Dogecoin leads meme coin recovery following positive investor sentiment

- Dogecoin has been among the top trending cryptocurrencies in the past 24 hours following Elon Musk's post.

- DOGE is on the verge of reclaiming a major support level that could lead to either of two key outcomes.

- DOGE could see a massive rally if it overcomes the $0.110 key resistance.

Dogecoin (DOGE) is up more than 8% on Monday, as it's leading the entire meme coin sector on a rebound. The top meme coin could see a massive rally if it completes a key move within a falling wedge.

DOGE trends following Musk’s post

Dogecoin has been one of the top trending tokens in the crypto market within the last 24 hours, per Santiment data. The increased social volume of DOGE centers around a post from Tesla and X CEO Elon Musk, in which he referenced the Department of Government Efficiency, abbreviated as DOGE.

Dogecoin community members seized the opportunity to draw connections between Musk's tweet and the DOGE meme coin.

Popular Dogecoin enthusiast @cb_doge quickly posted a Lion King-inspired DOGE meme, which captured the attention of Musk:

Naturally, our official mascot will be the Doge

— Elon Musk (@elonmusk) September 9, 2024

Musk's post seemed to have triggered positive sentiment toward DOGE, which led the entire meme coin sector into recovery with an 8% rally in the past 24 hours.

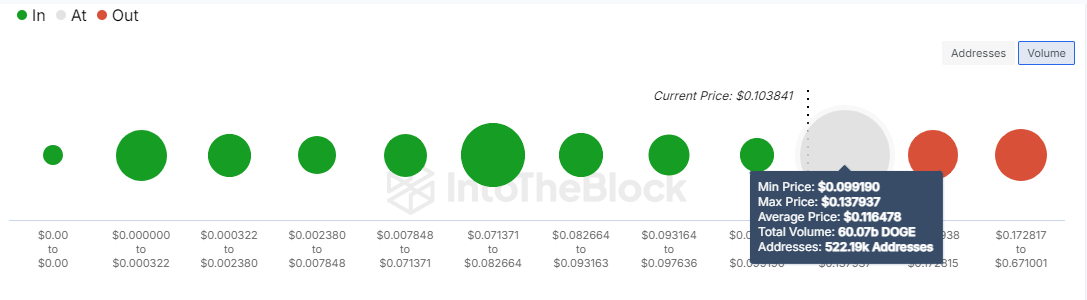

The rise has seen DOGE gradually enter a major accumulation zone where investors purchased over 60 billion DOGE tokens. If DOGE sustains a rise above this key zone, it could serve as a major support level.

DOGE Global/In Out of the Money

Conversely, it could also lead to a correction as some investors may want to sell immediately if they break even.

DOGE could trigger massive rally if it overcomes key resistance

Dogecoin is trading around $0.103 on Monday, up 8% on the day. In the past 24 hours, DOGE has seen $2.45 million in liquidations, with long and short liquidations accounting for $175,450 and $2.27 million, respectively.

DOGE is trading within a falling wedge on the 12-hour chart. This pattern, marked by even lower tops and lower bottoms, suggests that bears are losing momentum and buyers are gradually stepping into the market.

DOGE/USDT 12-hour chart

A crucial price level to watch as the top meme coin attempts a rally is the $0.111 price resistance. If DOGE overcomes this level and fails to see a correction, it could rally toward the next resistance around $0.142. A successful move above this level could see DOGE tackle a six-month resistance around $0.175.

A crucial indicator to watch amid the quest for a rally is DOGE's open interest (OI). Open interest is the total number of unsettled long and short positions in a derivatives market.

DOGE's OI is around $480 million at the time of writing, but it needs to grow to support the buying momentum.

The Relative Strength Index (RSI) is above its midline at 59, indicating rising bullish momentum.

The Stochastic Oscillator has moved into the oversold region, suggesting a potential brief price correction.

A daily candlestick close below the $0.088 support level could strengthen the bears and invalidate the bullish thesis.