Options traders are bullish on Bitcoin year-end rally to $120,000

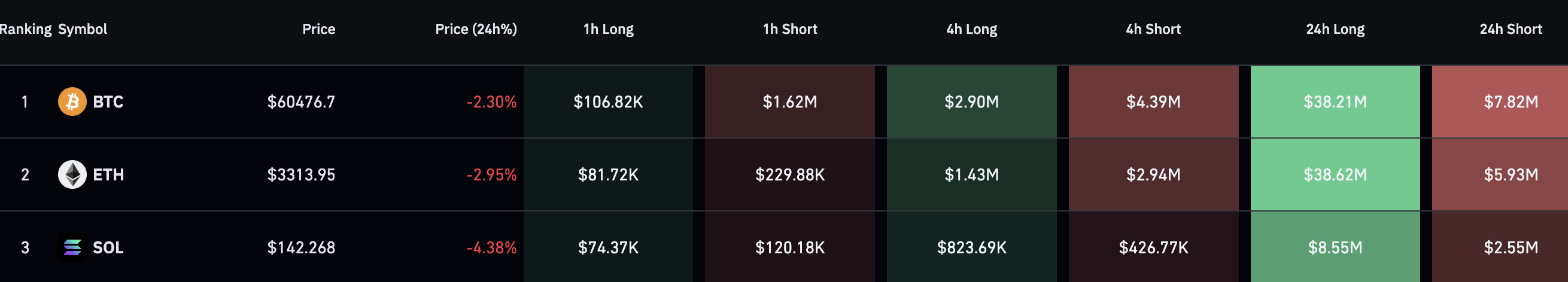

- Bitcoin long positions worth nearly $40 million were liquidated in the past 24 hours, options market still skewed in favor of topside.

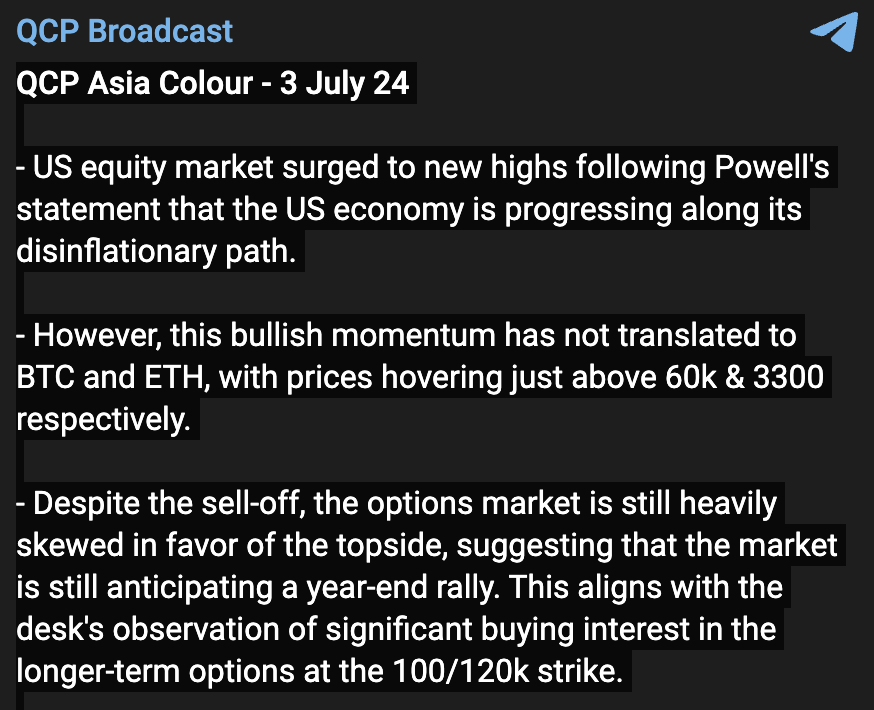

- QCP Capital notes that options traders are anticipating a year-end rally, significant buying interest in options at $100,000 to $120,000 strikes.

- Analysts predict Q3 2024 to be subdued for Bitcoin as market faces uncertainty from Mt. Gox payback to creditors.

Analysts at QCP Capital, a digital asset trading and market making firm, announced in a July 3 broadcast that Bitcoin options traders are bullish in the face of the recent sell-off. Bitcoin nosedived under $60,000 early on Wednesday, however, options traders held their ground, showing significant interest in buying long options at strikes between $100,000 to $120,000.

Bitcoin options traders expect year-end BTC price rally

Options market trading data provides insight into the direction of asset prices and the state of the overall crypto market. Spot market traders look at options data for future trends in an asset’s price.

Bitcoin options traders are bullish in the face of the recent meltdown in BTC. Early on Wednesday, July 3, Bitcoin dipped under $60,000, wiping out gains from the last week of June. Nearly $40 million in Bitcoin long positions were liquidated, per Coinglass data. Despite the sell-off and the correction, options traders held steady.

Bitcoin 24-hour long and short liquidations as seen on Coinglass

QCP Capital shared details of the buying interest in long options at $100,000 to $120,000 strikes for year end in a broadcast on Telegram.

The announcement reads:

Despite the sell-off, the options market is still heavily skewed in favor of the topside, suggesting that the market is still anticipating a year-end rally.

QCP Capital broadcast on Telegram

Bitcoin traders are facing uncertainty from the looming Mt. Gox payback to creditors this month and the German government’s BTC transfers tracked by on-chain data firms Lookonchain and Arkham Capital.

Analysts note that given the uncertainty, Bitcoin could note subdued performance in Q3 2024.

Bitcoin trades at $60,449 at the time of writing.