Nine days in and spot Bitcoin ETFs have already recorded $500 million worth of outflows

- Net flows into spot Bitcoin ETFs have been increasingly negative, recording $158 million in outflows on Wednesday.

- Grayscale’s outflows, on the other hand, do not seem to be slowing down as the fund has lost over 106,091 BTC.

- Bitcoin price is still stuck hovering around $40,000, testing the 100-day EMA on the daily chart.

Spot Bitcoin ETFs were expected to have an explosive start following their approval, which they did, but even though it has just been two weeks, the interest of the investors seems to be waning. Grayscale, which began bleeding right from the first day of trade, has seen some of the highest outflows.

Bitcoin ETF outflows hit a milestone

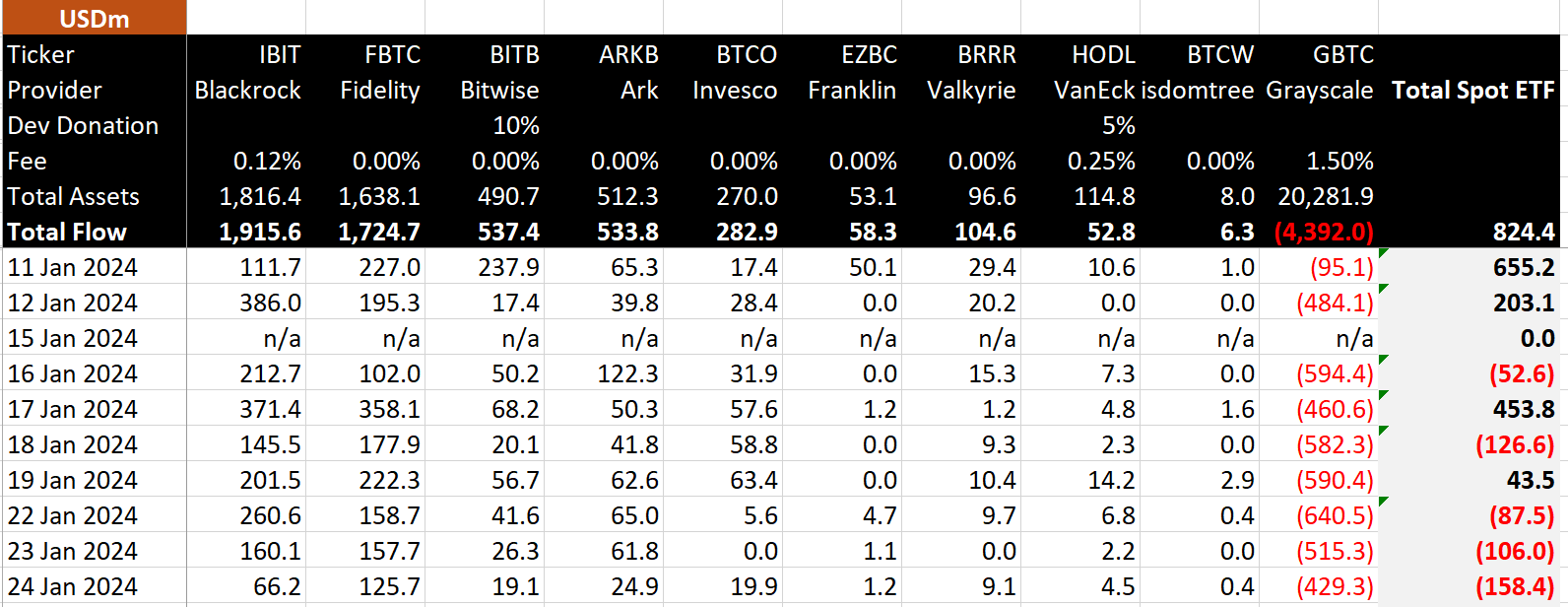

Spot Bitcoin ETFs have completed nine days of trading, and as of the moment, the outflows seem to be dominating. The net outflows recorded on the ninth day were about $158 million, which, combined with the outflows from the past nine days, brings the total to $528 million. This is solely due to Grayscale, which has seen consistently high outflows since Bitcoin spot ETFs were approved.

Thus, in less than ten days, over half a billion worth of BTC has already drained out of the spot ETF market. During the same period the market has noted inflows worth $1.2 billion in the same duration. This gives an overall balance of $824 million in net inflows.

Spot Bitcoin ETF outflows

The biggest loser, Grayscale, has been bleeding since the first day of trading, collectively noting 106,091 Bitcoin being sold in the same nine days. Apart from this $4.2 billion worth of outflow, the inflows of other digital assets have also begun declining. Wisdomtree spot BTC ETF noted the lowest inflow of just $10.6 million on Wednesday.

Total BTC outflow

It is evident that the hype is slightly fading since many people who were expecting a price rally soon after ETF approval have been left disappointed since Bitcoin price has not seen any growth in the last few days, hovering around $40,000.

Bitcoin price at risk

The cryptocurrency is observing support at $39,353, coinciding with the 100-day Exponential Moving Average (EMA). Some recovery on the daily chart has been observed in the last 24 hours. If this continues and the $41,814 resistance is breached, BTC will be able to flip the 50-day EMA into support.

BTC/USD 1-day chart

However, if the outflows continue to remain as large as they are at present, and Bitcoin price falls through the crucial support of $39,535, it could note a decline to $35,504, likely invalidating the bullish thesis.