

- Solana Labs announces Seeker, second mobile device from the project, assures rewards to users.

1/ We’ve been deep in build mode for months, and we’re excited to show you what we've been working on.

— Seeker | Solana Mobile (@solanamobile) September 19, 2024

Introducing the next chapter of Solana Mobile: the Solana Seeker pic.twitter.com/2UW3Wqhymw

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.