Could this be a good time to buy Dogecoin, Here's what on-chain metrics say

- DOGE investors are buying the dip as exchange net flows turn negative.

- Dogecoin weighted sentiment and active addresses have been trending downward.

- DOGE could find support around key accumulation level at $0.116.

Dogecoin (DOGE) is down 2% on Wednesday, but its on-chain metrics suggest that the current price level could be a good buying opportunity.

DOGE on-chain metrics reveal buying opportunity

Investors are buying the dip as DOGE's decline to $0.128 saw the top meme coin experience net exchange outflows of 339.36 million DOGE tokens.

Weighted sentiment around DOGE has remained largely below 0 in the past three months, indicating less or negative sentiment from traders towards DOGE.

The Santiment Weighted Sentiment indicator helps capture a balanced overview of an asset's social volume combined with investors' sentiment. The indicator spikes when there's increased social volume around an asset, and the messages are largely positive. It dips when the volume is still high, but the sentiment is negative. If the social volume is high but the sentiment is mixed, it stays around 0. If the volume is low, it also stays around 0.

DOGE's active daily addresses align with its weighted sentiment, decreasing steadily in the past three months.

[01.04.42, 25 Jul, 2024]-638574647424734547.png)

DOGE On-chain Metrics

DOGE Market Value to Realized Value (MVRV) 30-day Ratio is now downward, hovering around 1.87%. This indicates that investors who bought DOGE within the last 30 days have seen an average gain of 1.87%.

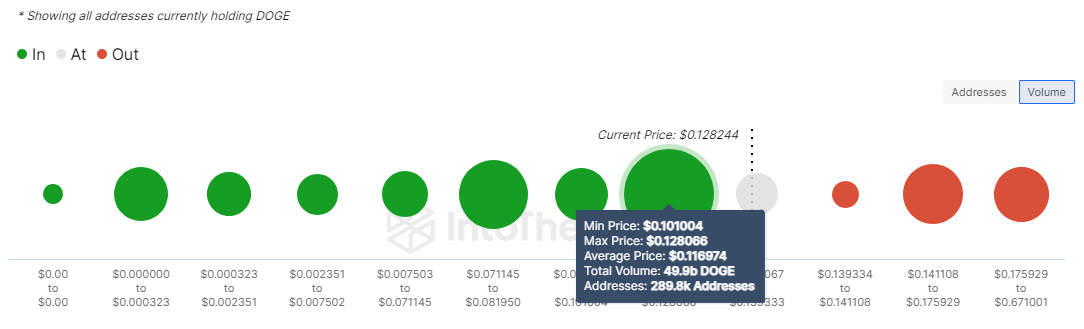

Dogecoin could find support around the $0.116 price level, where investors purchased about 49.9 billion DOGE tokens. Price levels with historically heavy purchases often serve as key support, as investors who bought around the level may want to defend their holdings from further losses.

A bounce around this level could see DOGE rise to attack the $0.175 resistance.

If DOGE holders fail to sustain the $0.116 level, the coin could see a further decline as investors may sell to reduce losses.

These metrics conclude that DOGE's current price could be a good buying opportunity ahead of a potential meme coin rally when the market fully recovers.