Bitcoin Miners Could Unlock $38 Billion in Revenue With AI and HPC Shift

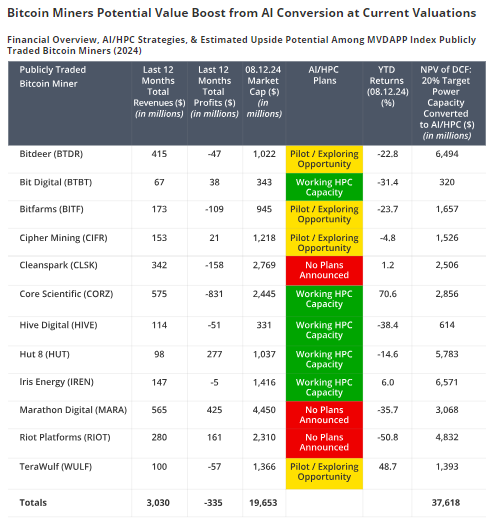

VanEck, an asset management firm, predicts that Bitcoin miners could unlock up to $38 billion in revenue by shifting 20% of their operations to artificial intelligence (AI) and high-performance computing (HPC).

The firm believes miners can leverage their advanced hardware and cooling systems to address the growing demand for AI data centers.

How AI Pivot Will Benefit Bitcoin Miners

With their expansive data centers and significant power resources across the US, Bitcoin mining companies are well-positioned for compute-intensive AI tasks. This infrastructure is critical for AI operations, making their facilities highly sought after by companies in the AI industry.

VanEck suggests that by 2027, if miners allocate 20% of their energy capacity to AI and HPC, they could see annual profits increase by an average of $13.9 billion over 13 years. This contrasts sharply with the group’s current net income, which stands at -$335 million for the past year.

“After factoring in the 17% discount rate, in the aggregate, we estimate the net present value of this opportunity to be ~$37.6 billion, compared to the current total market cap of the 12 companies under consideration, which sits at ~$19.7 billion as of August 12th, 2024,” the firm added.

Read more: AI in Finance: Top 8 Artificial Intelligence Use Cases for 2024

The asset manager also highlights that entering the AI/HPC sector could help Bitcoin miners improve their financial health. Typically, these companies struggle with poor balance sheets due to excessive debt, share issuance, or high executive compensation.

Bitcoin Miners Potential AI Earnings. Source: VanEck

Bitcoin Miners Potential AI Earnings. Source: VanEck

However, many have restructured during the bear market, and AI/HPC customers are often willing to fund capital expenditures. This could lower miners’ cost of capital and aid in negotiating better energy deals.

In addition to immediate earnings, VanEck believes that venturing into AI/HPC could potentially double the value of mining stocks. Preliminary data indicates that miners engaged in HPC, like Core Scientific and TeraWulf, are outperforming those without AI/HPC strategies, such as Marathon Digital and Riots Platform.

Read more: How Much Electricity Does Bitcoin Mining Use?

Notably, Core Scientific and TeraWulf have also outperformed Bitcoin year-to-date due to their focus on AI/HPC revenue streams.

“As the synergies between bitcoin mining, AI/HPC, and electrical grids continue maturing—ideally in an energy-abundant, technologically progressive regulatory environment—we believe the miners in the MarketVector Digital Asset Equity Index, collectively, should be able to easily double their market capitalization by 2028, even assuming no growth in bitcoin profits,” VanEck concluded.