Ripple price is poised for a rally as on-chain data shows a positive trend

- Ripple price finds support around its 200-day EMA, impending rally on the horizon.

- On-chain data shows that XRP's open interest is rising, and long-to-short ratio is above one, signaling a bullish trend ahead.

- A daily candlestick close below $0.544 would invalidate the bullish thesis.

Ripple (XRP) retested its 200-day Exponential Moving Average (EMA) and rose 6.7% on Monday. During Asian trading hours, it trades slightly higher by 1.2% at $0.606 on Tuesday.

Onchain data shows that XRP's open interest is rising, and long-to-short ratio is above one, signaling a bullish trend on the horizon.

Ripple price is set for a rally following retest of key support level

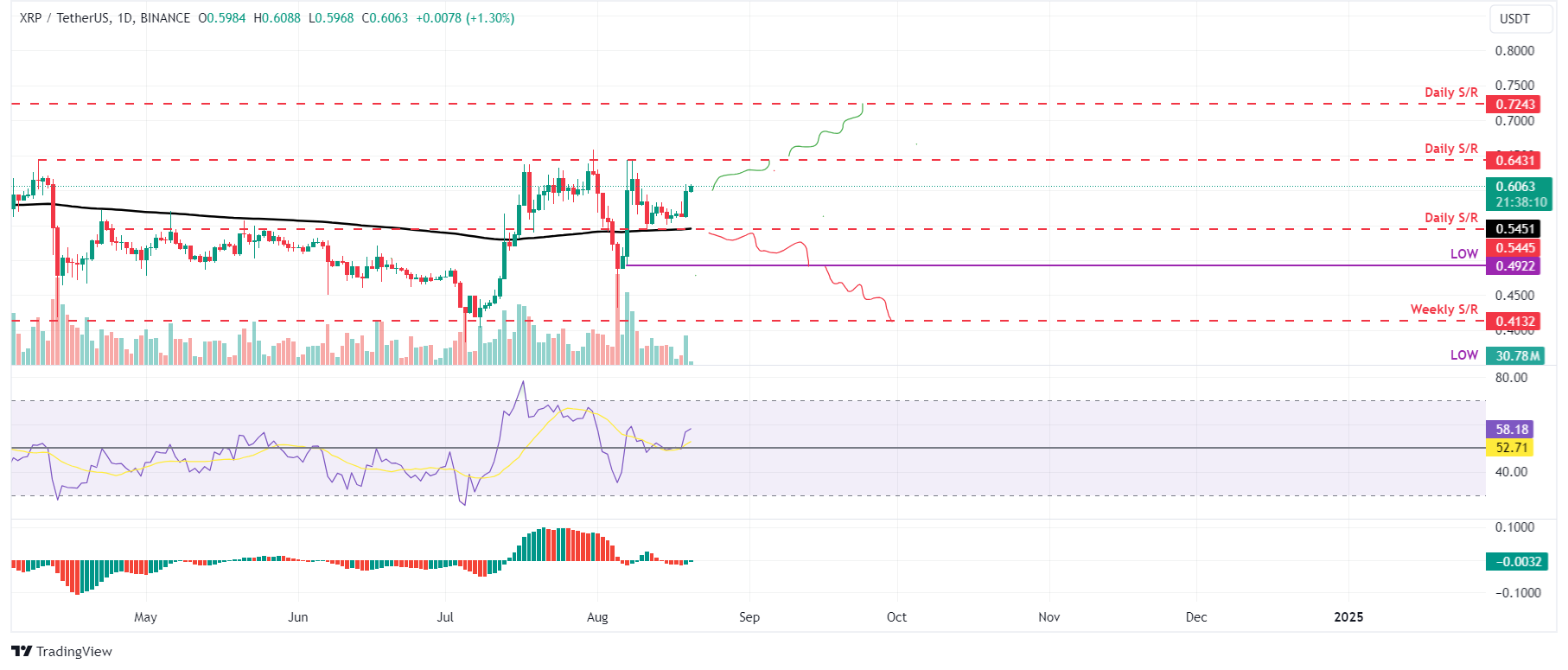

Ripple price retested its 200-day Exponential Moving Average (EMA) at around $0.545 over the past few days and bounced 6.7% on Monday. This 200-day EMA roughly coincides with daily support at $0.544, making this area a key support level. At the time of writing on Monday, it trades slightly higher by 1.2% at $0.606.

If the 200-day EMA, at $0.545, holds as support, XRP could rally 6.5% from its current trading level at $0.606 to retest its daily support level at $0.643.

The Relative Strength Index (RSI) on the daily chart has flipped over its neutral level of 50, and the Awesome Oscillator (AO) is about to trade over its neutral level of zero. For bullish momentum to sustain, the indicators must trade above their neutral levels for the ongoing rally.

If the bulls are aggressive and the overall crypto market outlook is positive, XRP closes above $0.643; it could extend an additional rally by 13% to retest its next daily resistance at $0.724.

