Bitcoin and Ethereum whale activity declines 50% while BTC, ETH accumulation continues

- Bitcoin and Ethereum whale activity down to nearly 50% of peak 2024 level observed in mid-March.

- Analysts note that declining activity does not necessarily mean a sell-off, whales are steadily accumulating BTC, ETH.

- Bitcoin and Ethereum trade close to key support levels, dipping slightly on Tuesday.

Bitcoin and Ethereum whale activity has slowed down since mid-March 2024 when it hit its peak this year. In March 2024, Bitcoin and Ethereum prices hit a peak of $73,777 and $4,093. The two largest cryptocurrencies have noted a correction in their prices since then.

On-chain analysts note declining whale activity in Bitcoin and Ether

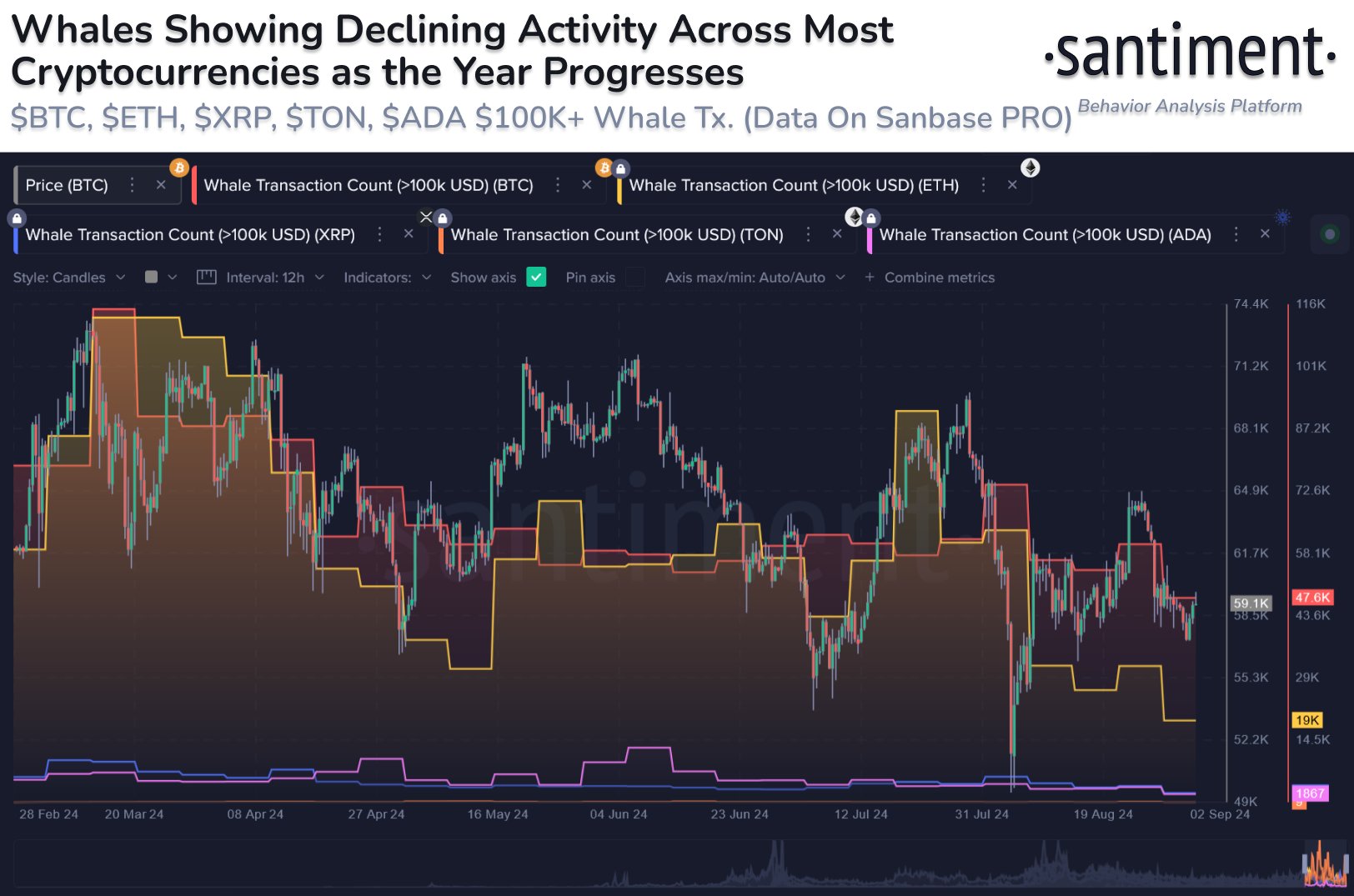

Analysts at crypto intelligence platform Santiment noted a significant drop in the overall whale activity in Bitcoin and Ethereum, compared to the peak observed in March 2024. Data shows that whale activity, defined as transactions valued at $100,000 and higher, are down close to 50%.

Bitcoin whale transactions dropped from 115,100 to 60,200 from mid-March to August 2024. Similarly, Ethereum transactions took a hit, down from 115,100 to 31,800.

Whales showed declining activity across most cryptocurrencies

Analysts explain that a decline in whale activity does not mean that large-wallet investors are shedding their token holdings at a loss. However, top addresses historically become most active during times when volatility is high.

Santiment researchers explain that the data indicates a steady flow of BTC, Ether accumulation by whales, even as overall transactions drop.

The decline in overall whale activity across most crypto assets has become more and more noticeable. Peak 2024 $100K+ transaction weeks for BTC & ETH compared to recently:

— Santiment (@santimentfeed) September 3, 2024

Bitcoin:

March 13-19: 115.1K Whale Transactions

August 21-27: 60.2K Whale Transactions

Ethereum:

March… pic.twitter.com/kBseamXiCT

Crypto intelligence tracker Spotonchain identified a whale wallet accumulating Bitcoin on September 2.

A smart whale with a $62M profit withdrew 1,100 $BTC ($64.2M) from #Binance 14 hours ago.

— Spot On Chain (@spotonchain) September 3, 2024

This whale is skilled at buying $BTC at lows and selling at highs:

• accumulated 2,947 $BTC (most of its holdings) during the pre-pump period (Nov 2023 - Jan 2024) at $44,300 on average;… pic.twitter.com/aCAX2xHoG0

Bitcoin and Ethereum dip slightly, down 0.17% and 0.53% respectively.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.