Solana Active Addresses Hit All-Time High: What it Means for SOL Price

Solana (SOL) recently set a new record for daily active addresses, leading to speculation that its price could gain from this milestone. Despite this, SOL’s price has struggled, much like other altcoins in recent times.

With this surge in activity and a major Solana event expected next week, investors are now wondering if SOL could experience a price rebound.

Solana Active Addresses Skyrocket Ahead of Breakpoint

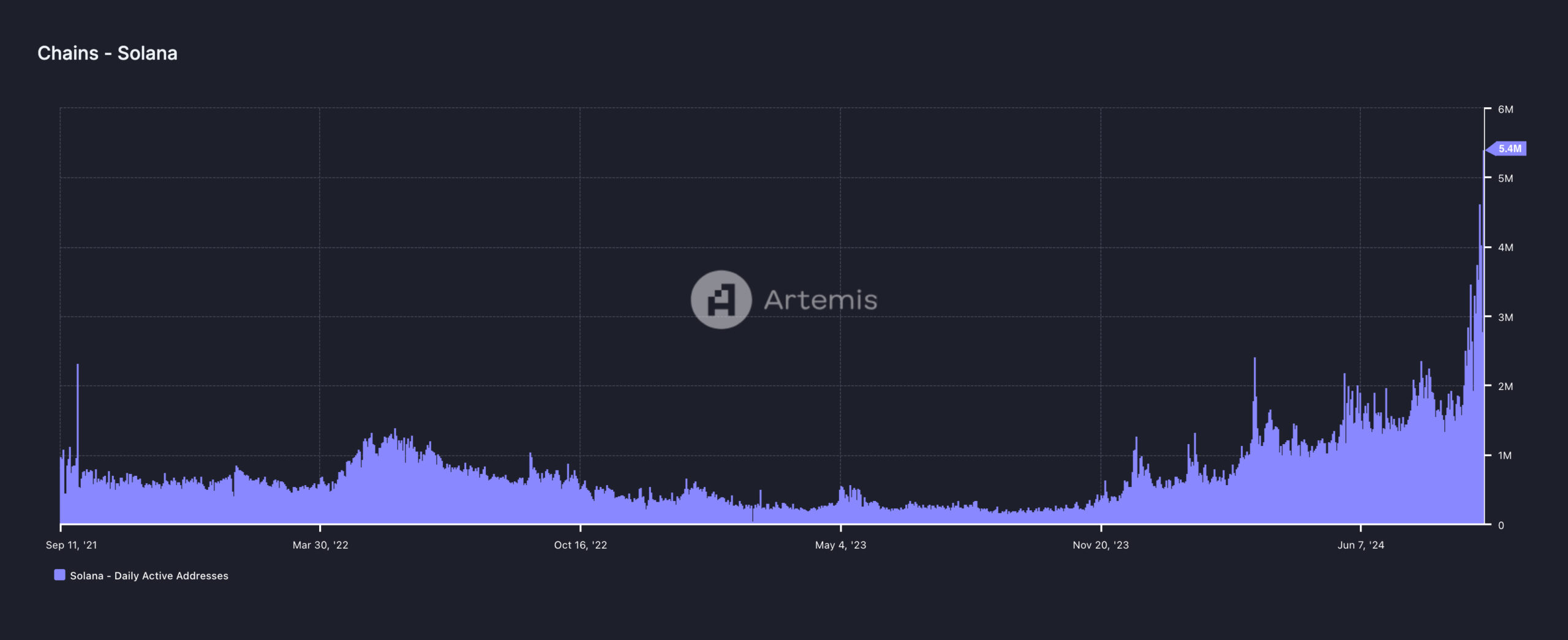

On September 10, the daily active addresses on Solana hit 5.4 million. According to an assessment of Artemis data, this was the highest level the metric has reached in the blockchain’s history.

Active addresses serve as a good indicator of a project’shealth for a project. Apart from that, it signals utility and active participation, which is sometimes crucial in driving up a cryptocurrency’s value.

Therefore, for the token, the incredible surge in user engagement is bullish and could play a vital role in helping SOL erase some of its recent losses.

Read more: 13 Best Solana (SOL) Wallets To Consider in September 2024

Solana Active Addresses. Source: Artemis

Solana Active Addresses. Source: Artemis

Another factor supporting a potential Solana price increase is the upcoming Breakpoint conference, set for September 20-21. This event, which highlights technological advancements within the Solana ecosystem, has historically been bullish for SOL.

For example, in 2023, the conference took place from October 30 to November 3, and SOL’s price surged from $21 to $65 between mid-October and mid-November. In 2022, however, the bear market prevented any significant rally. In 2021, Solana saw a “buy the rumor, sell the news” effect, with prices jumping from $157 to $258 leading up to the event.

Solana 5-Day Price Chart. Source: TradingView

Solana 5-Day Price Chart. Source: TradingView

Once this event began on November 7, SOL slid. Therefore, if past performances rhyme with future events, then SOL’s price might pick up at some point before the conference.

SOL Price Prediction: Dip, Then Breakout

On the daily chart, the %K and %D line of the Stochastic Relative Strength Index (RSI) has hit the overbought region. Commonly referred to by its short form, the Stoch RSI measures the strength and weakness of a trend.

It also shows when a cryptocurrency is overbought or oversold. Values over 80.00 indicate that an asset is overbought, while those below 20.00 mean it is oversold. Therefore, in Solana’s case, the current condition suggests that it could undergo a short-term price decline.

Based on current trends, Solana’s (SOL) price could dip below $130. However, the $127.78 support level suggests a potential rebound. If the token bounces from this support, it could rise above both the 20 and 50 Exponential Moving Averages (EMAs), marked in blue and yellow, respectively.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

Solana Daily Analysis. Source: TradingView

Solana Daily Analysis. Source: TradingView

If validated, Solana’s next target before the Breakpoint conference could be around $169.63. However, if the number of active addresses declines, this prediction may not hold. In that case, SOL’s price could fall to $124.19 instead.