Bitcoin price retraces to the $61,000 level as miners' selling pressure resumes

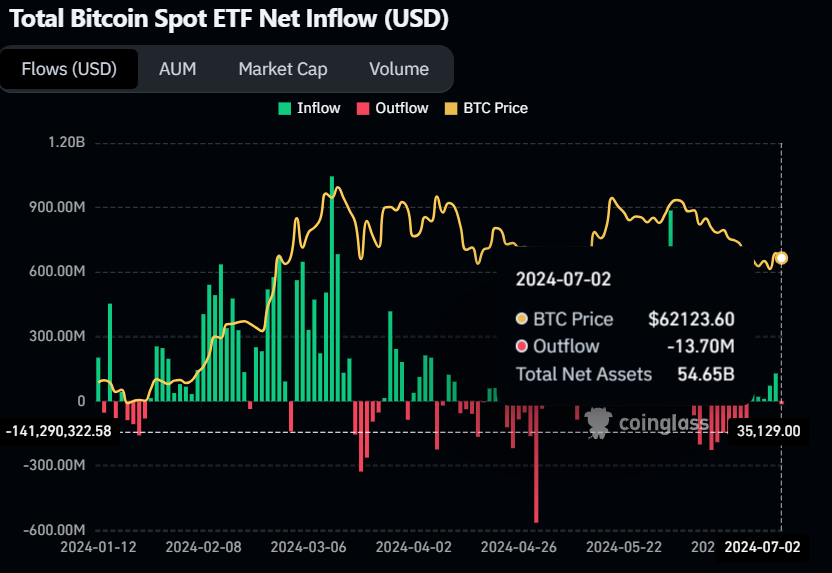

- U.S. spot Bitcoin ETFs registered slight outflows on Tuesday.

- The German Government transferred another 832.7 BTC, valued at $52 million, on Tuesday.

- On-chain data shows that Bitcoin miners have increased their selling activity at the beginning of this week.

Bitcoin (BTC) extends correction on Wednesday and hovers around $61,000 after finding resistance near the $64,000 level on Monday. Recent on-chain data indicates heightened selling activity from Bitcoin miners early in the week. Meanwhile, U.S. spot Bitcoin ETFs experienced minor outflows on Tuesday, coinciding with the German Government transferring an additional 832.7 BTC, valued at $52 million, on the same day.

Daily digest market movers: Bitcoin price declines as German government transfers weigh

- According to data from Lookonchain, the German Government transferred 832.7 BTC, valued at $52 million, from its wallet on Tuesday. Of this, 282.7 BTC, worth $17.65 million, were transferred to Coinbase, Bitstamp and Kraken exchanges.

- Over the past week, German authorities have moved 2,240 BTC worth $142 million to Coinbase, Bitstamp, Flow Traders, and Kraken. This significant transfer activity may have fueled FUD (Fear, Uncertainty, Doubt) among traders, potentially influencing Bitcoin's 2.5% price decline this week.

The German Government transferred 832.7 $BTC($52M) out again 35 minutes ago, of which 282.7 $BTC($17.65M) was transferred to #Bitstamp, #Coinbase and #Kraken.

— Lookonchain (@lookonchain) July 2, 2024

German Government currently holds 43,859 $BTC($2.74B).https://t.co/uBaH2Wtxev pic.twitter.com/f15sht8Npc

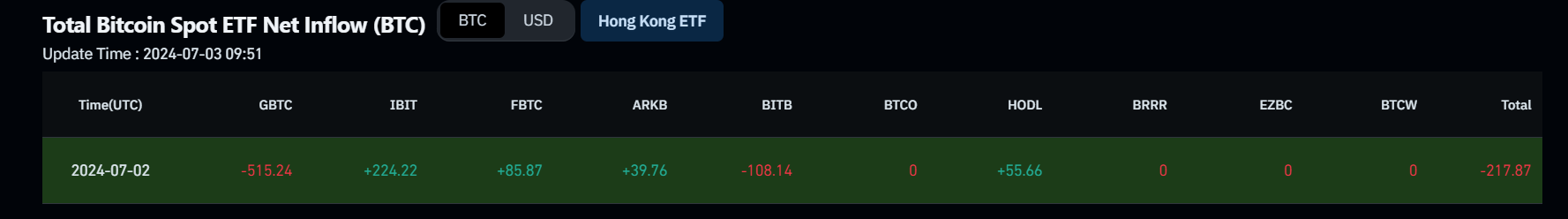

- On Tuesday, U.S. spot Bitcoin ETFs recorded outflows totaling $13.70 million. Grayscale (GBTC) and Bitwise (BITB) saw decreases of 515.12 BTC and 108.14 BTC, respectively, while Blackrock (IBIT), Fidelity (FBTC), ARK 21Shares (ARKB), and VanEck (HODL) added 224.22 BTC, 85.87 BTC, 39.76 BTC, and 55.66 BTC, respectively.

- This decline suggests a slight weakening in investor confidence, potentially indicating a temporary downturn in Bitcoin's price. ETF net inflow data is crucial in assessing investor sentiment and market dynamics in Bitcoin ETFs. Together, the 11 spot BTC ETFs hold reserves totaling $54.65 billion in Bitcoin.

Bitcoin Spot ETF Net Inflow (BTC) chart

- According to CryptoQuant data, Bitcoin miners have increased their selling activity at the beginning of this week. On Monday, miners transferred 9,096.67 BTC to exchanges, followed by 6,751.91 BTC on Tuesday. Selling was subdued over the weekend but picked up as the week began. This uptick in transfers may reflect miners' efforts to cover operational costs or capitalize on perceived price overvaluation, contributing to selling pressure. Such actions typically signal a bearish sentiment in the market, potentially foreshadowing a price decline.

- All Miners, All Exchanges (3)-638555921689923407.png)

Bitcoin Miners to Exchange Flow (Total) chart

- Conio revealed on social media platform X their partnership with Mesh, a U.S. fintech firm supported by Paypal Ventures, introducing Europe's first Open Banking solutions for Bitcoin. This collaboration enables Conio app users to access 10 top crypto exchanges, such as Binance and Coinbase, and transfer purchased bitcoins directly into their Conio wallets. By leveraging open banking technology, a Mesh account can authenticate users across over 300 centralized crypto exchanges and self-custody wallets.

➡️ We are thrilled to announce Conio’s partnership with Mesh @meshconnectapi, launching the first #OpenBanking solutions for #Bitcoin in #Europe. This partnership has two main objectives: reducing friction and simplifying transfers, and promoting the use of secure #custody… https://t.co/DGL2ZDD7rv

— Conio (@conio) July 1, 2024

Technical analysis: BTC declines after retesting daily resistance around $64,000 level

Bitcoin price was rejected by the daily resistance level at $63,956 on Monday, and fell by more than 1% on Tuesday. BTC is extending losses and trades down by 1.8% on a daily basis at $60,987 on Wednesday.

If BTC's price closes above the hurdle at the $63,956 daily resistance level, it could rise 5% to retest its next weekly resistance at $67,147.

The Relative Strength Index (RSI) and the Awesome Oscillator in the daily chart are below their neutral levels of 50 and zero. If bulls are indeed returning, then both momentum indicators must regain their positions above their respective neutral levels.

If the bulls are aggressive and the overall crypto market outlook is positive, BTC could extend an additional rally of 6% to revisit its weekly resistance at $71,280.

BTC/USDT daily chart

However, if BTC closes below the $58,375 level and forms a lower low in the daily time frame, it could indicate that bearish sentiment persists. Such a development may trigger a 3% decline in Bitcoin's price, to revisit its low of $56,522 from May 1.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.