XRP/USDT daily chart

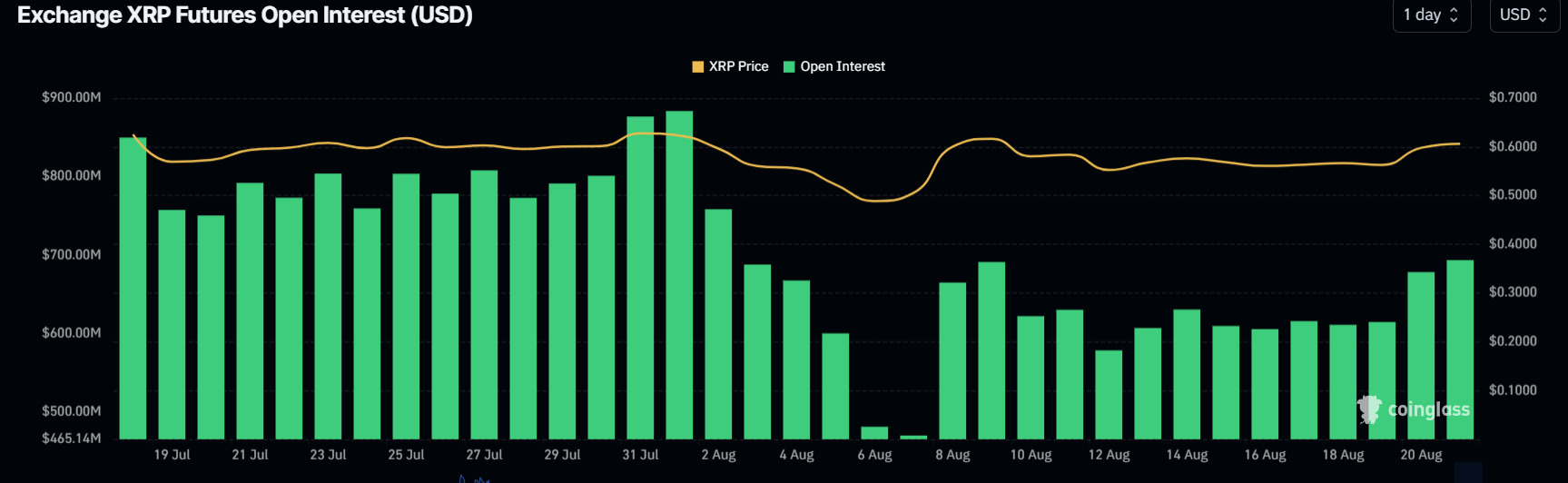

Data from CoinGlass shows that the futures' Open Interest (OI) in Ripple at exchanges is also increasing. The OI indicates the total number of outstanding derivative contracts that have not been settled (offset by delivery) and whether money flows into the contract are increasing or decreasing.

Increasing OI represents new or additional money entering the market and new buying, which suggests a bullish trend. When OI decreases, it is usually a sign that the market is liquidating, more investors are leaving, and the current price trend is ending.

The graph below shows that XRP's OI increased from $610.95 million on Sunday to $693.44 million on Tuesday, indicating that new or additional money is entering the market and new buying is occurring.

XRP Open Interest chart

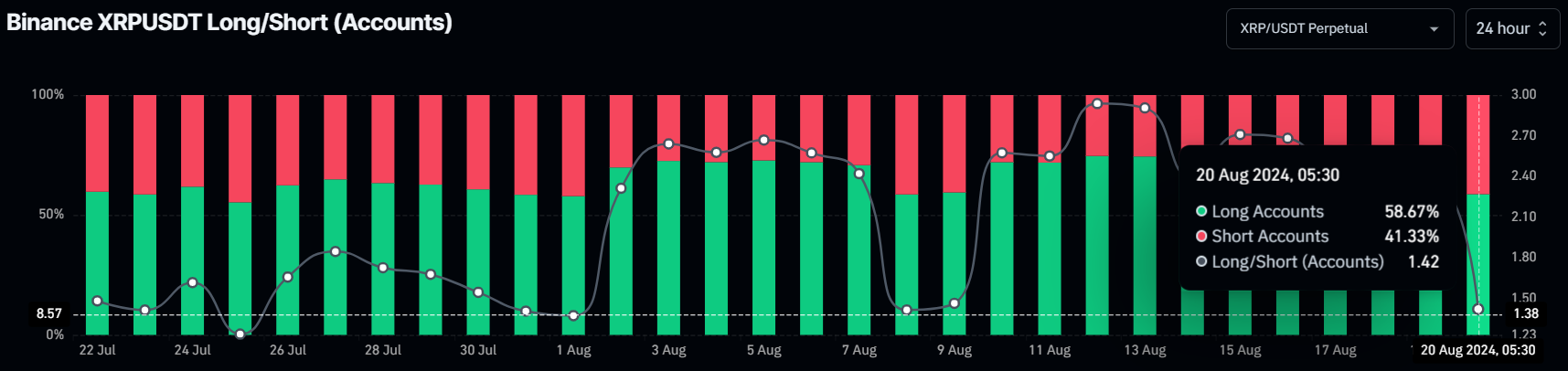

Additionally, according to Coinglass's data, XRP's long-to-short ratio is 1.42. This ratio reflects bullish sentiment in the market, as the number, above one, suggests that more trades anticipate the price of the asset to rise, bolstering Ripple's bullish outlook.

XRP Long to short ratio

Despite the bullish thesis signaled by both on-chain data and technical analysis, the outlook will shift to bearish if Ripple's daily candlestick closes below the $0.544 daily support. This scenario could lead to a 9.6% decline to retest its low of $0.492 on August 7.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.