Bitcoin price eyes recovery above $40,000, traders are split on where BTC is headed next

- Bitcoin price made a comeback above $40,000 on Thursday, eyeing gains after the recent correction.

- Bitcoin’s long term holders sent over $430 million in Bitcoin to exchanges as BTC dipped below $39,000.

- Santiment experts believe that it is the ideal time to take a contrarian position in Bitcoin, as volatility prevails in cryptocurrencies.

Bitcoin price suffered a setback after hitting its two year high of $48,989 on January 11. The asset dropped to its 2024 low of $38,555 on Tuesday before beginning its recovery to the psychologically important level of $40,000.

The approval of Bitcoin Spot ETFs by the Securities and Exchange Commission (SEC), ushered a volatility in crypto prices, and divided traders on their sentiment on BTC.

Santiment experts recommend taking a contrarian stance to benefit from the shifting Bitcoin price trend.

Also read: Bitcoin price decline triggers nearly $83 million in liquidations, BTC price recovers from drop below $39,000

Daily Digest Market Movers: Bitcoin traders divided on their sentiment on Bitcoin price

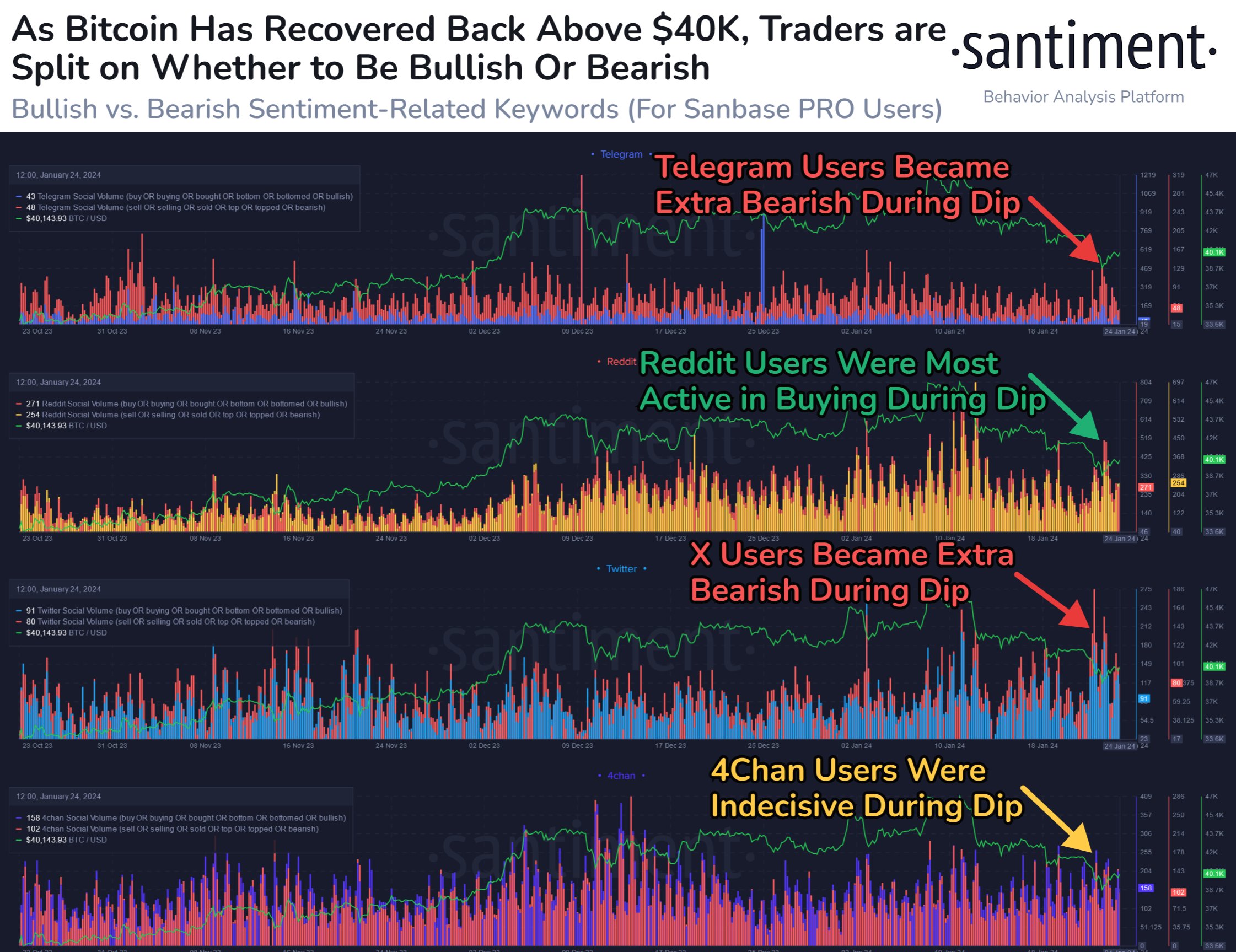

- On-chain intelligence tracker Santiment identified that the sentiment among Bitcoin traders on Telegram, Reddit, X and 4Chan is divided.

- BTC traders on Telegram and X became excessively bearish before Bitcoin price dip, on Reddit and 4Chan it was the opposite.

