Toncoin (TON) Whales Increase Holdings Despite Price Stagnation

The price of Toncoin (TON), the cryptocurrency linked to the popular messaging app Telegram, has consolidated within a range since June 15. It has faced resistance at $8.16 and has found support at $6.16. As of this writing, the altcoin trades at $7.39.

As the market awaits the token’s breakout in either direction, the whales are betting on a rally.

Toncoin Whales Buy More Tokens

Data from IntoTheBlock show that Toncoin’s large holder netflow has surged by over 31,000% in the past seven days.

Large holders refer to addresses that hold over 0.1% of an asset’s circulating supply. An asset’s large holder netflow measures the difference between the coins these large holders buy (inflows) and the amount they sell (outflows) over a specific period.

When the metric spikes, it is a bullish signal because it suggests that whale addresses are accumulating the asset. Conversely, a dip in an asset’s large holder netflow signifies rising outflows from whale addresses. It is a bearish signal, suggesting potential selling pressure and a risk of price decline.

Read More: 6 Best Toncoin (TON) Wallets in 2024

Toncoin Large Holders Netflow. Source: IntoTheBlock

Toncoin Large Holders Netflow. Source: IntoTheBlock

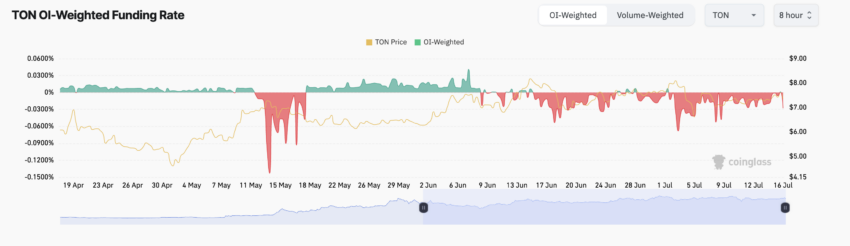

However, not everyone shares the whales’ optimism. In fact, a significant portion of TON’s derivatives market is betting on its price to continue to fall. This can be gleaned from the negative funding rate that has trailed the altcoin since June 15. As of this writing, TON’s funding rate is -0.02%.

Toncoin Funding Rate. Source: Coinglass

Toncoin Funding Rate. Source: Coinglass

Funding rates are a mechanism used in perpetual futures contracts to ensure the contract price stays close to the spot price.

When an asset’s funding rate is negative, more traders hold short positions. This means that more traders expect the asset’s price to fall than those who buy it with the expectation of selling at a higher price.

TON Price Prediction: Sellers Remain in Control

Although the altcoin trades within a range, the bearish sentiment surrounding it is still significant. Readings from its Directional Movement Index (DMI) confirm this as its Negative Directional Indicator (-DI) rests above the Positive Directional Indicator ( DI) at press time.

Toncoin Price Analysis. Source: TradingView

Toncoin Price Analysis. Source: TradingView

The DMI measures the strength and direction of an asset’s price trend. When it is set up this way, it means that the asset’s downward price movements are currently stronger than upward movements.

Traders interpret this as a sign that sellers are in control and the price might continue to fall in the short term. If TON’s price falls, it will exchange hands below $7 at $6.93.

Read More: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

Toncoin Price Analysis. Source: TradingView

Toncoin Price Analysis. Source: TradingView

However, if the bulls initiate an uptrend, the token’s price could witness a rise to $8.32.