Circle and Sony Introduce USDC on Soneium Blockchain for Creators

- Circle has partnered with Sony’s blockchain to increase USDC adoption on the Soneium L2 network.

- The Bridged USDC Standard enables Web3 producers to make safe, digital dollar payments.

On September 15, Circle, the world’s second-largest stablecoin issuer, announced a collaboration with Sony Block Solutions Labs to increase USDC acceptance on Soneium, Sony’s Layer-2 Ethereum network. This project seeks to integrate Circle’s Bridged USDC Standard, making the stablecoin one of the key tokens for value exchange on the blockchain.

Sony Block Solutions Labs, a joint venture between Sony Group Corporation and Startale Labs, created Soneium, a public Layer-2 blockchain that will be launched in August 2024.Circle’s connection to Soneium aims to speed the adoption of USDC in Web3, improve digital payments, and facilitate a more integrated ecosystem for creators.

Bridging USDC for Seamless Payments

The Bridged USDC Standard allows a proxy version of the stablecoin to run on Ethereum Virtual Machine (EVM)-compatible networks. This enables developers to employ digital currency payments on L2 networks, broadening use cases for decentralized applications (dApps). According to Circle’s CEO, Jeremy Allaire, this integration is a big step forward in Circle’s objective to create safe, user-friendly blockchain experiences.

The alliance also creates new opportunities for developers. Soneium will provide the infrastructure required to construct decentralized apps (dApps), allowing users to use Sony goods in innovative and decentralized ways. According to Jun Watanabe, Chairman of Sony Block Solutions Labs, “This collaboration ideally aligns with our goal of creating a more linked and efficient digital ecosystem.”

This collaboration comes as Circle’s USDC supply is expected to increase by 47% in 2024, bolstering its position in the stablecoin market. However, it is still behind its peak of $56 billion in 2022. This strategic decision, which is expected to benefit both developers and users on Soneium’s developing platform, strengthens Circle’s efforts to establish USDC as the digital currency for the Internet age.

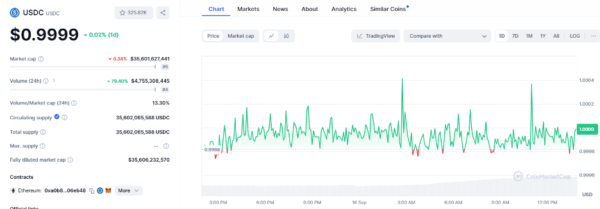

Soneium remains committed to partnerships, but the USDC continues to face the up-and-down march. As of the time of writing, USDC is up 0.002% over the last day to trade at $0.99.

Source: (CMC)

As the Web3 market expands, Circle and Sony Block Solutions’ collaboration is expected to increase use of stablecoins and blockchain technology, enabling producers to make secure digital payments across the Soneium network.

The post Circle and Sony Introduce USDC on Soneium Blockchain for Creators appeared first on Live Bitcoin News.