Bitcoin sentiment among BTC traders. Source: Santiment

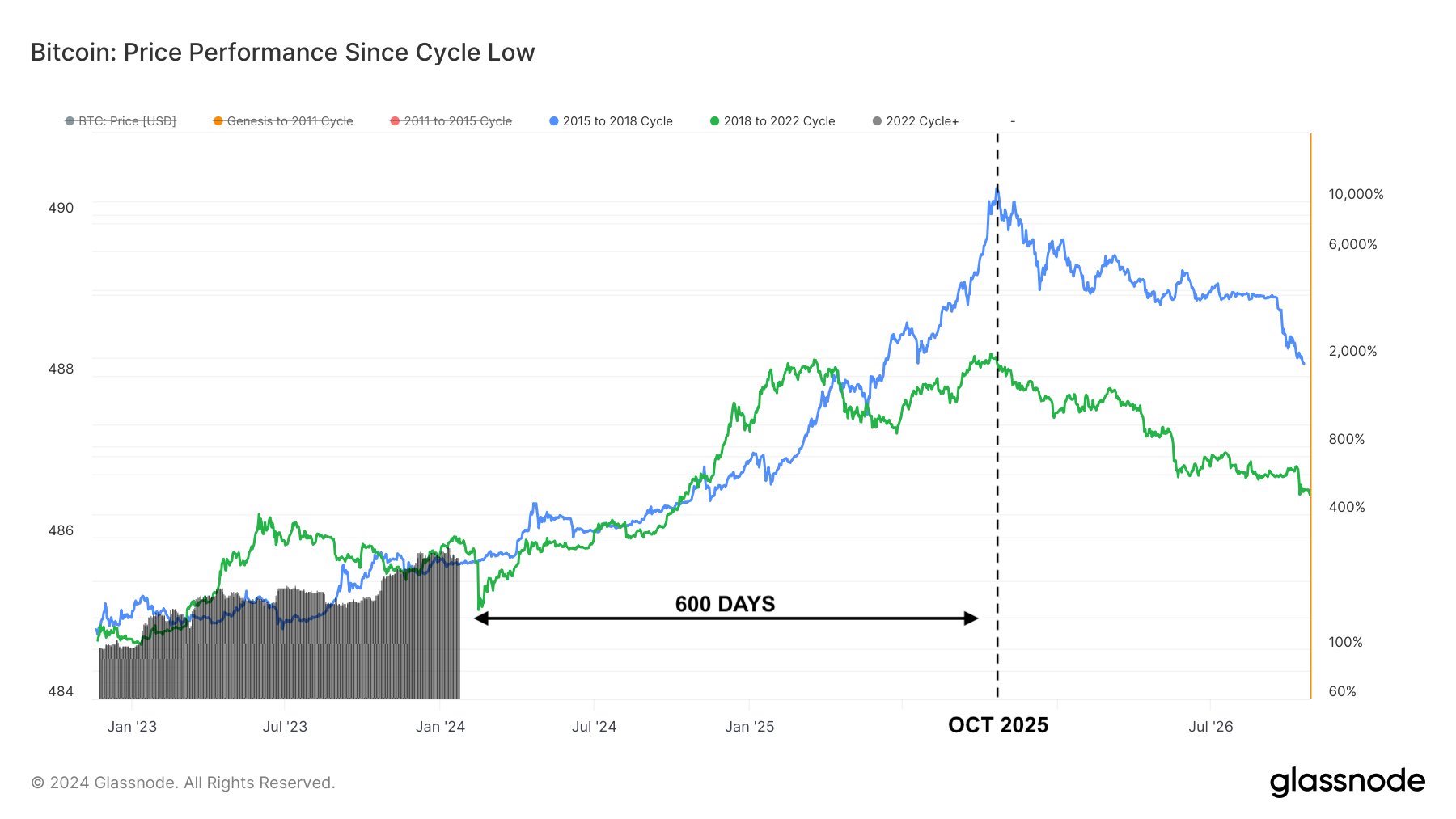

- Glassnode data reveals that Bitcoin’s current price action mirrors prior bull runs, between 2015 and 2018, 2018 and 2022. BTC price climbed from its market bottom and based on data from the chart below, the next market peak could arrive in October 2025.

Bitcoin price performance since cycle low. Source: Glassnode

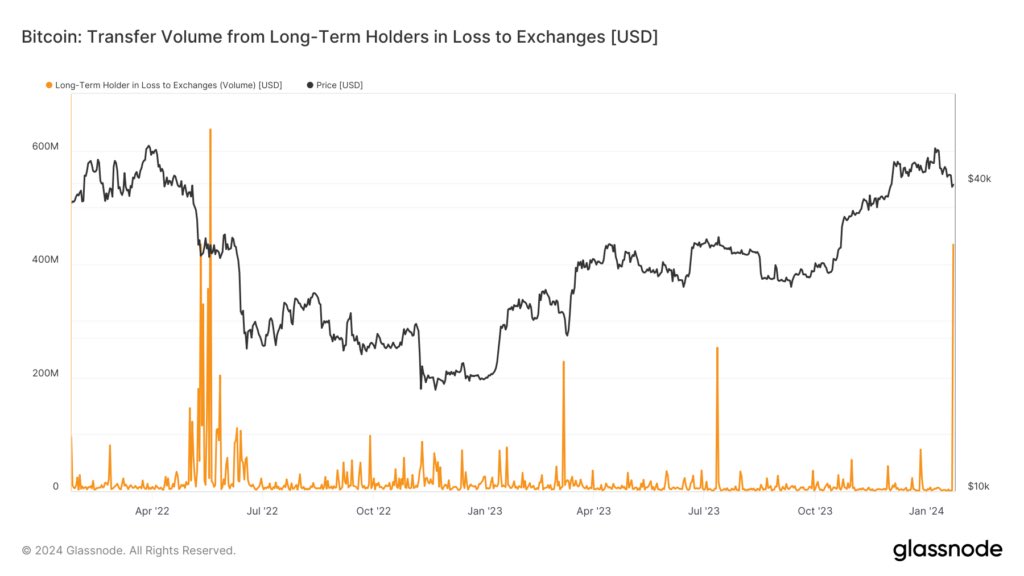

- Bitcoin’s long term holders sent over $430 million worth of BTC at a loss to exchanges on January 22 on the day when BTC declined below $39,000. Glassnode data shows that BTC is going through capitulation and a breakout in the asset is closer.

Bitcoin Transfer Volume from Long-term holders. Source: Glassnode

Technical Analysis: Bitcoin price eyes recovery

Bitcoin made a comeback above the $40,000 mark on Thursday. BTC price has faced volatility since the ETF approval by the SEC. In the two weeks following the approval, Bitcoin price has declined, and traded sideways below the psychologically important $40,000 mark.

Bitcoin price is likely to make a comeback to $41,466, a key resistance level for BTC, as seen in the chart below.

BTC/USDT 1-day chart

In the event of further decline in Bitcoin, the asset could find support between $38,197 and $39,026, a zone where 549,410 addresses scooped up 266,390 BTC.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.