Arbitrum (ARB) Whale Count Reaches All-Time High: Price Impact

ARB, the native token of leading Layer 2 (L2) network Arbitrum, has caught the attention of the whales in the past few weeks.

This has occurred despite the steady decline in the altcoin’s value. Trading at $0.73 at press time, ARB’s price has dropped by almost 10% in the past 30 days.

Arbitrum Whales Are “Buying the Dip”

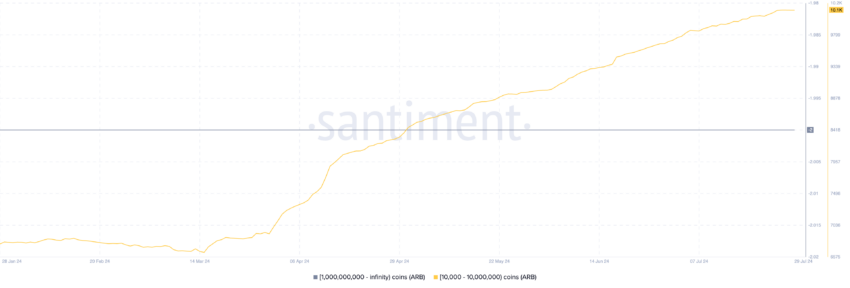

An on-chain assessment of ARB’s supply distribution shows that the number of whale addresses that hold between 10,000 and 10,000,000 tokens has trended upward since April 1. At 10,100 addresses as of this writing, this cohort of ARB whales is at its largest since the token launched.

Arbitrum Supply Distribution. Source: Santiment

Arbitrum Supply Distribution. Source: Santiment

Amid last month’s price decline, these whales have continued to buy the token. In the past 30 days, their number has grown by 4%, according to Santiment’s data.

The uptick in ARB’s whale accumulation is due to the steady fall in its value in the past few weeks. This has caused it to trade at prices lower than its historical cost basis, which has presented a buying opportunity for those looking to trade against the market.

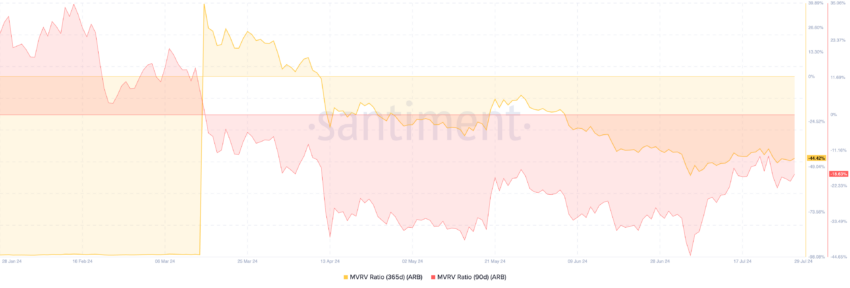

Readings from the token’s market value to realized value (MVRV) ratio confirm that ARB is currently undervalued. The token’s MVRV ratio is negative when assessed over various moving averages. Specifically, ARB’s MVRV ratios for the 90-day and 365-day moving averages are -18.63% and -42.42%, respectively.

Read More: How to Buy Arbitrum (ARB) and Everything You Need to Know

Arbitrum MVRV Ratios. Source: Santiment

Arbitrum MVRV Ratios. Source: Santiment

This metric measures the ratio between an asset’s current price and the average price at which all its coins or tokens were acquired. When it is above zero, the asset’s current market value is higher than the price at which most investors acquire their holdings. It is deemed overvalued, thereby increasing selling pressure.

On the other hand, an MVRV ratio below zero suggests that the market value of the asset in question is below the average purchase price of all its tokens in circulation. When this occurs, the asset is said to be undervalued.

A negative MVRV ratio presents a good buying opportunity because the asset trades at a lower price, and traders can accumulate it at that level to sell it at a higher price.

ARB Price Prediction: Road to All-Time Low?

ARB’s downtrend is still underway, as the altcoin has fallen by an additional 6% in the past seven days. The general demand for the L2 token continues to plummet, making any near-term price growth challenging.

As of this writing, ARB’s Relative Strength Index (RSI) lies below the 50-neutral line at 46.44. This suggests that selling pressure outweighs buying activity among market participants.

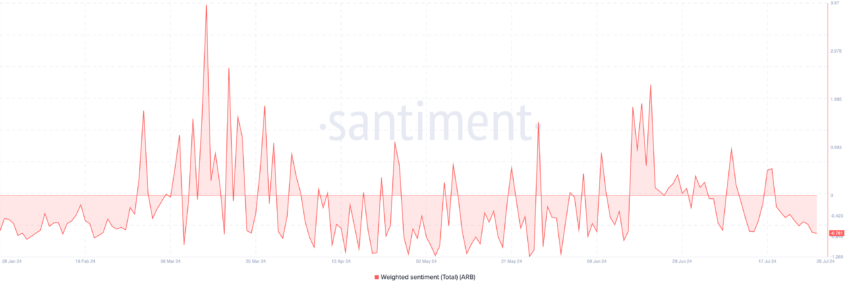

Further, despite the surge in whale accumulation, negative sentiment continues to trail ARB. At press time, its weighted sentiment is -0.78.

Arbitrum Weighted Sentiment. Source: Santiment

Arbitrum Weighted Sentiment. Source: Santiment

This metric tracks the overall mood of the market regarding an asset. When its value is below zero, it suggests that most social media discussions about the asset are fueled by negative emotions like fear, uncertainty, and doubt. It is often a precursor to a continued price decline.

If sentiment remains negative, ARB’s value may revisit its all-time low of $0.57, which it last traded at on July 5.

Arbitrum Analysis. Source: TradingView

Arbitrum Analysis. Source: TradingView

However, if market sentiment shifts to positive, the L2 token’s price may climb to $0.99.