XRP re-listing on Robinhood could fuel double-digit price rally, push XRP to $0.66

- Robinhood, commission-less exchange platform re-lists XRP, per official website.

- Users cannot trade XRP Ledger’s native token on the exchange yet, XRP is back above $0.59 on Sunday.

- XRP eyes nearly 12% gains, targets July 2024 peak of $0.6602.

Ripple (XRP) is back on the commission-free exchange Robinhood per the official website of the platform. Users can currently watch XRP price chart, the altcoin is yet to be listed for trading.

XRP made a comeback above key resistance at $0.5900 and gears up for a return to its July 2024 peak of $0.6602.

Robinhood brings back XRP to its platform

The commission-free exchange brought back Ripple’s XRP token to its platform however users have to wait longer before they can begin trading in the altcoin. In July 2023, XRP Ledger’s native token gained legal clarity and was re-listed at major crypto exchanges worldwide.

Robinhood relists XRP

Robinhood has finally listed XRP on its zero-commission exchange and shows the price tracker. The website shows traders can watch XRP and trade in other crypto currencies. XRP holders keep their eyes peeled for the exchange’s announcement to kickstart trading in the native token of the XRP Ledger.

In recent news, Grayscale, asset management giant, announced a single asset investment fund focused on XRP. The development boosts the likelihood of higher institutional capital inflow and utility for XRP, could contribute to gains in the asset.

XRP could rally to $0.6602

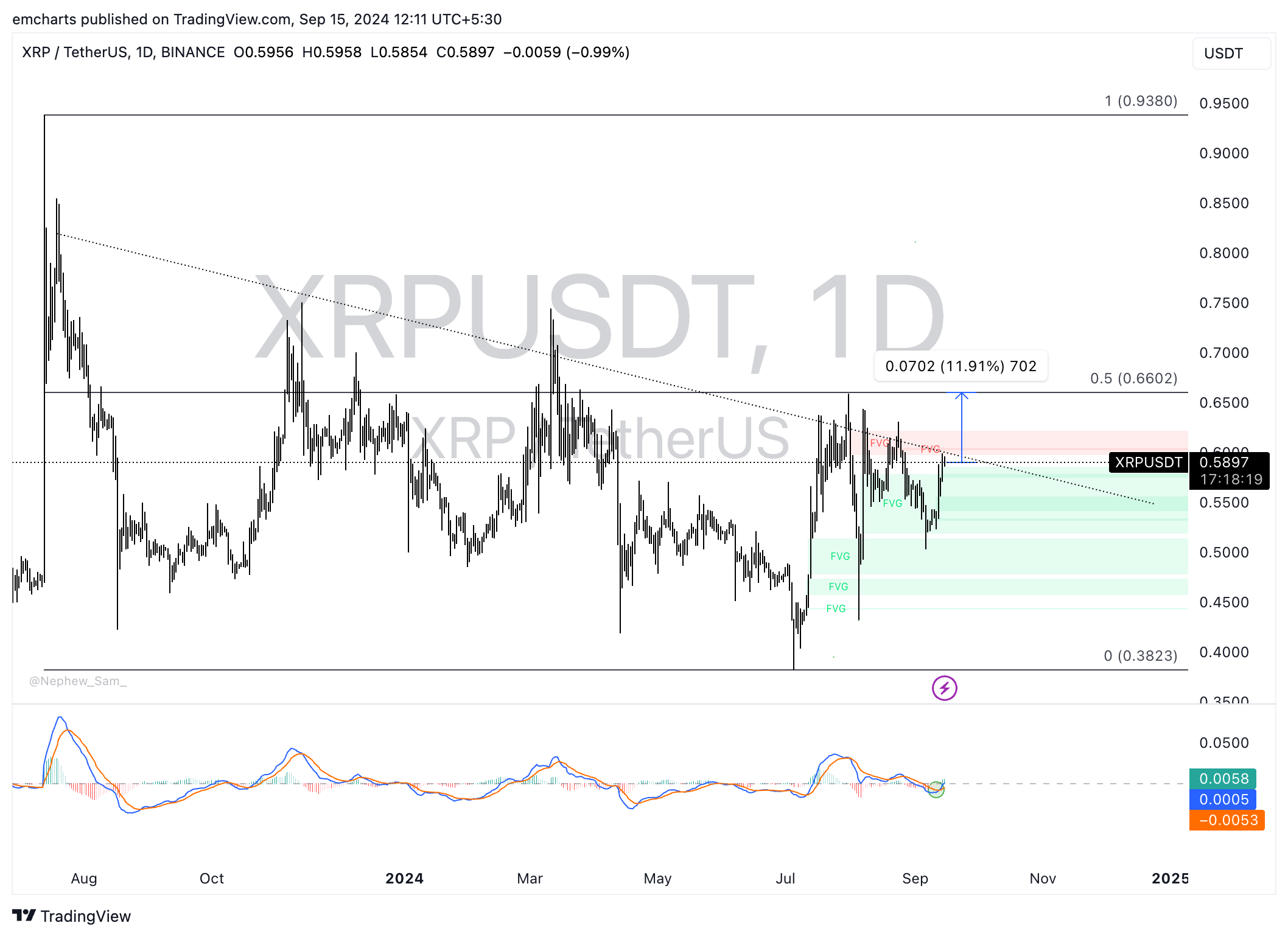

XRP has been in a multi-month downward trend since its July 2023 top of $0.9380, as seen in the XRP/USDT daily chart. The altcoin is likely primed for double-digit gains, 11.91% rally to the 50% Fibonacci retracement of the decline from July 2023 top of $0.9380 to the July 2024 bottom of $0.3823.

The Moving Average Convergence Divergence (MACD) momentum indicator flashes green histogram bars above the neutral line, meaning there is underlying positive momentum in XRP price trend.

XRP could face resistance at the psychologically important $0.60 level and $0.6217, the July 31 low for the altcoin.

XRP/USDT daily chart

Looking down, XRP could find support in the Fair Value Gap (FVG) between $0.5745 and $0.5854.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.