Bitcoin ETFs Attract Over $1 Billion in 3 Days Despite Mt. Gox FUD

Bitcoin exchange-traded funds (ETFs) have accumulated over $1 billion in BTC in the last three trading days, indicating strong investor interest. This remarkable influx of funds coincides with Bitcoin’s price reaching $66,000 despite ongoing market uncertainties.

This strong participation from institutional and retail investors reflects bullish sentiments in the market.

Bitcoin ETFs, Crypto Whales Accumulate

According to Farside Investors, spot Bitcoin ETFs experienced substantial inflows on Tuesday, receiving over $422.5 million—the month’s peak. BlackRock’s iShares Bitcoin Trust (IBIT) led these inflows with $260.2 million.

Meanwhile, Fidelity’s Wise Origin Bitcoin Fund (FBTC) saw about $61.1 million in inflows. Impressively, there were no outflows from Bitcoin ETFs during the past three trading days.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

| Date | IBIT | FBTC | BITB | ARKB | BTCO | EZBC | BRRR | HODL | BTCW | GBTC | DEFI | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| July 12, 2024 | 120.0 | 115.1 | 28.4 | 13.0 | 4.0 | 0.0 | 0.0 | 6.6 | 0.0 | 23.0 | 0.0 | 310.1 |

| 15 Jul 2024 | 117.2 | 36.1 | 15.2 | 117.2 | 7.9 | 3.7 | 0.0 | 3.6 | 0.0 | 0.0 | 0.0 | 300.9 |

| 16 Jul 2024 | 260.2 | 61.1 | 17.3 | 29.8 | 20.5 | 9.4 | 2.2 | 22.0 | 0.0 | 0.0 | 0.0 | 422.5 |

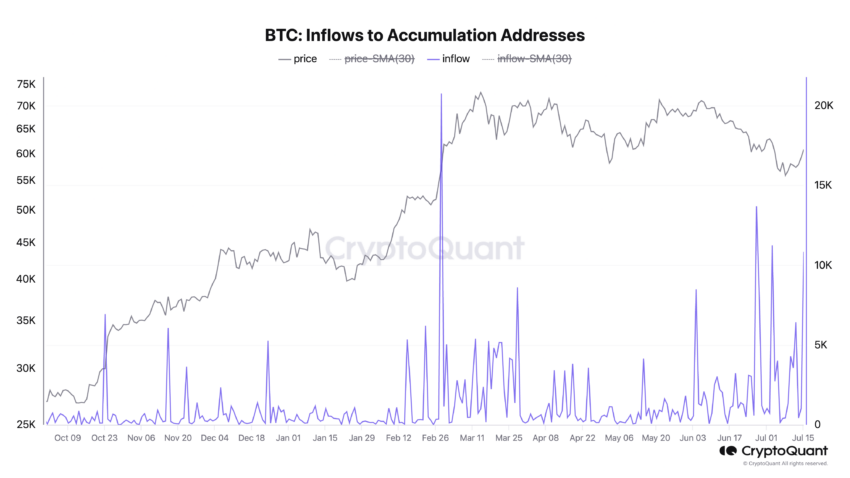

Simultaneously, crypto whales have also been active, accumulating significant amounts of BTC. On July 15, data from CryptoQuant showed that Bitcoin accumulation addresses received approximately 10,800 BTC, roughly $656.64 million.

Bitcoin Inflows to Accumulation Addresses. Source: CryptoQuant

Bitcoin Inflows to Accumulation Addresses. Source: CryptoQuant

Moreover, Ki Young Ju, CEO of CryptoQuant, shared insights on X (formerly Twitter) regarding the behavior of Bitcoin holders. Over the last 30 days, primarily custodial wallets, which typically see no outflows, have amassed 85,000 BTC. According to Ju, while some market participants are panic selling, others are capitalizing on the opportunity to buy.

Amid these developments, concerns about Mt. Gox have resurfaced. The defunct exchange recently moved 91,755 BTC (~$5.8 billion) to new addresses, stirring fears among investors. Shortly after, Kraken announced that it would distribute Bitcoin and Bitcoin Cash (BCH) to those affected by the Mt. Gox collapse.

Despite these fears, experts like Ju, believe the market has overestimated the potential turmoil from Mt. Gox repayments.

“Since 2023, $224 billion in Bitcoin sold, yet price up 350%. Even if Mt. Gox’s $3 billion is sold on Kraken, it’s just 1% of the realized cap increase in this bull cycle — manageable liquidity,” Ju explained.

Galaxy’s head of research, Alex Thorn, also argues that the impact on Bitcoin’s selling pressure might be less than expected. His assessment stems from detailed reviews of bankruptcy filings and discussions with creditors.

Read more: Top Crypto Bankruptcies: What You Need To Know

Thorn believes that the payout conditions might encourage creditors to hold onto their assets, considering the significant capital gains taxes involved. After early payout deductions, individual creditors will receive around 65,000 BTC. Even if 10% of this is sold, only about 6,500 BTC would enter the market—much less than market fears had anticipated.