SUI outperforms crypto market following consensus upgrade and launch of Grayscale Trust

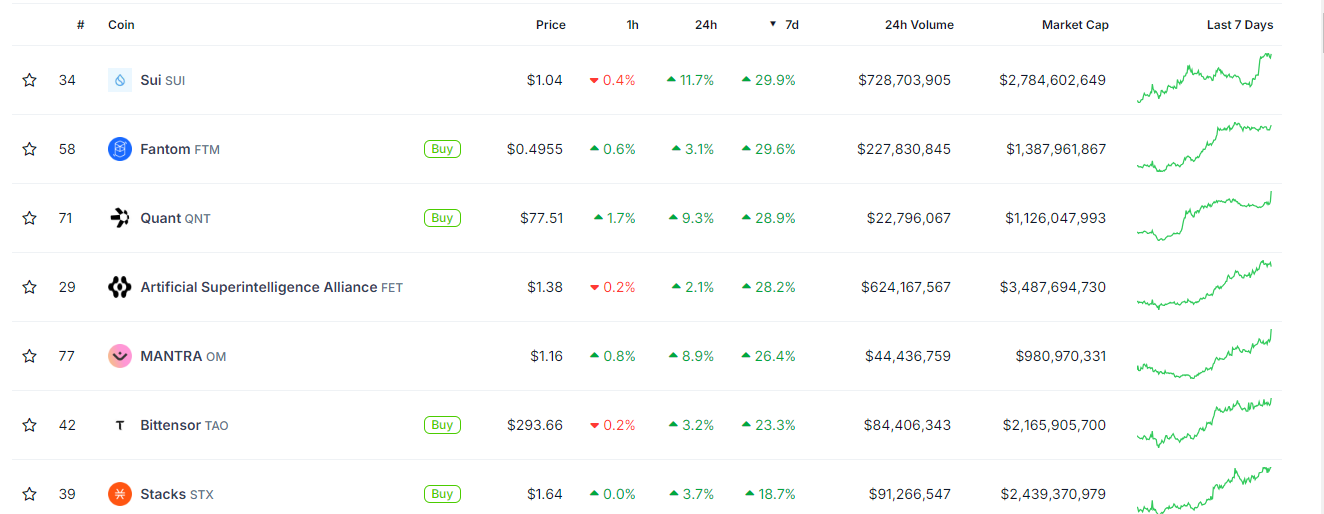

- SUI has outperformed the top 100 cryptocurrencies in the past week with a 30% gain.

- SUI's rise comes on the heels of a consensus upgrade and the launch of Grayscale SUI Trust.

- SUI could rally over 37% if it breaks above the $1.171 level but risks correction if the resistance holds.

SUI is up 11% on Thursday, continuing its impressive rise over the past week. The rise follows several key upgrades and launches related to the SUI token. While SUI could stage a further rally if it breaks above the $1.171 level, investors need to watch out for a potential price correction if the resistance holds.

SUI's rise comes on the back of key upgrades and launches

SUI soared over the past 24 hours, gaining 11% on the day. SUI's uptrend goes back to September 6, when it broke out of a sharp bearish pressure. Notably, SUI has outperformed every other cryptocurrency in the top 100 category in the past week, noting a 30% price increase, per Coingecko data

SUI Weekly Outperformance

These are some of the reasons why SUI has outperformed the crypto market:

- Sui upgraded to a Mysticeti consensus protocol, which will cut consensus time to 390 milliseconds, enabling faster transactions on its blockchain. Following this, SUI upgraded shared-object transactions to improve its congestion control mechanism.

- Grayscale announced the launch of its latest SUI Trust fund on Wednesday. The fund, open to eligible investors, will provide clients with exposure to SUI's price and function like other Grayscale trust funds.

- The Total Value Locked (TVL) on the SUI Layer One has risen over 9% in the last 24 hours to $720.97 million. The rise has seen it overtake chains like Optimism and Scroll, stretching its weekly TVL gain more than 15%

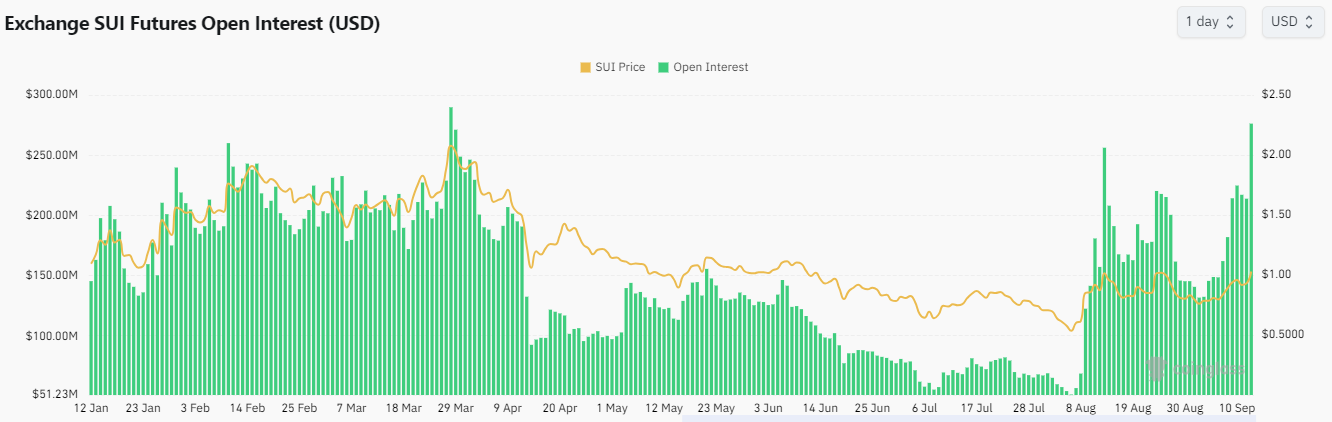

- SUI's open interest (OI) reached a six-month high on Thursday, rising by nearly 390% since August 6. In the past 24 hours alone, SUI's OI has soared by over 35%. The rising OI could strengthen the bullish move if prices continue the uptrend. Open interest is the total number of unsettled long/short contracts in a derivatives market.

SUI Open Interest

Key metrics to watch out amid SUI's uptrend

Despite rising prices and strong bullish momentum, SUI may see a potential price correction if demand doesn't absorb the supply hike from its $83 million worth of monthly token unlocks.

On the daily chart, SUI is trading within a key rectangle channel with support and resistance levels at $0.731 and $1.171, respectively. A breakout above the $1.171 resistance and the 100-day Simple Moving Average (SMA) could see SUI rally further by 37% toward the $1.611 price level.

SUI/USDT Daily chart

On the flip side, SUI could see a rejection around the $1.171 resistance level, especially as the Stochastic Oscillator (Stoch) has entered the overbought region. The Relative Strength Index (RSI) is also approaching the overbought region. If it crosses into this region, SUI could be experiencing a price correction.