Internet Computer (ICP) Correlation With Bitcoin May Spark Further Gains

Not all cryptocurrencies tend to move with one another. However, Internet Computer (ICP) has been tied up with Bitcoin (BTC) for some time.

Will the altcoin eventually chart its own path? This on-chain analysis proves that investors may not want to place bets on that in the short term.

Internet Computer Is In Lockstep With Bitcoin

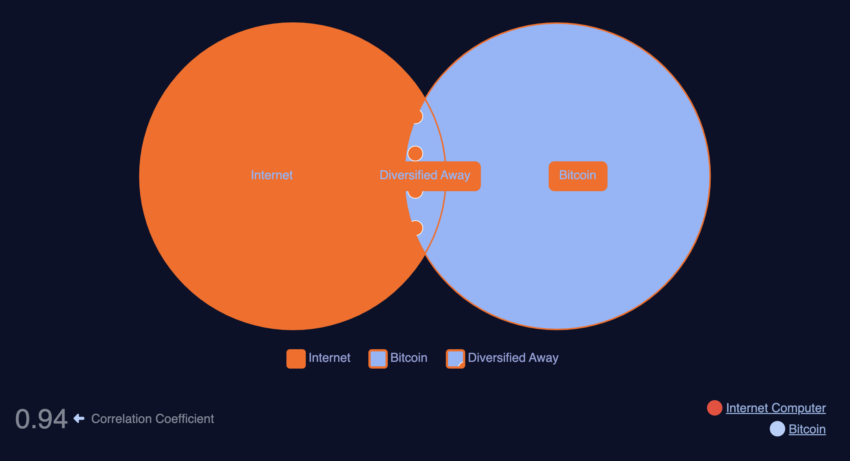

According to data from Macroaxis, the 90-day correlation between ICP and BTC is 0.94. A correlation coefficient of 1 or close to it implies that the prices of two cryptos move in similar directions most of the time.

However, when the coefficient is close to -1, it indicates a strong divergence. On a 90-day horizon, Internet Computer underperforms BTC, especially as it generates negative returns.

During the same timeframe, Bitcoin’s price return was not impressive. However, it was not as underwhelming as ICP.

Read More: Internet Computer (ICP) Coin Explainer for Beginners

Internet Computer Price Correlation With Bitcoin. Source: Macroaxis

Internet Computer Price Correlation With Bitcoin. Source: Macroaxis

However, the strong correlation could be linked to ICP’s resurgence within the last 30 days, which saw the price move in tune with BTC while gaining 23.55%.

Furthermore, developments outside of the on-chain environment reveal that it is possible to see a stronger correlation.

This is because Copper.co, a collateral management firm for digital assets, has facilitated a cross-chain infrastructure that supports BTC interaction on the Internet Computer Network.

“A leading institutional digital asset custodian has integrated support for ckBTC, the Bitcoin digital twin on ICP.” DFINITY is a handle dedicated to providing updates on ICP posted on X.

With cross-chain interactions like this, liquidity can easily move between networks, and sometimes, native cryptos of networks involved benefit from one another while heading in similar directions.

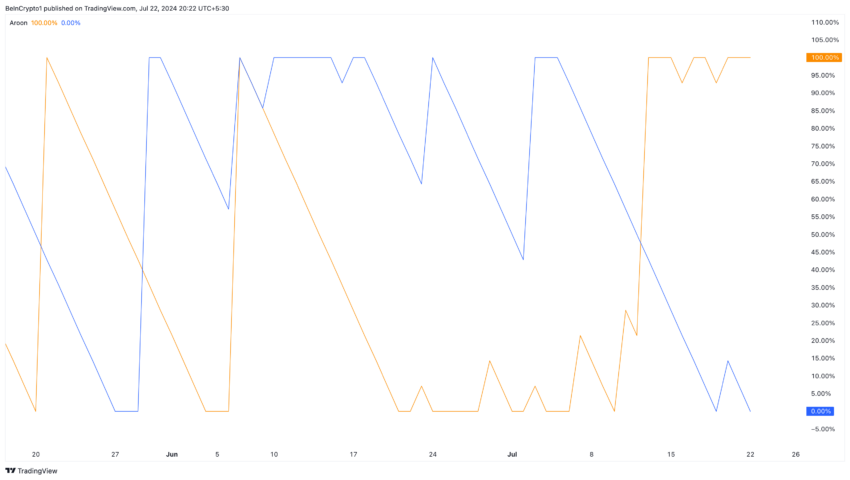

BeInCrypto recently explained that Bitcoin’s price could go higher. If this prediction is validated, ICP will likely follow suit. The Aroon indicator also reinforces this forecast.

The indicator has two lines: the Aroon Up (orange) and the Aroon Down (blue). In summary, it shows whether the price of a cryptocurrency is beginning a new trend, changing it, or continuing in a specific direction.

Internet Computer Analysis. Source: TradingView

Internet Computer Analysis. Source: TradingView

From the chart above, we observed that the Aroon Up is much higher, indicating that ICP’s price could remain bullish.

ICP Price Prediction: Can It Surge to Above $12?

ICP rose above the downtrend on July 6, which was crucial to its recent upward run. While the token trades at $10.25, it remains above the 20 EMA (blue), which positions at $9.13.

EMA stands for Exponential Moving Average. When the price is above it, the trend is bullish, but if it is below, the trend is bearish. Therefore, the current ICP condition implies that the token has a higher chance of increasing than its possibility to decline.

Furthermore, the Supertrend had flashed a buy signal at $8.34. This technical analysis tool shows the trend that cryptocurrency follows. If the red region appears above the price, it is a sell signal, and the price could trend downwards.

The green segment of the Supertrend hovers below the price for ICP, indicating that the token’s value could be higher.

Read More: Internet Computer (ICP) Price Prediction 2023/2025/2030

Internet Computer Daily Analysis. Source: TradingView

Internet Computer Daily Analysis. Source: TradingView

If buying pressure increases, the Fibonacci Retracement indicator reveals that ICP could reach $10.80.

Should bulls sustain the uptrend, the price may reach $12.14 in the coming days. However, this prediction may not come to pass if the token’s price drops below the 20 EMA. If that is the case, ICP’s price may decrease to $9.86.