Tron (TRX) Set to Lose Bull Market Support Floor on Investors Demand

Tron’s (TRX) price made splashes during the second week of July as it shot up but lost momentum soon after.

Now, considering investors’ behavior and the market’s declining demand, the path forward for TRX does not look very bright.

Tron Investors Lose Bullishness

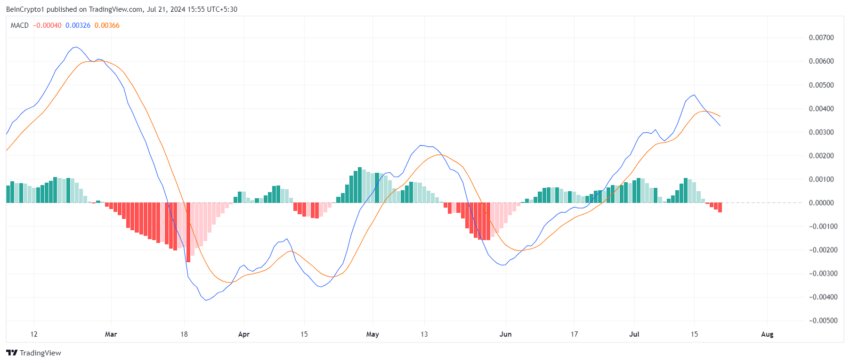

Tron’s price noted a drop in price a few days ago but has stabilized since then. However, this may not continue down the line. This is because TRX’s Moving Average Convergence Divergence (MACD) is exhibiting a potential decline. The indicator has recorded its first bearish crossover in more than a month and a half.

This technical signal often marks the beginning of a downward trend. It suggests that the asset’s recent upward momentum might be waning.

Tron RSI. Source: TradingView

Tron RSI. Source: TradingView

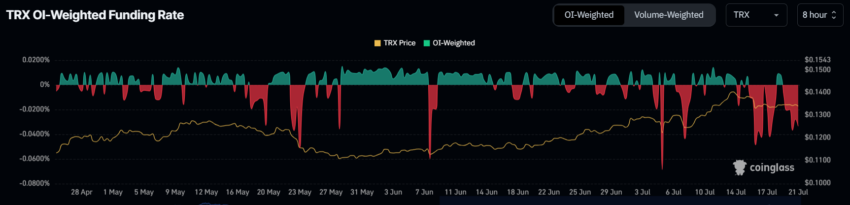

Additionally, Tron’s funding rate has turned highly negative. A negative funding rate occurs when the cost to maintain long positions is lower than for short positions.

It is an indication that more traders are betting on a price decline. This imbalance suggests a prevailing bearish sentiment among market participants.

Overall, the combination of the bearish MACD crossover and the negative funding rate highlights growing pessimism among investors regarding TRX’s near-term price performance. These indicators point to a potential shift in the market, with a larger number of traders expecting a downturn in the asset’s price.

Read More: What Is TRON (TRX) and How Does It Work?

Tron Funding Rate. Source: Coinglass

Tron Funding Rate. Source: Coinglass

TRX Price Prediction: Fulfilling Demand

Tron’s price after failing to establish a new year-to-date high. The altcoin is currently changing hands at $0.134, which is above the support of $0.131. This level coincides with the 61.8% Fibonacci Retracement line.

This Fib line is also known as a bull market support floor and tends to support the recoveries noted. Losing it tends to extend the drawdown significantly, but that may not be the case, and TRX could remain consolidated at under $0.136.

Read More: TRON (TRX) Price Prediction 2024/2025/2030

Tron Price Analysis. Source: TradingView

Tron Price Analysis. Source: TradingView

But on the off chance that Tron’s price breakout of the 61.8% Fib line, the altcoin would have another shot at the rally. This would also invalidate the bearish thesis.